Cryptocurrency markets have calmed down in November but retained a bearish bias. Ethereum, which brought the world the second generation of blockchain technology which supported smart contracts as well as dApp development, currently remains the second-largest cryptocurrency behind Bitcoin. This may change as soon, especially with TRON taking market share away from Ethereum in the dApp sector while Binance is also posing a threat to it. ETH/USD has struggled with its resistance zone which rejected three breakout attempts and keeps this cryptocurrency pair below the $200 level or roughly 86% below its all-time high just above $1,400.

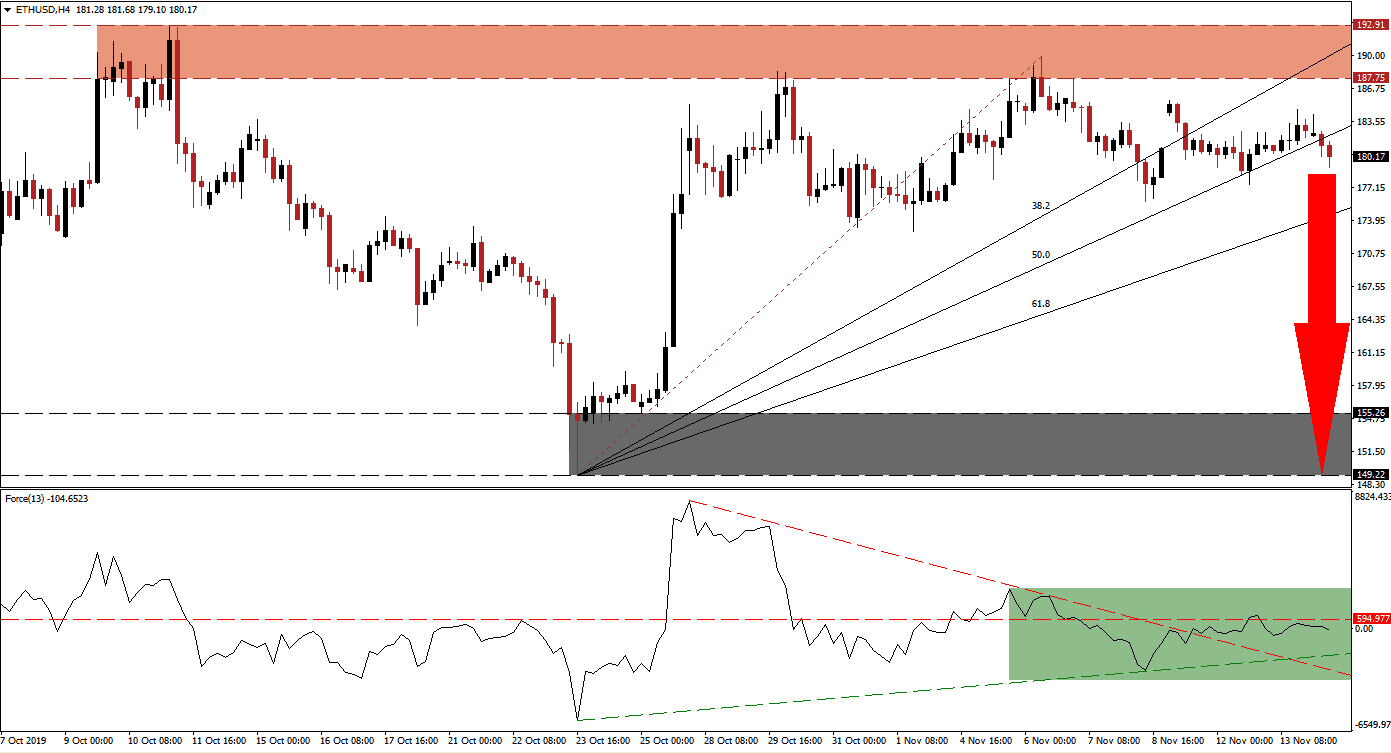

The Force Index, a next-generation technical indicator, ranged sideways with price action and remained mostly below its horizontal resistance level. The latest push into its resistance zone resulted in the re-drawing of the Fibonacci Retracement Fan and while the Force Index bounced off of its ascending support level, its descending resistance level rejected a further advance. This technical indicator also remains in negative territory, as marked by the green rectangle, and bears are in charge of price action. A breakdown below its ascending support level is expected to lead ETH/USD farther to the downside. You can learn more about the Force Index here.

Earlier today, this cryptocurrency pair completed a breakdown below its 50.0 Fibonacci Retracement Fan Support Level and turned it into resistance. This has increased bearish pressures and the 38.2 Fibonacci Retracement Fan Support Level has moved into the resistance zone which is located between 187.75 and 192.91 as marked by the red rectangle. Traders should now monitor ETH/USD as it approaches the intra-day low of 175.86 which represents the low of the last breakdown in price action below its resistance zone. A sustained push lower could take it below its 61.8 Fibonacci Retracement Fan Support Level which will clear the path for a bigger correction, partially powered by a profit-taking sell-off.

As fundamental bearish developments materialize and the technical picture suggests more downside potential, ETH/USD is expected to descend into its next long-term support zone which is located between 149.22 and 155.26 as marked by the grey rectangle. A double breakdown in the Force Index, below its ascending support level and its descending resistance level which currently acts as temporary support, cannot be ruled out which may lead to another breakdown in price action after this cryptocurrency pair reaches its support zone. You can learn more about a support zone here.

ETH/USD Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 180.00

⦁ Take Profit @ 149.50

⦁ Stop Loss @ 188.50

⦁ Downside Potential: 3,050 pips

⦁ Upside Risk: 850 pips

⦁ Risk/Reward Ratio: 3.59

In the event of a spike higher in the Force Index, supported by its ascending support level, which will convert the horizontal resistance level back into support, ETH/USD could attempt to push above its resistance zone. The long-term prospects for this cryptocurrency pair remain to the downside and any push into its next resistance zone, located between 212.73 and 219.72 should be taken advantage of by taking short-positions.

ETH/USD Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 195.00

⦁ Take Profit @ 212.50

⦁ Stop Loss @ 188.50

⦁ Upside Potential: 1,750 pips

⦁ Downside Risk: 650 pips

⦁ Risk/Reward Ratio: 2.69