The Australian dollar continues to see a lot of noise in general, which makes quite a bit of sense considering just how noisy the situation has been in the Forex markets as of late. The Australian dollar is highly levered to the Chinese markets, which of course are being thrown around by the US/China trade situation. Ultimately, this is a market that is waiting to see what happens next, and during the day on Wednesday, we had seen a lot of noise around the US/China signing of “Phase 1.” This is causing a lot of problems in the market as it looks like the signing will be until at least December, and you would have to be rather gullible to think that it’s going to happen anytime soon anyway. At this point, this is a market that seems to be getting tossed around quite a bit, but at this point that should be nothing new.

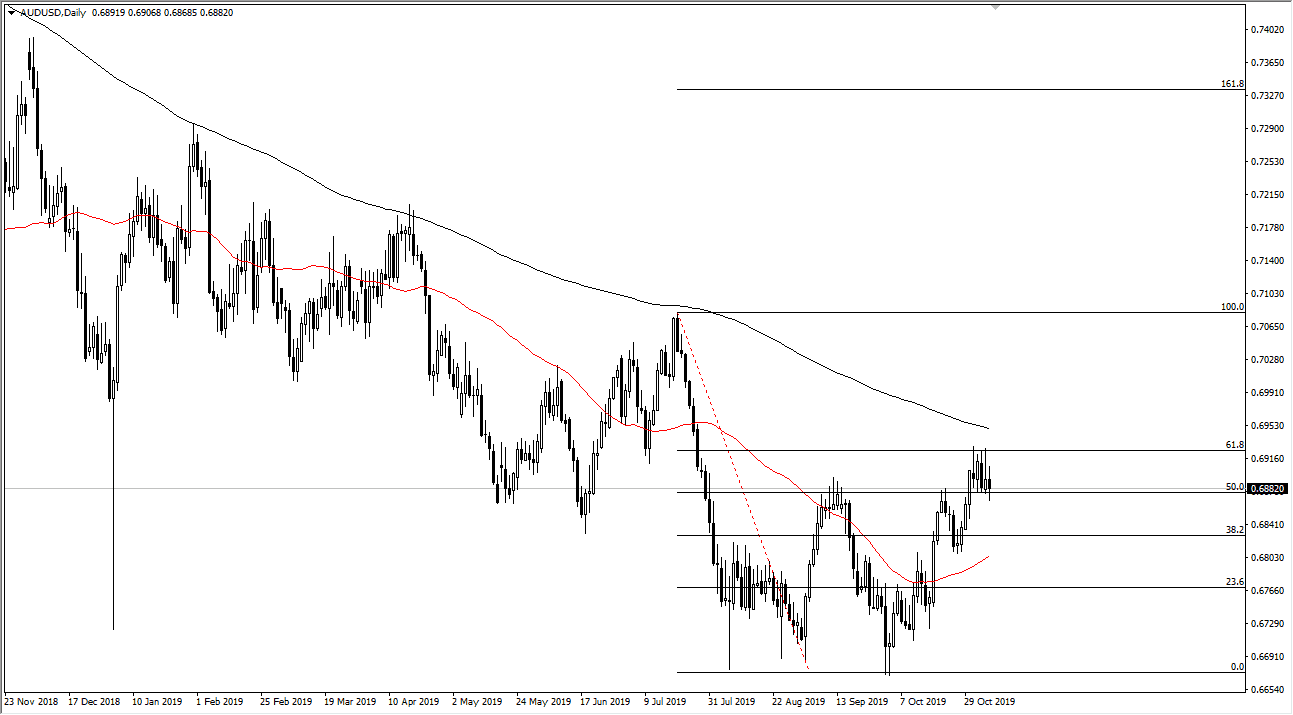

Looking at the chart, the 200 day EMA is sitting just above, which is sitting at the 61.8% Fibonacci retracement level. This is an area that will attract a certain amount attention, but we also have a lot of support underneath down 0.6850 level, so at this point it makes quite a bit of sense that we will continue to see the market go back and forth. With all of that being said, we could eventually get some type of move, but right now it seems to be stuck in this range, and as a result I don’t have a lot to do with this market recently. We will eventually get some type of impulsive candlestick that we can take as a signal.

To the downside, if we were to break down below the 50 day EMA it could send this market much lower, perhaps down to the 0.67 level. To the upside, if we were to break above the 200 day EMA we could see a move towards the 0.71 handle. All things being equal though, I believe that this market will continue to go back and forth and cause a lot of noise, so quite frankly unless you are a short-term trader you may find trouble trading this market for anything significant. We are in a downtrend longer-term, but also showing signs of possibly building some type of base. In other words, the Australian dollar will continue to be very confusing.