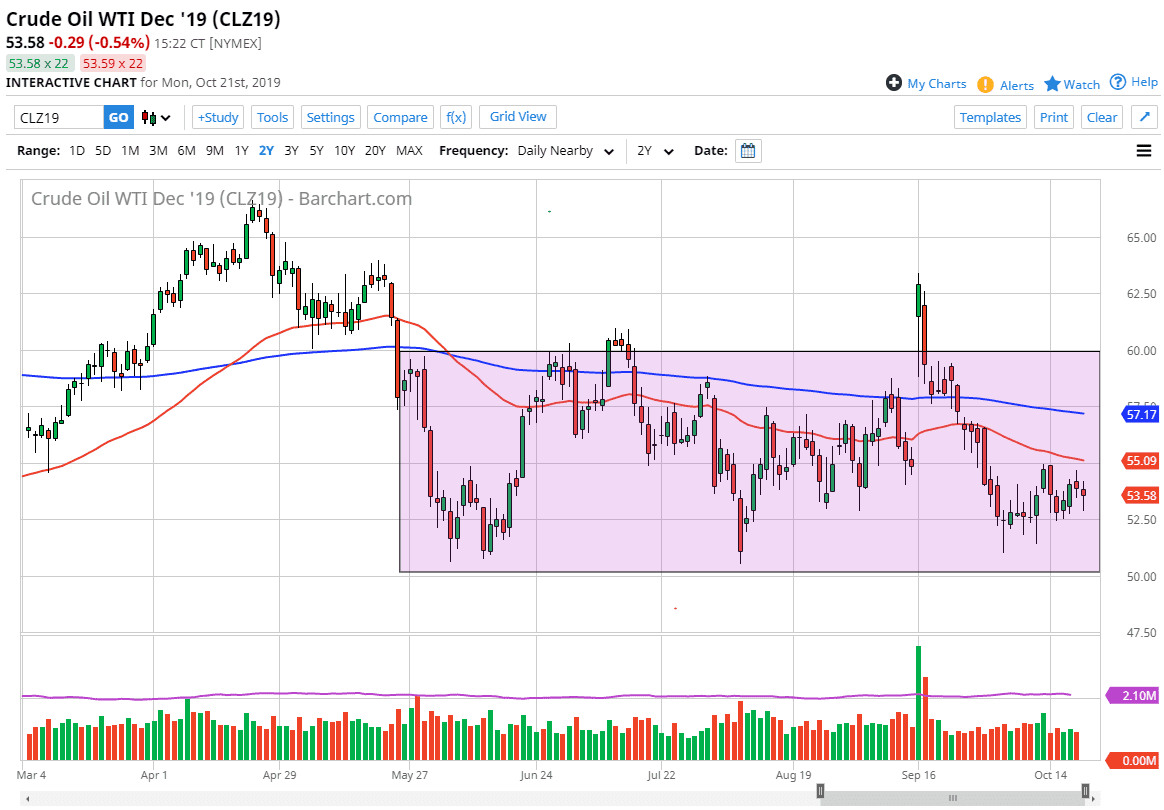

The WTI Crude Oil market fell during most of the trading session on Monday but did recover quite nicely. By doing so it shows just how back-and-forth the market is right now, dancing around in a $2.50 region yet again. The two areas include the $52.50 level underneath, and the $55 level above. With that being the case, the market continues to simply bounce around and short-term trading continues to be favored. With that being the case it’s likely that we will continue to see a lot of back-and-forth choppiness. All things being equal, this is a market that I do like the idea of trading range bound systems on short-term charts, but when I look out at a larger time frame, it shows the $50 level underneath offering a significant amount of support, while the $60 level above offer significant resistance.

That being the case, it makes sense that longer-term traders will be looking at these areas, and by extension I think that a lot of support will be found underneath. If that’s going to be the case, it’s very likely that the market will continue to find buyers in this general vicinity. Ultimately though, the $55 level above also features the 50-day EMA that could cause some type of situation. That situation being overcome could open the door to the 200-day EMA, which is closer to the $57 level. That being the case, the market looks likely to eventually try to break above there and go to the $60 level, although it won’t necessarily be easy to get there.

All things being equal, expect a lot of volatility even on the long time frames, and it makes sense that the Middle East tensions continue to cause a bit of bullish pressure but at the same time we have a lot of concern and bearish pressure when it continues to see a lot of negative economic numbers around the world with a lot of negative economic numbers. With the lack of demand, that should continue to push this market lower, so it will only be a matter time before rallies get sold into. I think you’re going to see a lot of noise at this point, and overall choppy behavior. With that being the case, keep your position size relatively small, because you could see sudden movements based upon headlines.