With the EUR/USD attempts during last week's trading to overcome the 1.1100 resistance and find the necessary momentum to confirm the strength of the bullish correction, it was normal that the decline quickly returned to the 1.1014 support, where the pair closed the week's trading around. This performance underlines the strength of the downtrend. The Euro rallied briefly on Friday after PMI surveys showed fresh hope that manufacturing recovery is coming, especially after ECB President Christine Lagarde promised to revise the policy.

The Eurozone manufacturing PMI in November was at 46.6, up from 45.9, a slight difference from the consensus reading of 46.4, and with gains mostly driven by Germany. The German PMI rose from 42.1 to 43.8 in November, while markets were expecting an increase to only 42.9.

On the negative side, the European Services PMI came in below expectations, dropping from an upwardly revised 52.2 to just 51.5 this month, the lowest level since December 2018, while markets were expecting a reading of 52.4. The downward movement in the services gauge was led by Germany, where the PMI fell from 51.6 to 51.3, while markets were looking for an increase to 52.0.

Service numbers in Europe have been disappointing for the markets, and some earlier doubts may confirm that a downturn in manufacturing could spill over into the rest of the economy, although stability in the manufacturing sector may ease concerns about the potential extent of any damage to the service industry. The German economy avoided a technical recession in the third quarter. The ECB is buying large amounts of government bonds and cutting interest rates for years in the hope of raising economic growth to levels that sustainably achieve the inflation target that is “close to, but less than 2%”.

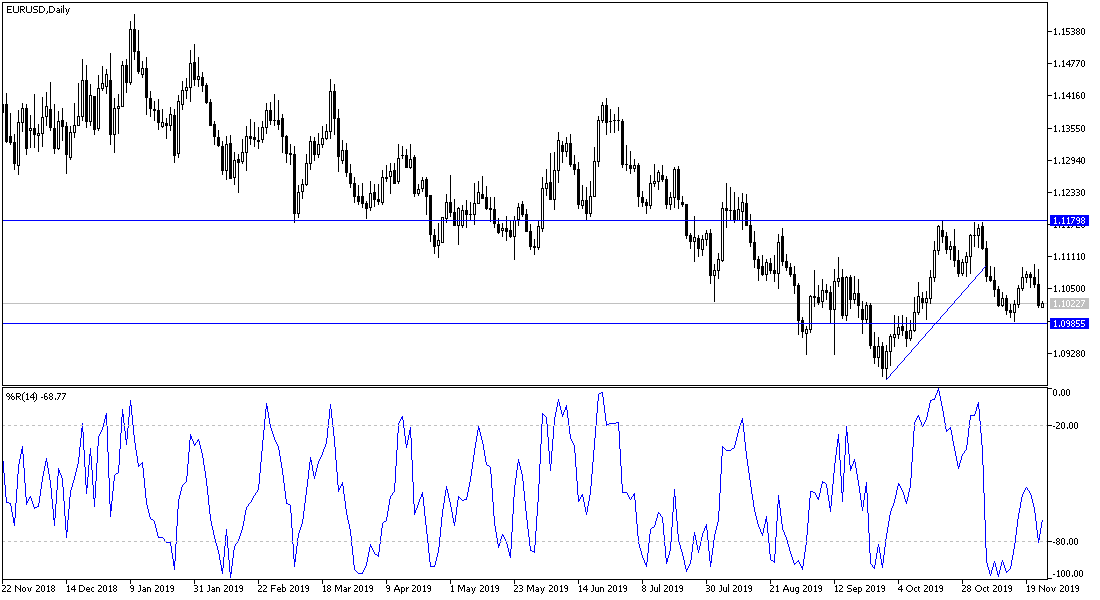

According to the technical analysis of the pair: The general trend of EUR/USD is still bearish and the ,move below the 1.1000 support will increase the strength of the bearish momentum again, and thus return to test stronger support levels, which are currently at 1.0945 and 1.0880 respectively. Continued pessimism may prompt the bears to move towards these levels as soon as possible. As we expected, the pair will not have the momentum for an upward correction without stability above the 1.1120 resistance. The announcement of signing the Phase1 agreement between the US and China may strengthen the pair's strength rather than wait for an improvement in the European data.

As for the economic calendar data: All focus will be on the release of the German IFO Business Climate Index. There are no significant US economic releases today.