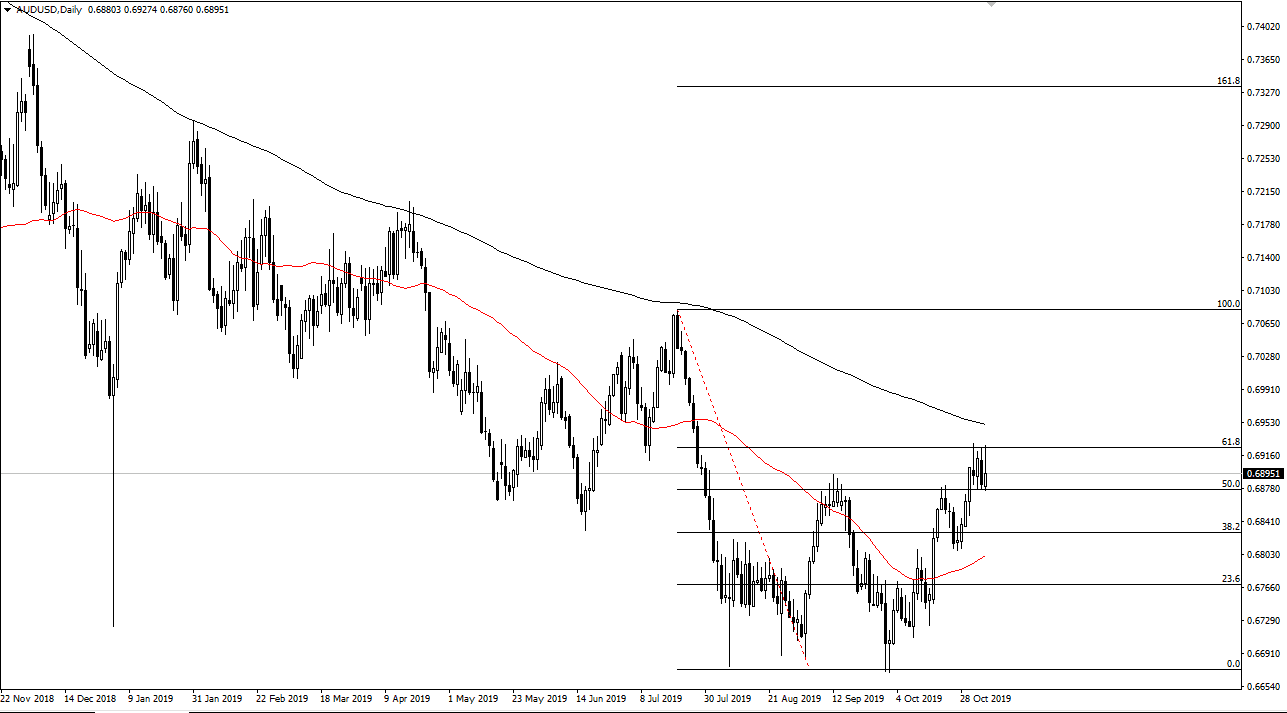

The Australian dollar tried to rally during the trading session on Tuesday, but then rolled over to form a bit of a shooting star. The market has shown a lot of selling pressure the 61.8% Fibonacci retracement level again, as we have no true signs of strength at this point. Quite frankly, the market is going to continue to see a lot of back and forth action in this area until some type of confirmation involving the US/China trade war comes about, and as a result although it certainly looks bearish, I don’t necessarily think that this pair is going to fall apart either.

We had seen a lot of US dollar strength in general during the trading session, so the move makes quite a bit of sense. This isn’t necessarily about the Australian dollar being we, but more to do with the US dollar being strong. As the ISM Non-Manufacturing PMI figures came out stronger than anticipated, it shows just how different the US economy is then so many others around the world. It makes sense that this market breaks down a bit, but I would not expect some type of major meltdown. Quite frankly, if we were going to see it, we would’ve seen it during the Tuesday session.

The 200 day EMA sits above and continues to offer a lot of resistance. The 61.8% Fibonacci retracement level is just below there, and it looks likely that traders will continue to short the market in that vicinity, unless of course something drastically changes. On the other hand, there is a lot of support at the 0.68 level underneath, which also features the 50 day EMA. If we were to break down below there, then the bottom would probably fall out and the Aussie would go back to the recent lows. I don’t think that’s the most likely thing though, as we are waiting to see whether or not the United States and China can pull it together. After all, the Australian dollar is highly sensitive to the Chinese mainland and of course the Chinese economy. Australia provides a significant amount of raw commodities to the Chinese for both manufacturing and construction, so any good news in the Chinese economy typically favors the Aussie dollar as well. If we did break to the outside though, the market is likely to go looking towards the 100% Fibonacci retracement level which is closer to the 0.71 handle.