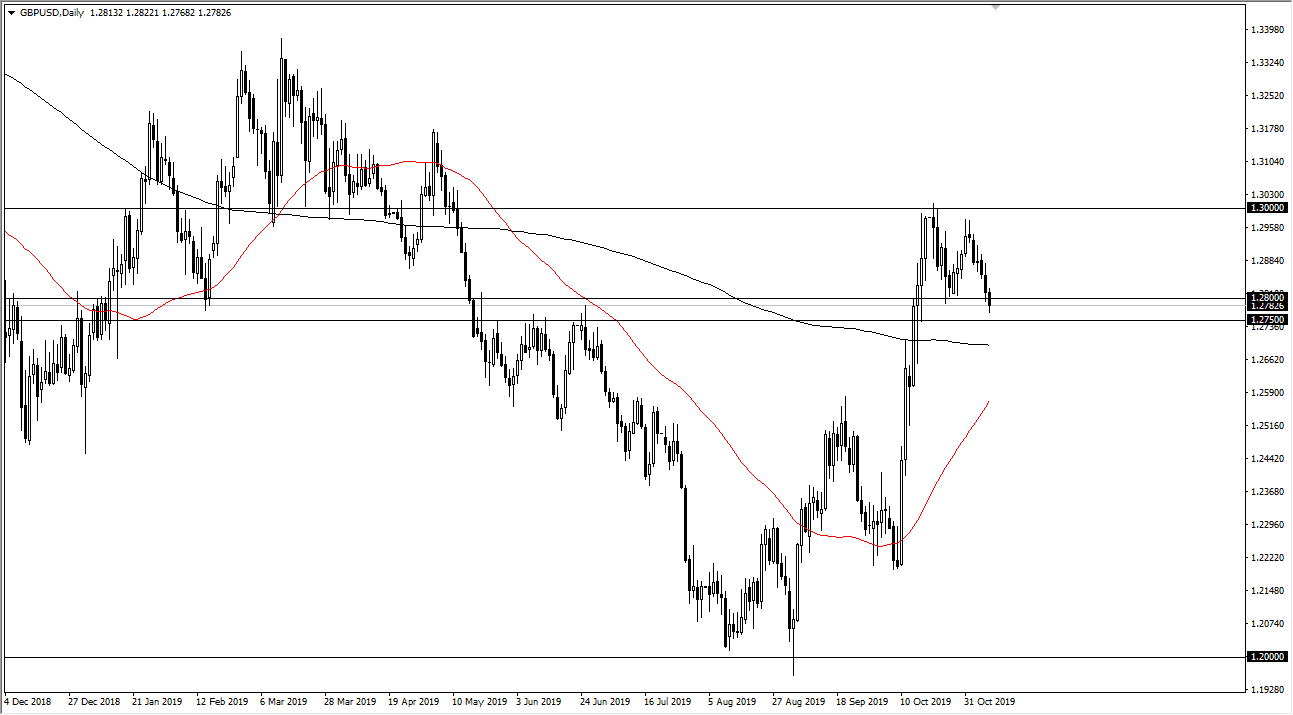

The British pound has dropped a bit during the trading session on Friday, breaking below the 1.28 level late in the American hours. At this point though, it looks as if there is a significant amount of support down to the 1.2750 level, and as a result it’s very likely that we will see buyers underneath that could come into play and cause a bit of a bounce. Beyond that, we also have the 200 day EMA underneath that should cause support as well.

On the other hand, if the market was to break down below the 200 day EMA is very likely that we could go lower to the 1.25 handle which is a large, round, psychologically significant figure. That’s an area that has also seen a lot of structural buying and selling, so it would not be a huge surprise at all to see this market react to this handle. Beyond that, we have also the fact that it’s a large, round, psychologically significant figure, and that almost always catches the attention of at least some market participants.

When you look at the chart, you can see that we had gotten way ahead of ourselves, so it’s not a huge surprise that we have struggled to continue going higher. It would not surprise me at all to see the 200 day EMA tested again, and that is going to be my most likely scenario at this point. If we do bounce from here though, the 1.30 level will cause a lot of resistance based on the previous action, the fact that it was previous support, and then of course the fact that it is a large, round, psychologically significant figure as well.

Furthermore, on the side of the buyers is the fact that the market is ready to see a “golden cross”, which is when the 50 day EMA crosses above the 200 day EMA, a longer-term “buy-and-hold” signal for big players. At this point, I think it’s only a matter of time before you find value in the British pound, so each pullback should be looked at as a potential value opportunity that traders will take advantage of. I don’t mind building up a core position at this point, but you need to do so slowly as there are still plenty of headlines out there involving Brexit that will cause issues.