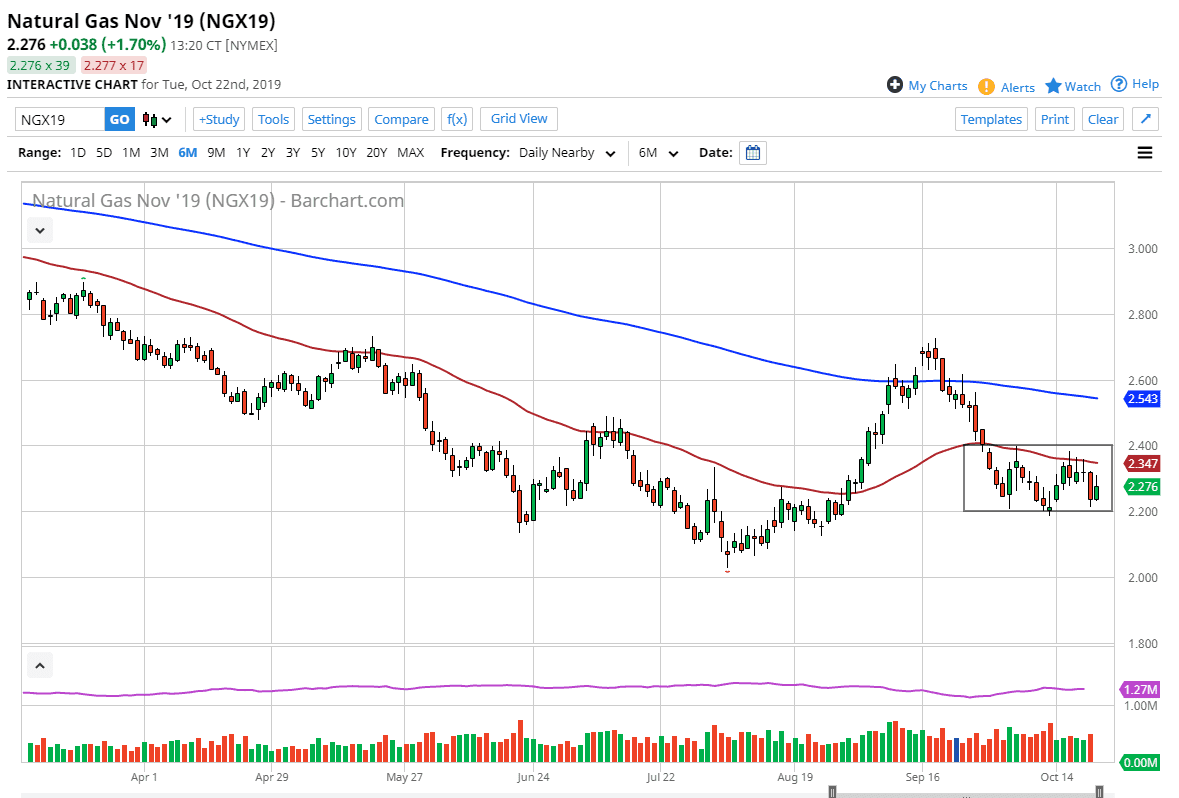

Natural gas markets have rallied a bit during the training session on Tuesday but gave back some of the gains. By doing so, it shows that there is a significant amount of bullish pressure underneath, as we continue to go back and forth. The market has shown a lot of support at the $2.20 level, so it’s likely that we will continue to see buyers in that general vicinity. The market has been very volatile overall, but this is typical of when we are trying to figure out the next trend. With that being the case it’s likely that we will continue to see a lot of volatility and choppiness as historically speaking, this is a time year that attracts a lot of buying pressure due to cold weather in the United States. However, we haven’t had that hit yet and of course there is a lot of concern when it comes to overall global demand due to the slowdown economically that we have seen. I think this continues to cause a lot of noise in this market but in the short term I look at this $0.20 range as the battlefield.

If we do break above the $2.40 level, it’s likely that we could go towards the 200-day EMA which is currently at the $2.55 level. Overall, I think pullbacks continue to offer buying opportunities, as long as we can stay above the $2.20 level. If we were to break down below there, then the market is likely to find even more support at the $2.00 level. Overall though, I think at this point it’s very unlikely to see that happen. All things being equal though, it is a market that I like buying short-term pullbacks in order to take advantage of value. Eventually, I think that the market will probably break above the $2.40 level, and then explode to the upside. That could probably send the market towards the $2.70 level eventually, which is quite typical for the wintertime in the United States when demand screams to the upside and sense price doing the same. I have no interest in shorting this market, although I do recognize that a certain number of patience may be needed in order to take advantage of the cyclical trade. Because of this, I will be looking for opportunities to buy natural gas and ignore sell signals.