The failure to pass the latest Brexit agreement between Boris Johnson and the EU through the British House of Commons further complicated the Brexit outlook. It was therefore a good reason for the GBP/USD to plummet back to the 1.2788 support level after its recent gains, which pushed it towards 1.3012 resistance, the highest level in more than five months. It closed last week around the 1.2830 support. Investors are watching the latest developments as the prime minister calls for early elections as punishment for the opposition, which has refused to pass his deal to set his goal of pulling Britain out of the European Union as scheduled on Oct. 31. The opposition rejected his request and forced him to ask the EU to extend the departure date, which has already happened.

On the US side the yield on 10-year US Treasuries fell by half a base point last week, so the overall yield rose by four base points for the third consecutive weekly increase. On October 4, the overall return was just under 1.60%. Since the middle of the month, it has the opportunity to reach 1.80%. September high was near 1.90%. The Fed's repurchase operations managed to cut the actual interest rate on federal funds, but has done little for fiscal conditions. On October 11, the Fed announced its intention to buy $60 billion of Treasury bills per month. This week, global financial markets are cautiously awaiting the Federal Reserve's announcement on its key interest rate, and is expected to cut rates by a quarter-point for the third time in 2019 to counter the risks to the US economy, especially as the global trade war continues.

Weak US economic indicators recently reinforced expectations of a rate cut by the US central bank this month.

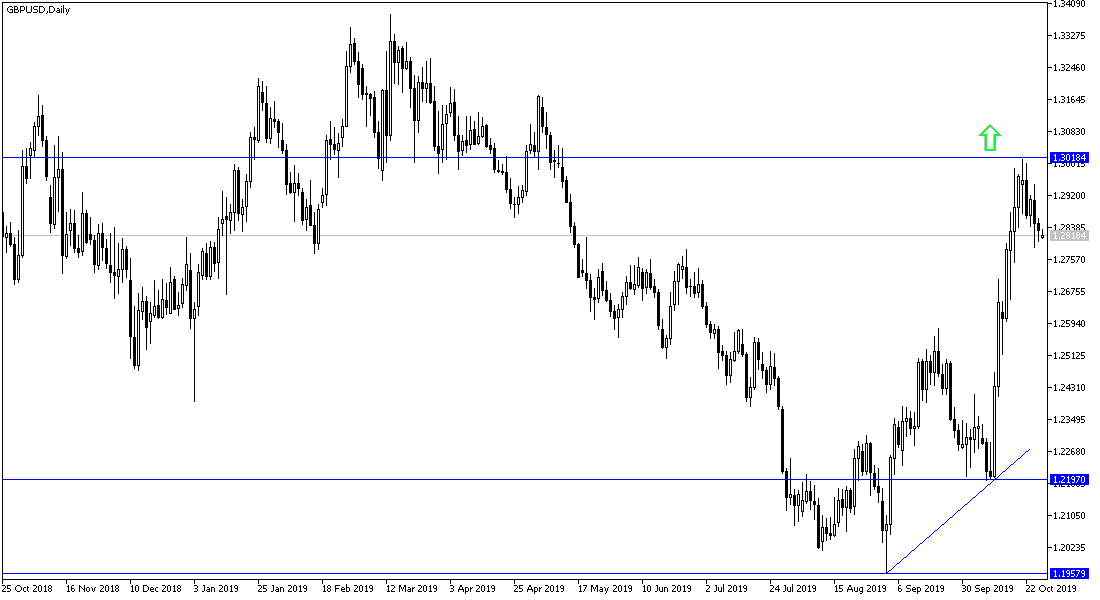

According to the technical analysis of the pair: On the daily chart below, it seems clear that the GBP/USD still has a chance for a bullish correction despite the recent Brexit uncertainty which has worsen things with a negative effect on those expectations. Technical indicators are showing signs of a support move to 1.2600 again if no agreement is reached before the Brexit 31 October deadline. As we expected before, 1.3000 psychological resistance will remain the key to the strength of the bullish correction.

As for the economic calendar data today: There are no important and influential data from either the UK or the United States. Brexit developments will continue to be the main driver of this pair.