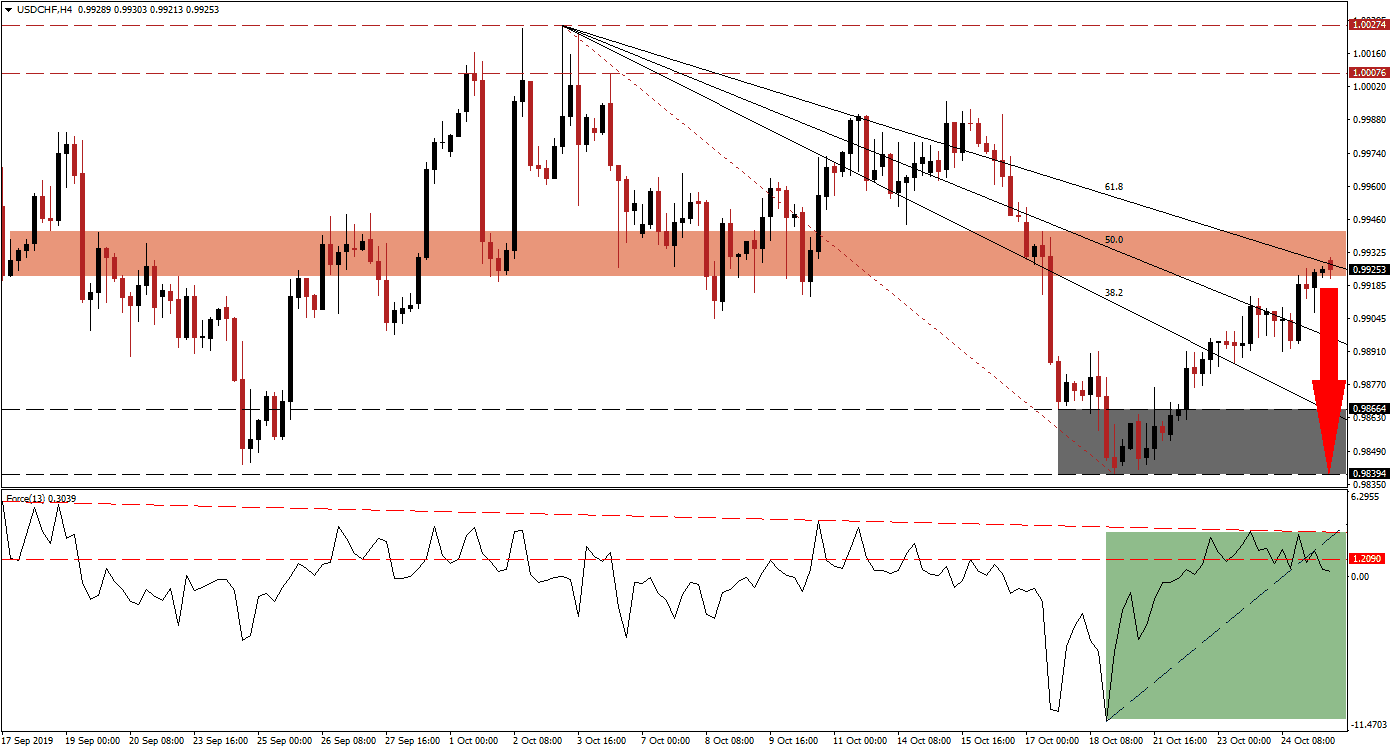

Following a breakout above its support zone, the USD/CHF extended its advance and pushed above its descending 38.2 and 50.0 Fibonacci Retracement Fan Resistance Levels, turning them into support. The rally is now showing signs of exhaustion as it reached a strong short-term resistance zone which is enforced by the 61.8 Fibonacci Retracement Fan Resistance Level. Economic data out of the US has come in much weaker than expected and provided a fundamental catalyst for a price action reversal. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next generation technical indicator, points towards the collapse in bullish momentum as price action reached its resistance zone. The Force Index completed a breakdown below its horizontal support level, turning it into resistance, after its descending resistance level exercised additional downside pressure. Adding to bearish developments, this technical indicator has pushed below its steep ascending support level, as marked by the green rectangle, and is now expected to slide into negative territory which will place bears in charge of the USD/CHF.

As the short-term resistance zone, located between 0.99221 and 0.99410 which is marked by the red rectangle, is replacing bullish momentum with bearish one, forex traders should monitor the intra-day low of 0.99148. This level represents the low from where a previous sell-off accelerated to the downside; a move by the USD/CHF below this mark is likely to result in an accelerated contraction and invite new net short positions. A move by the Force Index into negative conditions could spark the expected price action reversal, partially fueled by profit taking. You can learn more about a profit taking sell-off here.

Given the lack of a meaning full support level following a confirmed breakdown below the short-term resistance zone, price action is expected to reverse into its next support zone; this zone is located between 0.98394 and 0.98664 which is marked by the grey rectangle. The 38.2 Fibonacci Retracement Fan Support Level has just entered this zone and considering the current fundamental scenario, a breakdown is possible follow and extend the corrective phase of the USD/CHF.

USD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 0.99250

Take Profit @ 0.98400

Stop Loss @ 0.99500

Downside Potential: 85 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 3.40

In the event of a breakout in the Force Index above its horizontal resistance level, which will turn it back into support, the USD/CHF may follow suit with a breakout attempt of its own above its short-term resistance zone. Upside potential is limited to its next long-term resistance zone located between 1.00076 and 1.00274 while parity remains a key psychological resistance level to consider; any advance into parity represents a solid entry opportunity for long-term short positions.

USD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.99650

Take Profit @ 1.00100

Stop Loss @ 0.99450

Upside Potential: 45 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.25