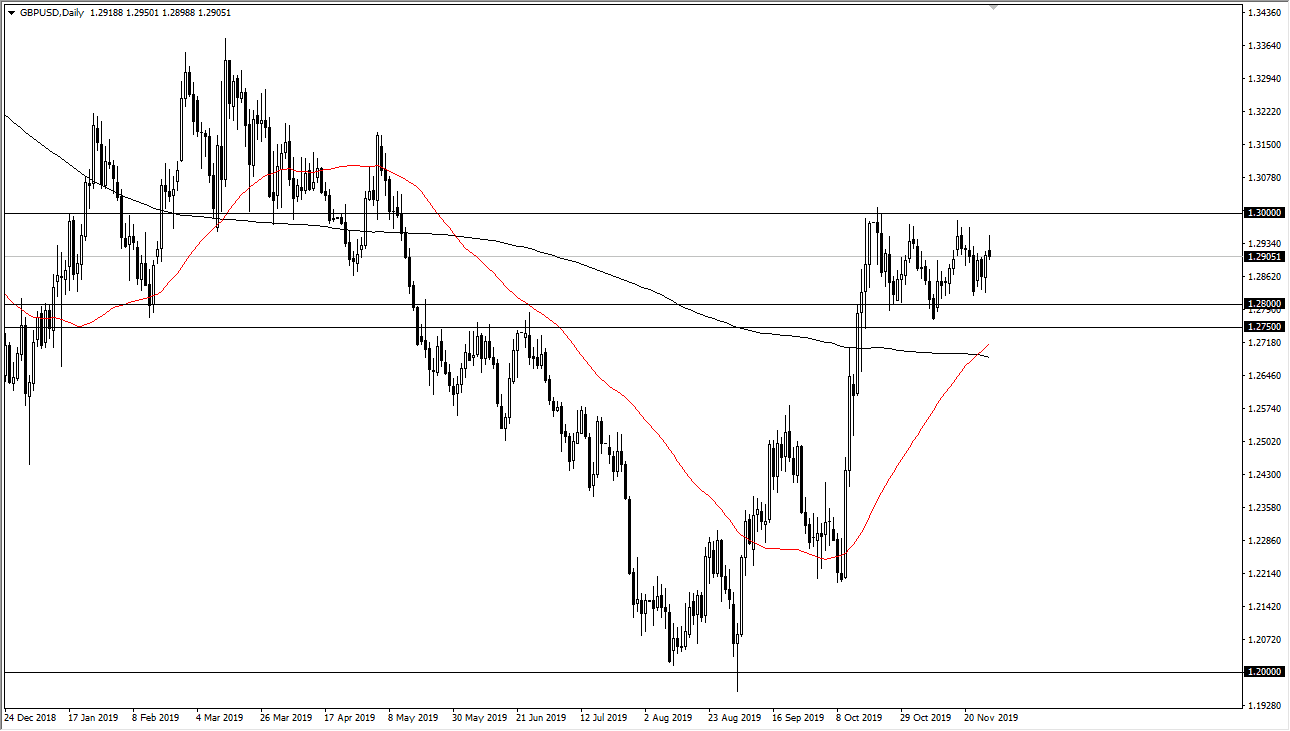

The British pound initially tried to rally during the training session on Thursday, but with Donald Trump signing the bill backing Hong Kong protesters from the U.S. Congress, China threatened to retaliate, and then all of a sudden everything was completely “risk off” going forward. With this, the British pound looks as if it is ready to continue the consolidation that had been such a major feature of the GBP/USD pair. We are currently stuck below the 1.30 level, waiting for some type of reason to celebrate.

Recent polls have suggested that the British election’s will probably favor a Tory Parliament, but at this point things are still trading on the latest headline more than anything else. It’s difficult to place longer-term traits with algorithms out there reading Twitter feeds and placing trade, but at this point it’s obvious that the consolidation is likely to continue. If we do break above the 1.30 level, then the market can go to the 1.33 handle, possibly even the 1.38 level based upon the fact that the bullish flag measures for that move.

Otherwise, if the market were to reach down a break below the 1.2750 level, it would throw bit of a spanner in the works, reaching down towards the 1.25 level next. That being said, I do favor the upside in general as the 50 day EMA has crossed above the 200 day EMA, showing signs of a longer-term “buy-and-hold” trade trying to set itself up. This is the so-called “golden cross”, and that would be a bullish sign for longer-term traders.

All things being equal it’s going to come down to the latest election poll results, and that of course the election itself. If we can get some type of certainty in the UK election and a majority ruled by the conservatives in Parliament, it lends credence to the idea of the UK finally leaving the European Union in our lifetime. That of course is a good sign, and at that point it would give markets a bit of certainty that they can focus on. At that point, I expect that the British pound should continue to go much higher, because it is so historically cheap at these levels. I continue to buy short-term pullbacks, went back and forth in this range that we have been in. I have no interest in trying to short this market, at least not until we get below the 1.25 handle.