The British pound has rallied a bit during the trading session on Monday, breaking back above the 1.28 handle as traders continue to consolidate the British pound against the US dollar. There are a lot of headlines and noise involving the British economy right now, not only due to the poor economic figures that we got during the training session on Monday, but also the fact that Nigel Farage has suggested that the Brexit Party won’t stand in the way of the Tories, and will concentrate mainly upon Labor Party seats during the upcoming election. This gives Boris Johnson the more likely favorable scenario of having a majority in Parliament.

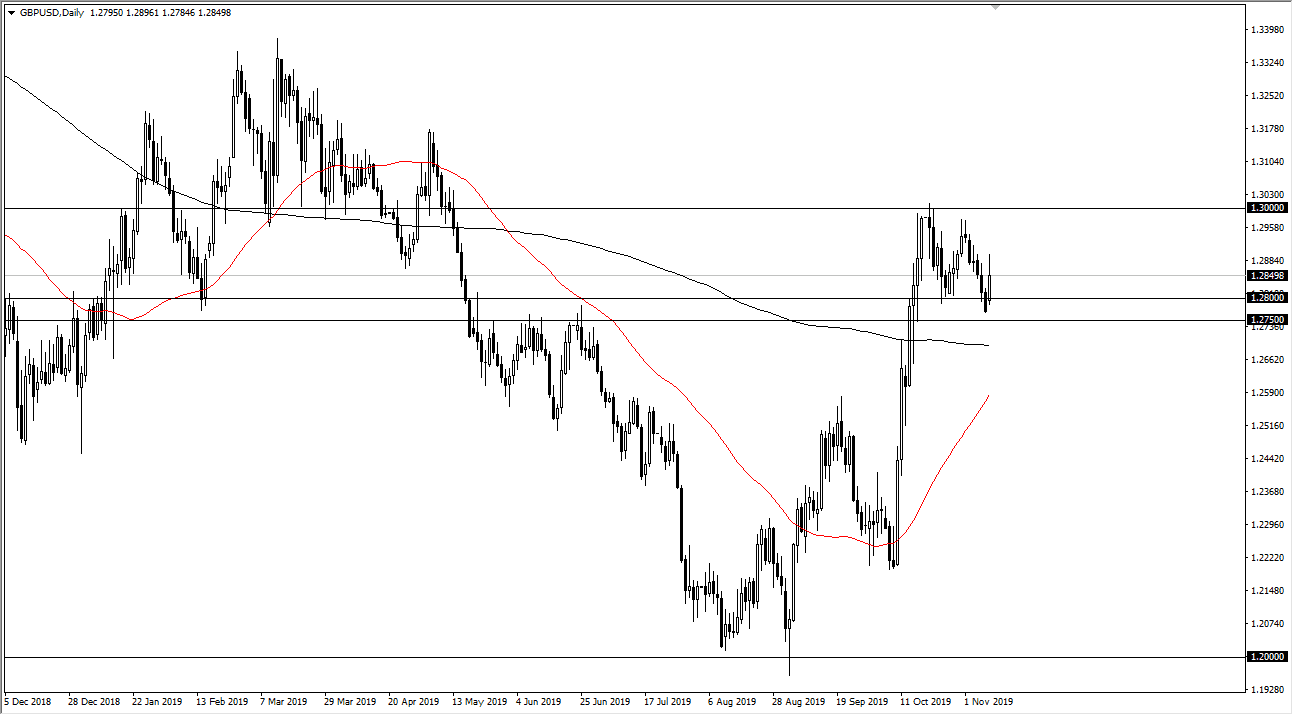

The idea of this is that there could be a little bit more in the way of confidence and at the very least a bit less uncertainty, something that causes chaos in a currency pair. Looking at the chart, it’s obvious that the 1.2750 level continues to cause significant amount of interest in the market, and beyond that we have the 200 day EMA just below causing significant support. With that, I do believe that the British pound will continue to grind higher, but the keyword here is of course going to be “grind.” Because of this, I believe that you will be able to take advantage of this overall uptrend, looking at short-term charts in order to take advantage of value when it appears.

At this point, I believe that there are plenty of buyers underneath just waiting to pop in, so look for signs of bouncing after short-term pullbacks, or I’d be interested in buying this market on a break above the highs from the trading session on Monday as well. It looks to me like we are forming some type of a bullish flag, which could send this market higher over the longer term, but we need to break above the 1.30 level. Once we do it opens up the door to the 1.33 handle, and then possibly even the 1.38 level. That obviously would take a lot of work but based upon the flag and that is being built, that is the measurement that we would be looking for. At this point, I don’t have any interest in trying to short the British pound because we have so much in the way of bullish pressure underneath as the buyers have been very aggressive in this market recently. That being said, we are essentially waiting for some type of good news catalyst to send this market much higher.