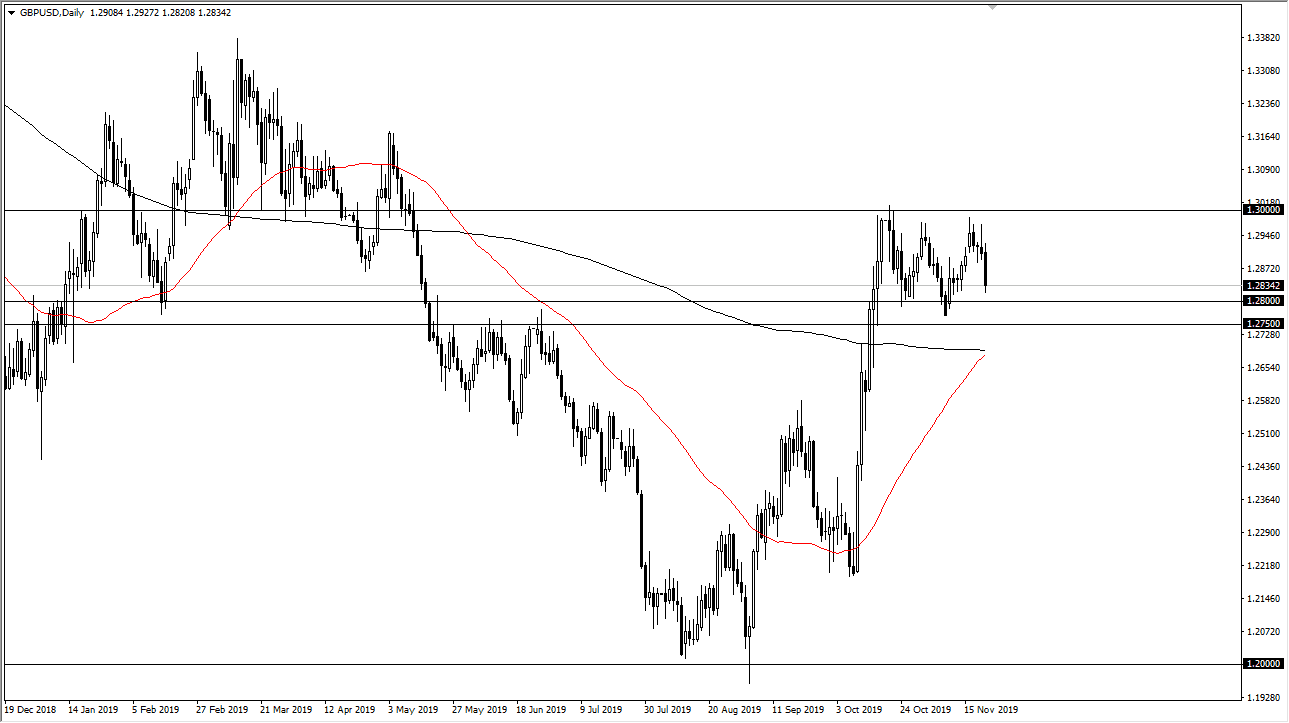

The British pound got hammered during the Friday session, but quite frankly when you look at the longer-term aspect of trading here, it’s obvious that we are still well within the tolerance of the bullish flag that has been building up for some time. We are still above the 1.28 level, which of course is a crucial level to pay attention to, as it is the bottom part of the range that we have been stuck in. Before building this area of support and resistance, we had a nice run higher which suggests that we are in fact in the middle of a bullish flag. That being said, the market looks as if we are going to continue to chop around in this area, as we have no real direction to be at this point. Markets are waiting around to figure out what’s going to go on with the election in the United Kingdom, so therefore it’s going to continue to be very noisy.

Just below, the 1.28 level extends down to the 1.2750 level, and that is your support zone. Otherwise, to the upside the 1.30 level continues to offer resistance, and it’s likely that the market will continue to respect that level. We will more than likely continue to pick around in this area and it should be noted that the 50 day EMA is starting to reach towards the 200 day EMA and possibly cross above there, but at this point it seems as if the market has no real catalyst to do anything. In a sense, this is a microcosm of what we are seeing in the markets, as there just is no movement in anything of measure. This will probably continue to be very quiet until we get to those elections in December, so this is a market that looks like it’s trying to build up inertia, but just doesn’t have a reason to move, and therefore we may have the occasional headline or nonsense that moves things around, but whether or not we can break out of this range is a completely different question. At this point, you would be forgiven for going to sleep and waking up in a few weeks. Even if we were to break down from here, the 1.25 level underneath should be massive support as it is a large, round, psychologically significant figure and an area that has seen a huge push.