A positive start for the price of gold in early trading this week, rebounding to the $1497 level after the price of the yellow metal fell to $1474 during last Friday's session. The success of gold in stability above the $1500 psychological resistance again will restore the bullish trend strength. After the lack of liquidity in financial markets early this week, investors are expected to return again with a batch of important economic data from Britain, the Eurozone and China. Thus, the stronger price of gold moved in one direction. The yellow metal is one of the most important safe havens for investors, and in the event of increased risk appetite, reaps more losses and vice versa; if the markets absorb the factors of its losses and began to hedge with it again.

Gold may find new support from the decline of the US dollar and the lack of full trade agreement between the United States of America and China and the slowdown of global economic growth, most notably in the Eurozone, as well as obstacles to the completion of a Brexit deal, in addition to tensions in the Middle East.

The most notable economic data in the early hours of this week was the release of China's trade balance. China's exports fell more-than-expected in September, reflecting weak global economic growth and trade disputes with the US administration. The data showed that the value of exports fell 3.2 percent year on year in September. This was larger than the expected 3 per cent decline and last month's 1 per cent decline. Meanwhile, imports fell 8.5% year-on-year against an expected 6% decline.

As a result, the trade surplus rose to $ 39.65 billion from $ 34.83 billion a month ago. The expected level was $ 36.73 billion. In Yuan terms, exports and imports fell 0.7% and 6.2% respectively in September.

The data came after the United States and China reached a "first phase" trade deal last week. The United States agreed to postpone the tariffs this week.

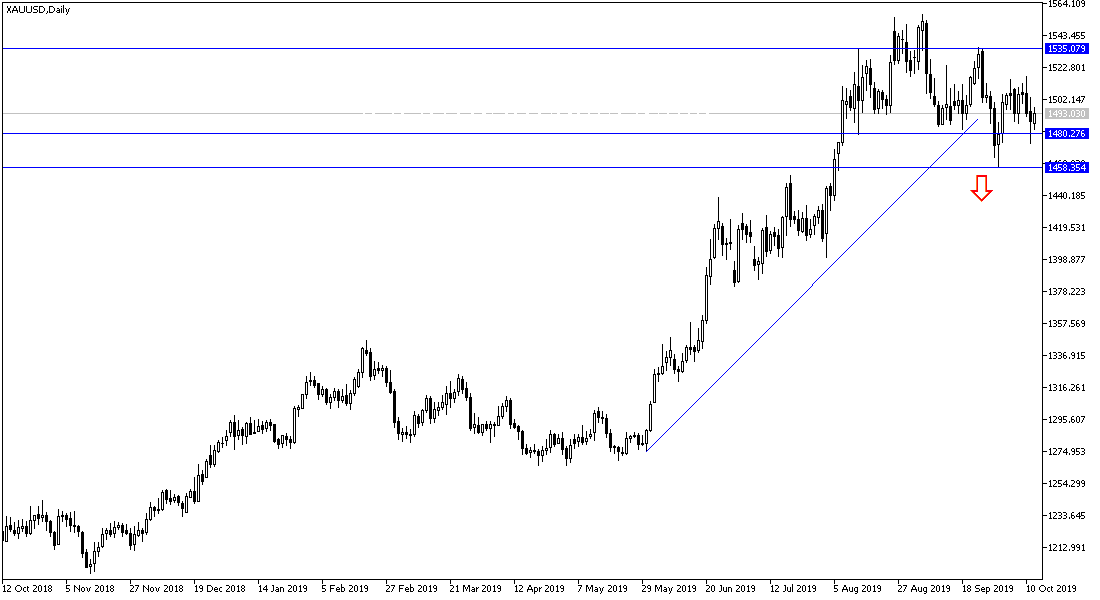

According to the technical analysis of gold: No change in my technical view of the Gold performance , stability above $1500 psychological resistance will remain supportive and a catalyst to complete the general upward trend, which is still active in the long term, and stronger if moved towards the resistance areas at 1512, 1525 and 1540 respectively . Conversely, if it returns to stabilize below 1480 support, it may support the bears to move towards stronger support levels, with which the correction will strengthen downwards.

As for the economic data today: The beginning will be with the Chinese inflation figures, then the unemployment and wage figures from the UK, and the Eurozone ZEW German economic sentiment index data.