Financial markets started to stutter as delays in the US-China phase one trade truce have increased fears that severe issues remain, even on the parts which analysts claimed were the easiest to accomplish. The Australian and New Zealand Dollar did receive a dose of positive news from the 35th ASEAN summit where the RCEP, the world’s largest free trade agreement, was agreed on in principle; both countries signed up to the 15-conntry trade bloc. Australia reported a surge in it trade surplus on the back of strong exports, but the AUD/NZD remained confined to its resistance zone from where a profit-taking sell-off may emerge.

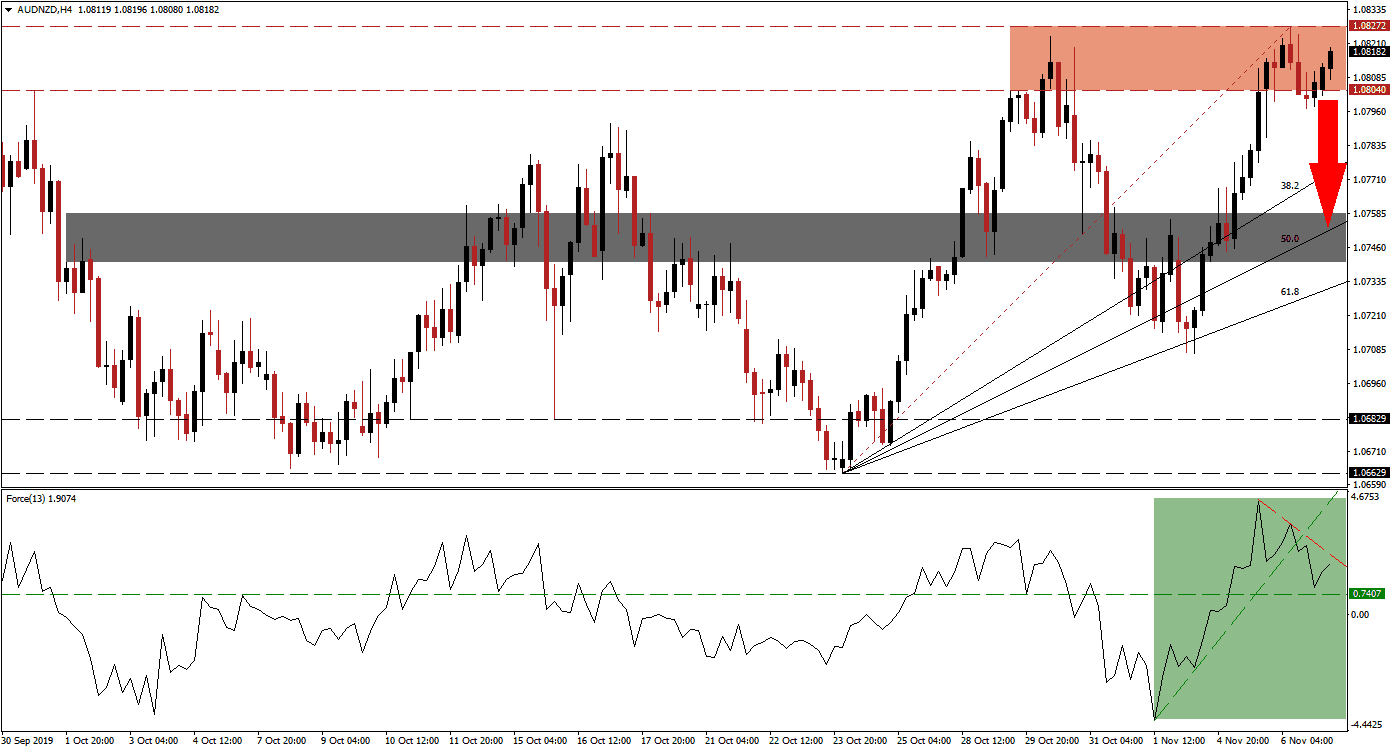

The Force Index, a next generation technical indicator, started to retreat from its higher and a descending resistance level emerged which is increasing downside pressure. The sharp advance in the AUD/NZD after it touched its 61.8 Fibonacci Retracement Fan Support Level was confirmed with a strong push higher by this technical indicator, but the reversal has resulted in a breakdown below its steep, ascending support level. This represents a bearish development and is marked by the green rectangle; a move below its horizontal its horizontal support level is likely to trigger a breakdown in price action. You can learn more about the Force Index here.

Despite the better-than-expected trade data out of Australia, this currency pair saw bullish momentum depressed further inside its resistance zone which is located between 1.08040 and 1.08272 as marked by the red rectangle. While the current intra-day high in the AUD/NZD marks a slightly higher high, it is not significant enough and the uptrend has therefore been broken. Price action is expected to reverse and forex traders should monitor the intra-day low of 1.07973, this marks the low of the previous push below its resistance zone which was reversed; a move lower is likely to result in new net short positions in this currency pair.

A corrective phase in the AUD/NZD is expected to take it into its 50.0 Fibonacci Retracement Fan Support Level which is currently passing through its short-term support zone, located between 1.07407 and 1.07586 as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Support Level, from where price action initiated its previous advance, is also closing in on the bottom range of this zone. A breakdown below this zone is unlikely unless a fresh fundamental catalyst will emerge. You can read more about the Fibonacci Retracement Fan here.

AUD/NZD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.08200

⦁ Take Profit @ 1.07550

⦁ Stop Loss @ 1.08400

⦁ Downside Potential: 65 pips

⦁ Upside Risk: 20 pips

⦁ Risk/Reward Ratio: 3.25

In the event of a reversal in the Force Index, assisted by its horizontal support level, which will take this technical indicator above its descending resistance level, a breakout in the AUD/NZD may follow. Given the current fundamental picture, a sustained breakout is not expected without a corrective phase and the technical scenario points towards a breakdown; the next resistance zone is located between 1.08986 and 1.09281.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 1.08550

⦁ Take Profit @ 1.09100

⦁ Stop Loss @ 1.08300

⦁ Upside Potential: 55 pips

⦁ Downside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.20