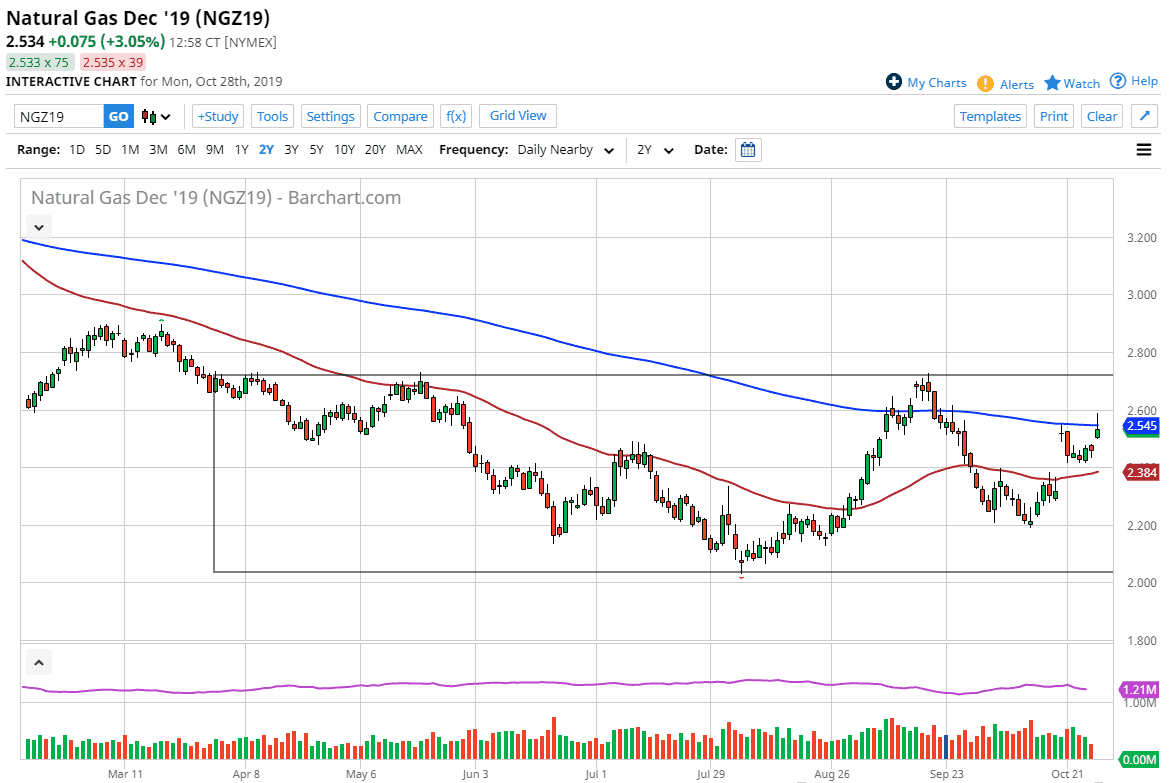

Natural gas markets gapped higher to kick off the week on Monday, and then eventually broke above the 200 day EMA. However, we have pulled back just a little bit, showing signs of exhaustion. Ultimately though, this is a market that focuses on the weather more than anything else, and with the colder temperatures coming in the United States, you will typically see this market rally significantly and reach to the upside.

The 200 day EMA will of course continue to attract a lot of attention, and it’s not a huge surprise to see the market pull back a bit from the highs of the day, but at this point I believe it’s only a matter of time before that continues. After all, the market has gapped a couple of times in the last couple of weeks, and now it has colder temperatures coming down the pipe. This should continue to push things in an upward manner, as the demand for natural gas should continue to be growing. If we can break above the highs from the trading session on Monday, then it’s very likely that we will continue to see the buyers push towards the highs that had been hit recently at the $2.72 level. After that, I would expect to move towards the $3.00 level which is a nice longer-term target based upon psychological influence anyway.

To the downside, I see the 50 day EMA offering support, extending down to the $2.30 level as it is the bottom of the overall gap. If we were to break down below there it would be a very negative turn of events, but it seems very unlikely this time year. Temperatures in America falling will continue to make buyers jump into this market trying to front run the possibility of an extremely cold winter. Weekly forecasts of places like New York City, Boston, Philadelphia, and Washington DC are the main drivers of natural gas is time of year. If there is some type of cold snap coming, this is the first market you should be jumping into to the outside. Ultimately, this tends to run until the middle of winter when the futures market started to trade spring contracts. Right now, we are just on the cusp of the most bullish time a year for this commodity, as the demand will start picking up shortly.