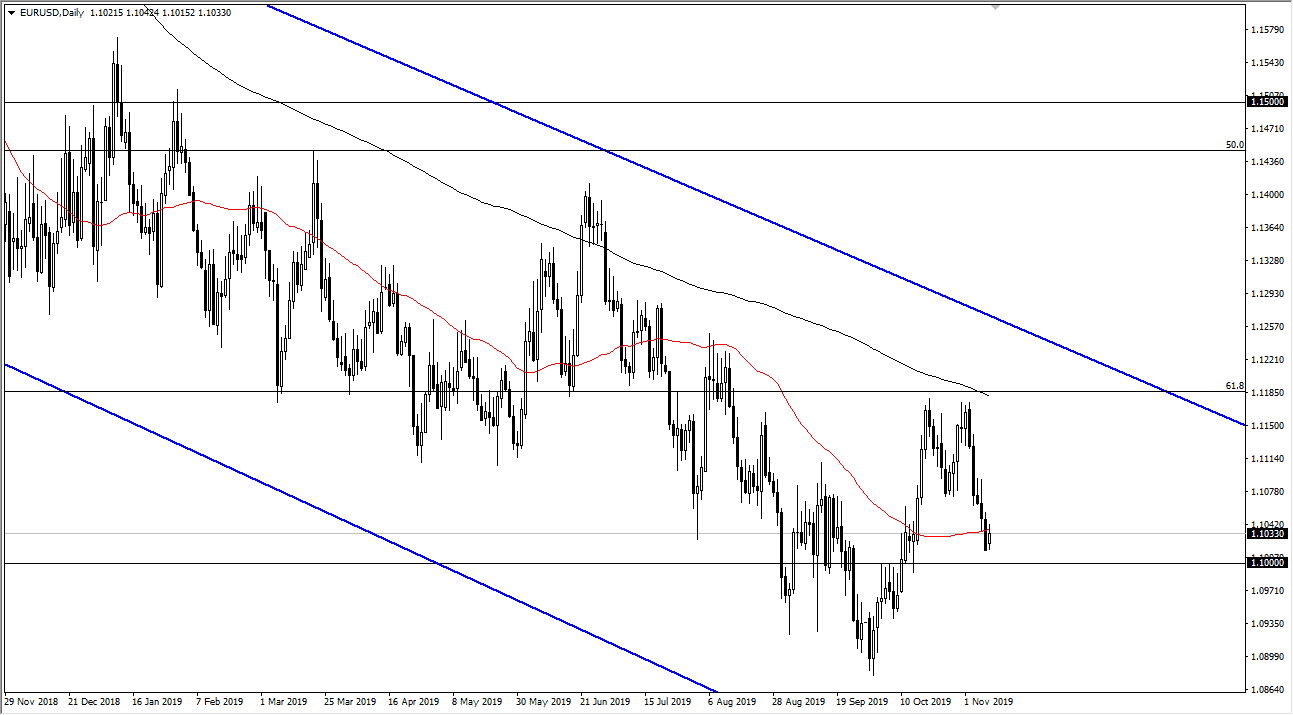

The Euro continues to go back and forth overall, but Monday was a slightly positive session. By bouncing the way, he did, we did eventually run into trouble at the 50 day EMA and pulled back from that level. The 1.10 level underneath should continue to be supportive, but if we were to break down below that area, it’s likely that the market could go much lower, to at least the 1.09 level as it was the most recent low.

The European Central Bank is going to continue to loosen monetary policy, and at this point it’s very likely that the market will continue to favor the US dollar, as the Federal Reserve is stepping on the sidelines and not doing anymore monetary policy going forward. Ultimately, this is a market that has been in a downtrend quite significantly, the reality is that the market has rolled over every time it has tried to break to the upside. All things being equal, it’s very likely that the market will continue to be one that you can fade on short-term rallies, and it should be noted that the 50 day EMA has come into play and pushed the market down as well.

Looking at this chart, I recognize of the 1.10 level my cause a little bit of support, and it’s possible that part of the rally during the trading session on Monday was due to the round figure, so at this point I suspect this is more or less a short-term phenomenon, but either way I like the idea of fading rallies if we get those opportunities. I look to short-term charts in order to do so, as the longer-term trend has most certainly been reliable, selling off every time they trying to push the Euro higher. I see no reason for it to rally from here as it looks like Germany is going to go into recession and of course Brexit drags on, so ultimately, I do think that we go much lower. Recently, we had tested the 61.8% Fibonacci retracement level and then broke below it, now that we have confirmed that level been broken, the theory is that we could go to the 100% Fibonacci retracement level which is at roughly 1.04. In other words, we have a long way to go in theory. Beyond that, we also have a gap at the 1.07 level, so I think it’s likely that we will at least try to fill that.