During yesterday's trading session, GBP/USD tried to maintain its bullish trend by returning to the vicinity of the 1.2900 resistance, but gains were stalled as investors awaited any developments in the Brexit file and the results of important US economic data and monetary policy decisions from the Federal Reserve today. The pair is stable around the 1.2865 level at the time of writing. UK voters will now be asked to return to the polls before Christmas, and between December 9 and 12, they are likely to choose their third government since the summer of 2015. This poll will be the fourth most important in several years and will have strong consequences on the future of Brexit, as well as the British economy.

Opinion polls suggest that the vote will be a narrow race between four parties. The ruling Conservative Party is expected to present British exit proposals from Prime Minister Boris Johnson, while the Liberal Democrats are working on an anti-Brexit policy, a new party that emerged in 2019 and the stronger opposition Labor Party, who’s next policy is unknown.

The Liberal Democrats and the Scottish National Party have confirmed that they may support Prime Minister Boris Johnson's next attempt to force parliament to hold early elections. Johnson recently choose to circumvent the House of Commons law, which demand a 2 thirds majority to approve early elections and secure voting support from other parties. Labor Party said it will support one bill that seeks a simple majority to hold elections. This makes a return to the ballot box a sure thing for voters, as Brexit policies will be the main determinants of the outcome of those elections.

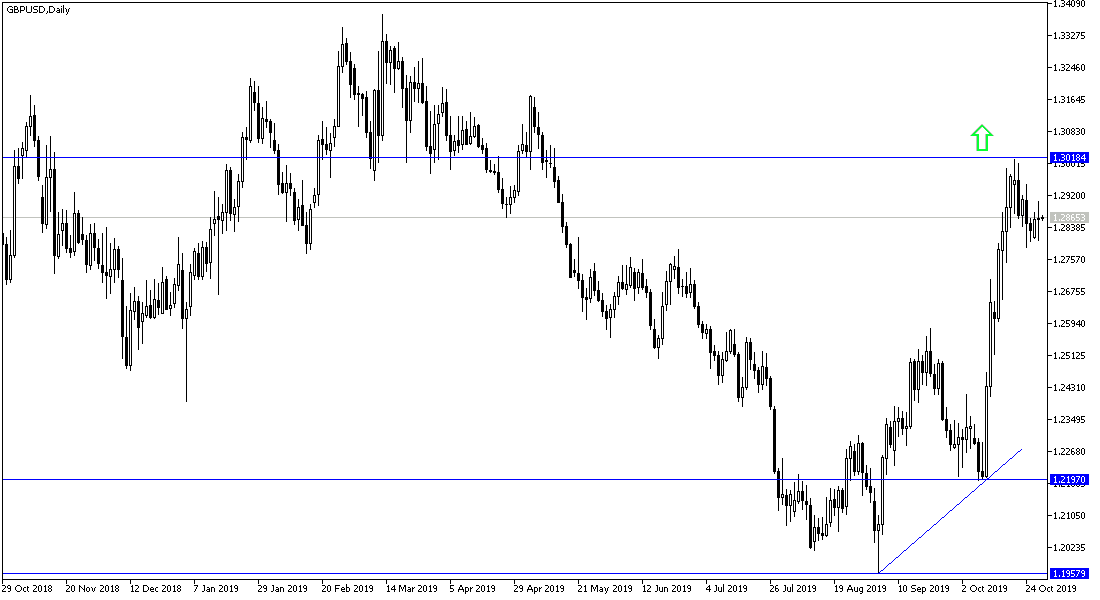

According to the technical analysis of the pair: The 1.3000 psychological resistance is still the ideal target for the bullish correction of the GBP/USD, and it may exceed it with any positive developments on the Brexit track. On the other hand, any move below the 1.2800 support is a threat to the bullish outlook, as it will increase the sell-off to move towards stronger support levels that could reach 1.2730 and 1.2600 respectively, which are strong threat areas for the current bullish outlook.

As for the economic calendar data today: From the UK, there will be no significant economic releases. From the United States, there will be announcements for GDP growth rate, the Fed's monetary policy decisions amid strong expectations of a quarter-point cut in US interest rates, and later a press conference by Governor Jerome Powell to explain why the bank made its decisions today.