The British pound has rallied significantly during the month of October as fears of a “no deal Brexit” are starting to subside a little bit. Ultimately, this is a market that has extended its run much higher in the short term, so I think that the next couple of weeks could be a lot of choppiness just waiting to happen but ultimately it should be noted that buyer should get involved on these dips as they could offer a bit of support.

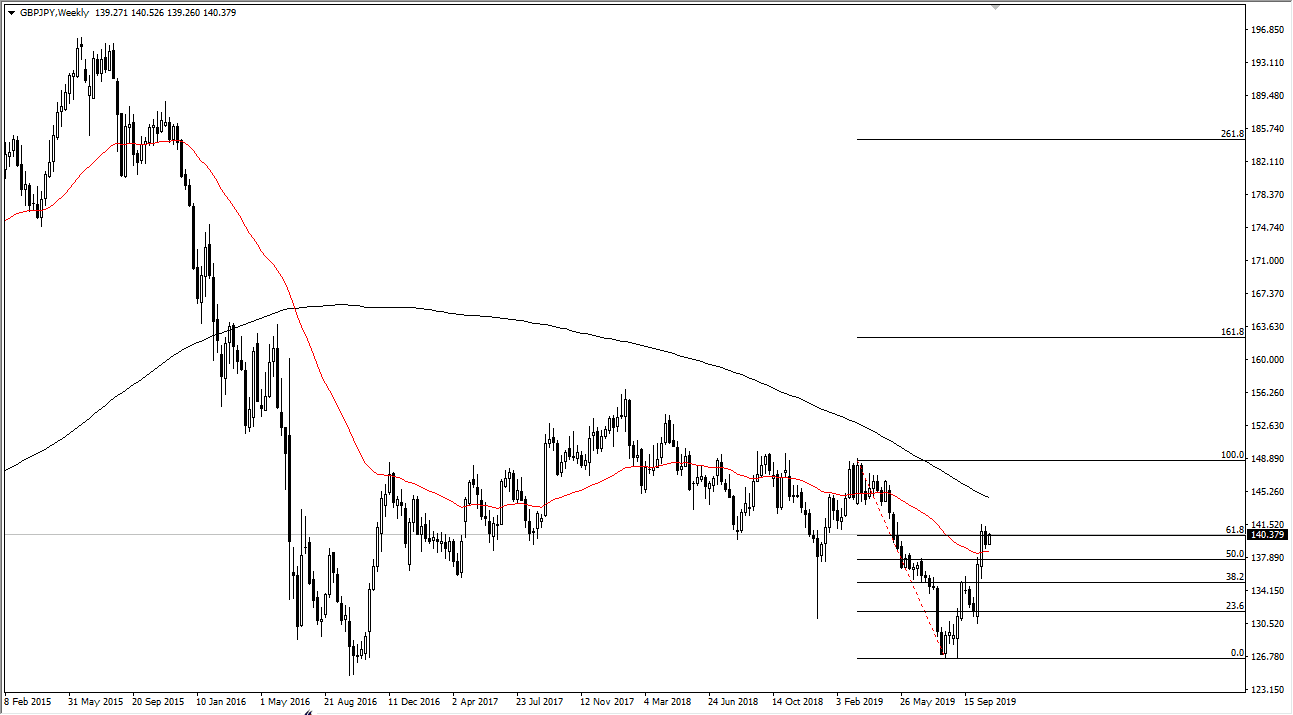

Currently, the market is bouncing around the ¥140 level, which is a large, round, psychologically significant figure, and an area that is previous support, so now course it makes sense that there would be a bit of resistance. All things being equal, another thing to pay attention to is that the 50 week EMA is starting to curl underneath and higher from below current pricing. At this point, if the market was to break out above the highs of the last couple of weeks, then the market could continue to go much higher, perhaps reaching towards the ¥145 level.

The market has made a significant turnaround, and I do believe that it is ultimately trying to build some type of longer-term base. At this point, it’s very likely that the market has put in a longer-term bottom, so look at pullbacks as potential buying opportunities in this pair. Ultimately, the Brexit moving forward will be one of the biggest pushes to the upside in this market, and therefore if we can get some type of good news coming out of that scenario it’s likely that this pair will rally. Beyond that, if the US/China situation continues to get better, it’s likely that this pair will rally as well, as it is a significant risk barometer.

Looking at this chart, if the market does rally, then not only could we reach towards the ¥145 level, and then possibly even the ¥150 level after that. To the downside, it looks very likely that the ¥135 level underneath offers a significant amount of support as there was a large, round, psychologically significant figure, it of course an area where we had previously seen a bit of a pullback, so at this point it’s likely that the market will continue to find buyers in that area as it was previous resistance and now should be support based upon market memory.