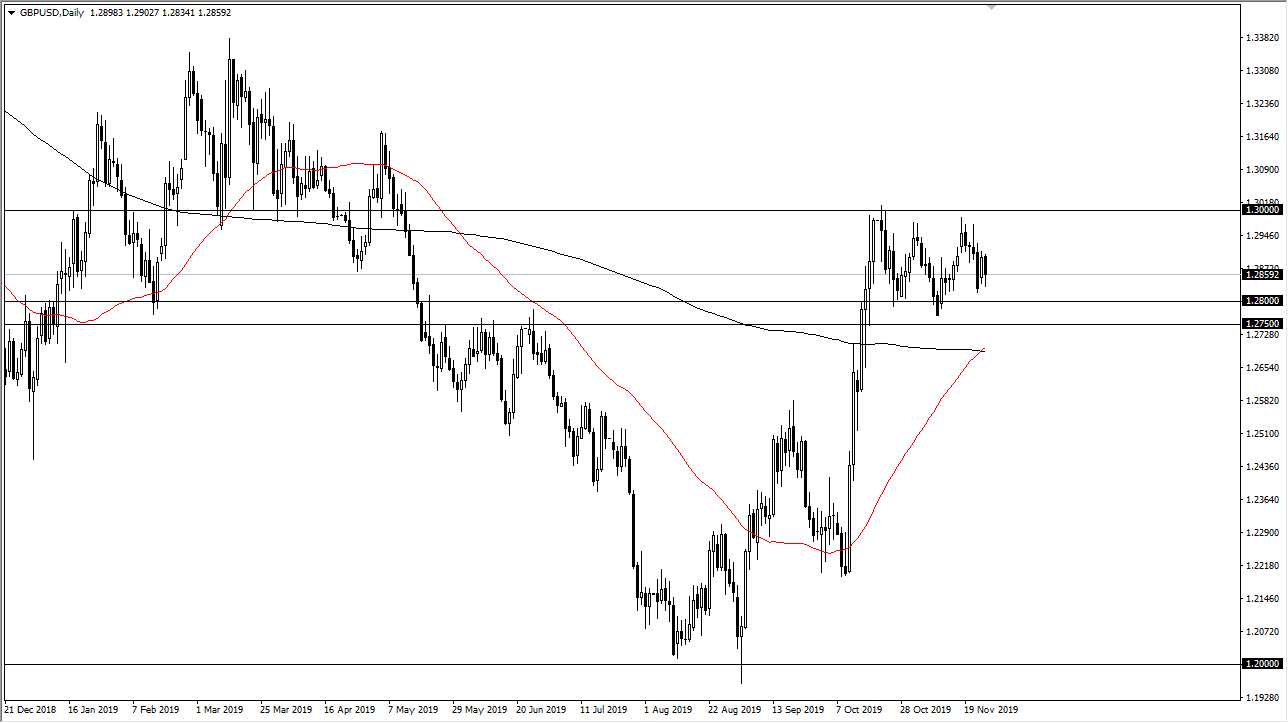

The British pound has fallen a bit during the trading session on Tuesday, reaching down towards the 1.28 level underneath. That support level extends down another 50 pips, to the 1.2750 level. I believe that there are plenty of buyers underneath there willing to come in and jump into the market, reaching towards the upside. All things being equal, the market looks very likely to continue to bounce around as we are waiting for the election results, and at this point we have seen the market fill the gap that kicked off the week as election polls suggest that perhaps Boris Johnson was going to have a conservative Parliament. That of course works out in his favor, but we have seen conflicting reports and pole since then so at this point the market isn’t ready to do anything.

The bullish flag that has been formed suggests that we would to go as high as the 1.38 level over the longer term, if we can get a daily close above that important 1.30 level. The 50 day EMA has just crossed above the 200 day EMA in the so-called “golden cross”, something that a lot of longer-term traders will continue to look at as a bullish signal. All things being equal, the market should continue to see a lot of back and forth in this area, so I think you should look at it under the microscope of a shorter time frame chart, looking for signs of supporting resistance at the levels, and taken advantage of it. One thing that I would say from a longer-term standpoint though is that if we do break down below the 1.2750 level, I think that there will probably have a lot of support near the 200 day EMA.

However, if we were to break above the 1.30 level then it’s likely that the market could go to the 1.33 level. That area has seen a lot of resistance in the past, so it makes sense that it could attract a certain amount of attention. I don’t think we can break above there without some type of good Brexit news, but once we do, we could fulfill the overall flag and reach towards the 1.38 level given enough time. Expect a lot of choppiness in volatility, but I still favor the overall uptrend, and therefore continue to buy short-term dips. I have no interest in shorting anytime soon.