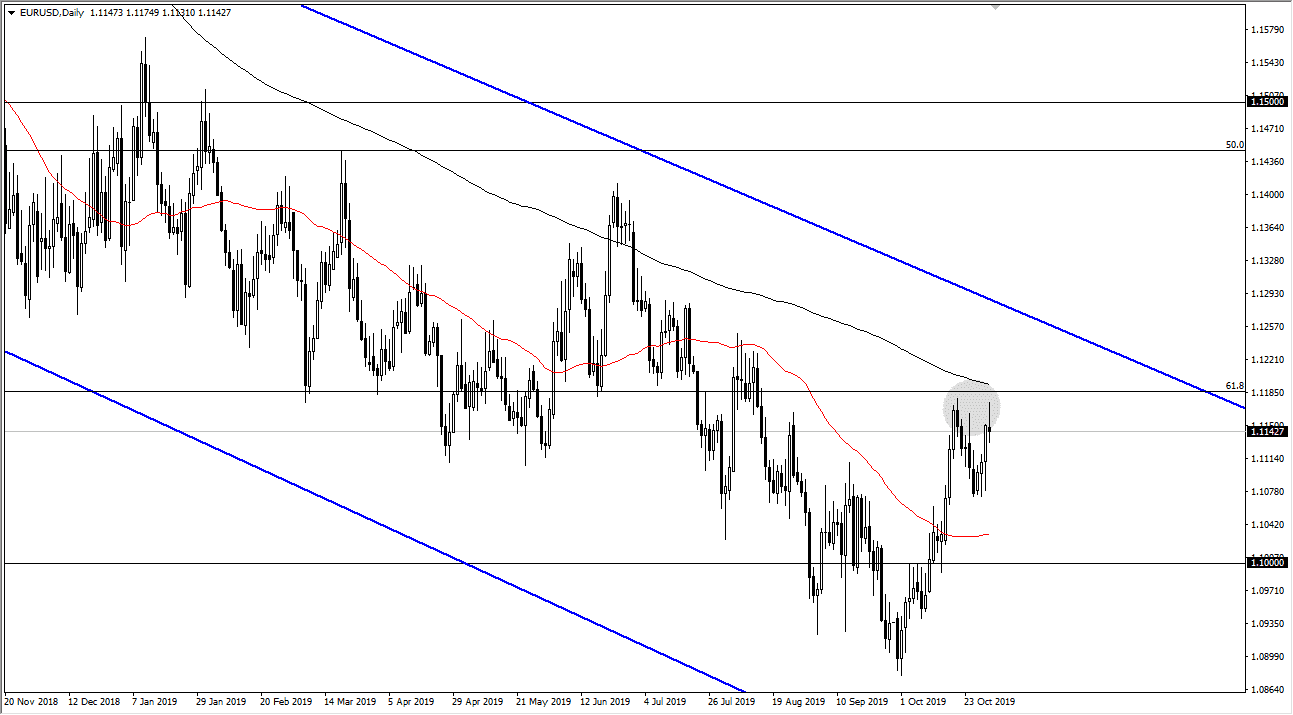

The Euro has initially tried to rally during the trading session on Thursday but has given back the gains to show signs of weakness again at the 1.12 level which is also near the 200 day EMA. At this point in time, the market looks as if it is ready to continue to consolidate, between the 1.12 level and the 1.1075 level underneath. The job summer comes out during the Friday session, and that, of course, will cause quite a bit of choppiness.

That being said, it will be interesting to see how this market plays out from here, as the market is in a huge downtrend but has recently seen a bit of a fight. Overall, the market has continued to see these rally sold into over the last three years, which has been a longer-term downtrend. At this point, the market looks as if it is ready to continue to the downside, at least from a longer-term standpoint. To the downside, if we were to break down below the 1.1075 handle, then the 50 day EMA is probably going to be targeted, and then eventually the 1.10 level after that. Don’t get me wrong, this doesn’t mean that it’s going to be easy, and it will probably be very noisy in general on the way down. Overall, I think that this market probably continues to see a lot of noise as per usual, as this pair tends to be traded by a lot of different types of traders. The market does tend to be visited by a lot of high-frequency traders, and that leads to a lot of choppy trading as well.

All things being equal, this is a market that has been going lower over the last three years and that something that you should keep in the back of your mind. Ultimately, the market should continue to go down to lower levels, but if the market was to turn around and break above the 200 day EMA and stay there, it could send the market much higher. Ultimately, this is a market that has done this before though, so it’s difficult to get overly excited about the upside quite yet. The jobs number could give us a little bit more moment one direction or another, so pay attention to how the daily candlestick from Friday closes. All things being equal, I believe that we are probably going to consolidate in general over the next couple of days.