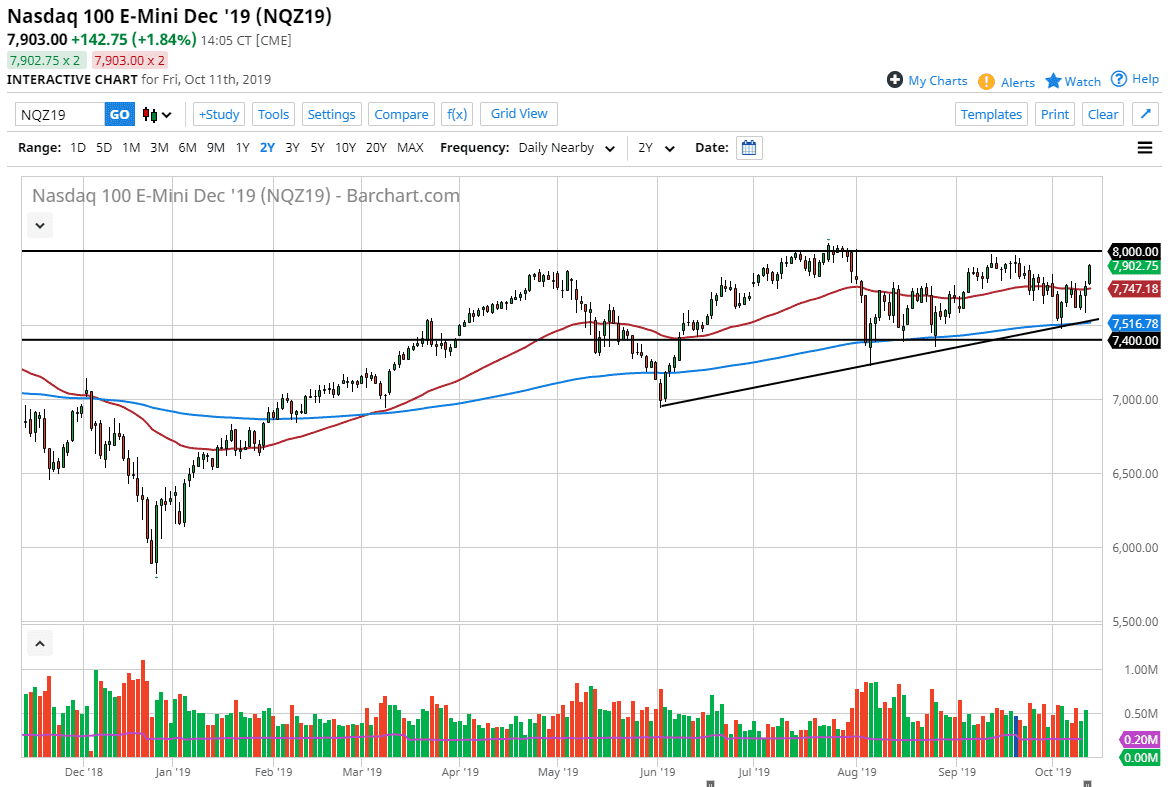

The NASDAQ 100 has rallied quite nicely during the trading session on Friday, reaching towards the 7900 level. This is a market that has been bullish for quite some time, and obviously there’s a lot of hope out there that the US and China can get something going as far as trade is concerned. That being the case, the market has started to rally and expectations of better economic conditions. The 8000 level above has been massive resistance though, so it will be difficult to get above there. Furthermore, going into the weekend it will be interesting to see how this plays out, as certainly the headlines of the weekend will make the open on Monday very interesting.

The market is more than likely going to gap at the open on Monday, as headlines will certainly cross the wire over the weekend as to how the trade talks have gone. There have been a lot of little tweaks and headlines here and there, but all things been equal we have gotten no substantial news. At this point, it’s very likely that what we are going to see is some type of “kick the can down the road deal”, and then will start to look ahead at earnings season. Obviously, earning seasons will have a massive effect on this market so what I anticipate is that the 8000 level is going to be very difficult to break above, but once it does break above there, the market could really start to take off.

Alternately, if we do get some type of bad news or at least underwhelming news, we could gap lower to reach towards the 50 day EMA which is painted in red on the chart. Underneath there, I see a massive amount of support in the form of the uptrend line at the bottom of the last couple of candles, and of course the 200 day EMA which is currently trading right around the 7500 level. That area should be massive support, so if we do break down below that region, then it’s worth paying attention to as it could lead to something much bigger, perhaps even a move down to the 7400 level, followed by the 7000 level. That almost certainly would be in conjunction with some type of really bad news coming out of Washington or Beijing. More than likely, the gap we get at the open will dictate where we go next.