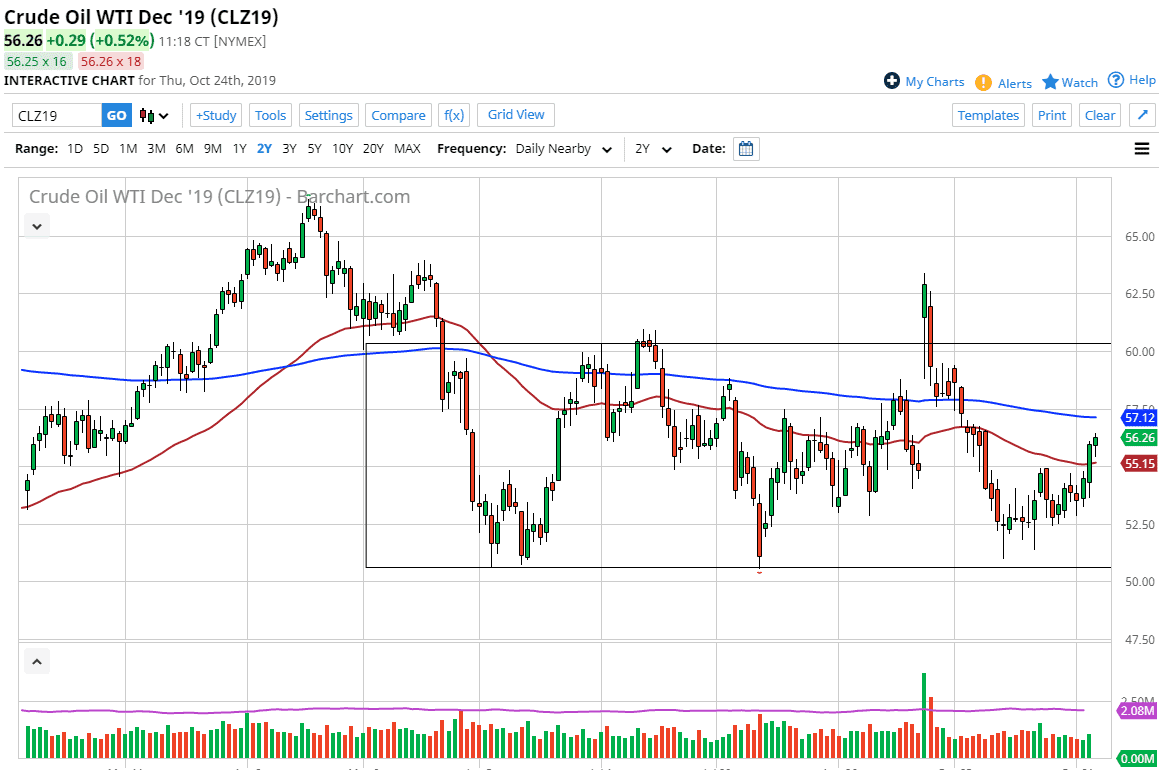

The West Texas Crude Oil market continues to see a lot of bullish pressure, and it’s only a matter of time before we break out to the upside. Ultimately the market looks as if it is going to try to go to the 200-day EMA, which is above at the $57.12 level. Short-term pullbacks will continue to offer value, as we have seen a lot of buying pressure underneath it should have people looking to get involved in the upswing.

When you look at the longer-term chart, we could see that there is essentially a range bound attitude to this market between the $50 level in the bottom and the $60 level and the top. If that’s going to be the case, then we should have further to go but it may take some time to get there. I like the idea of buying these dips for short-term moves. I don’t necessarily think that you can buy and hold, mainly because there isn’t much in the way of conviction even though it’s been a slow and steady grind higher.

To the downside if we were to break down below the 50-day MA it could to show some negativity but ultimately, I believe that there is enough support even underneath there to continue to push this market to the upside. In fact, you can take a look at the candlestick as a sign that we have broken major resistance and therefore there should be plenty of buyers underneath the get involved. OPEC looks as if it is going to try to cut production going forward, so therefore it’s probably best that we wait to see the reaction of the market over the longer term before jumping “all in”, but it’s likely that we will continue to see buying pressure so I think at this point what we should do is simply add to a core position for a bigger move towards the $59 level. Between the $59 level in the $60 level there should be a significant amount of noise and resistance, so I would be out of the position by the time we got there. As far as selling is concerned, I don’t have any interest in doing so at this point, as it looks like the selling pressure has finally completely abated. Another external factor could be the US dollar, so if it starts to lose a bit of value this could see oil rally as well.