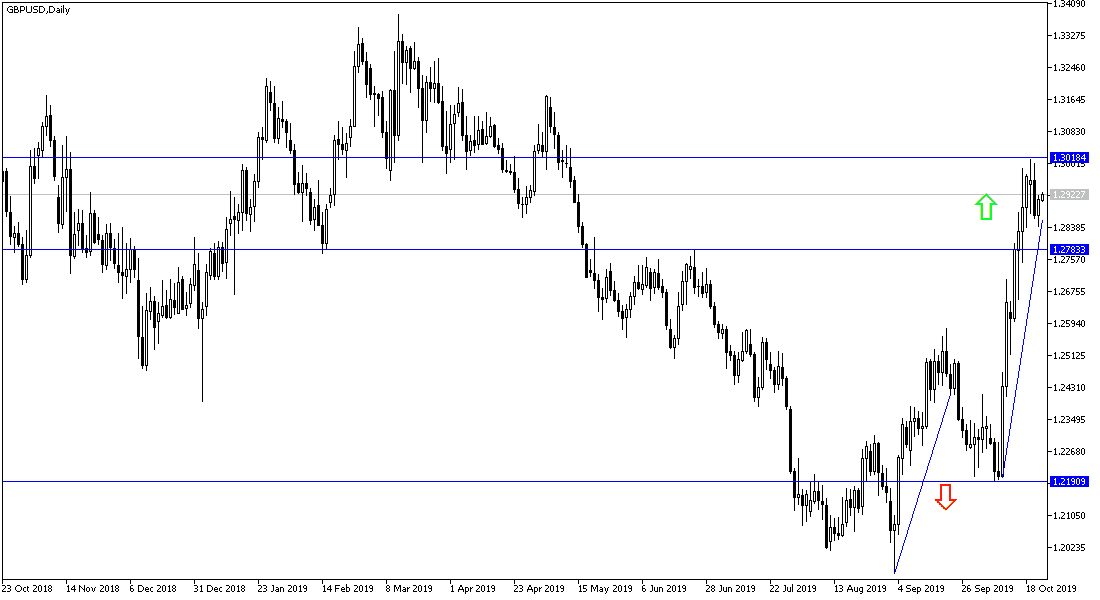

Instability dominates the Pound's performance against other major currencies as investors disperse the rapid and successive developments of Brexit. The GBP/USD gains pushed it to a five months high at 1.3012 and then corrected lower to the 1.2841 support, and then stabled around the 1.2916 resistance at the time of writing. The stronger price fluctuated towards completing the bullish correction. British Prime Minister Boris Johnson's hopes of ending Brexit by Halloween ended on Tuesday, after the House of Commons voted to reject a "fast track" bill. In a separate vote, the deal itself won with a majority.

Now Johnson should ask for an extension of the Brexit deadline, and at the same time, the expected delay brings with it a whole host of other risks that could hamper Britain's exit from the EU. For example, the longer the delay, the more time available to parliament to change the deal by making amendments to its clauses, the deal includes the possibility of another referendum; an item that could completely neutralize Brexit. Johnson might instead prefer to call for a general election to secure a larger working majority to get lawmakers' approval for the Brexit deal.

The British House of Commons endorsed the broad principles of the Johnson Accord with 322-299 votes, and minutes later, the Parliament rejected its attempt to push the necessary legislation without much debate (322-308). What happened ensures that the October 31 Brexit deadline is not met. The European Union will consider a request for a three-month extension. According to EU President Tusk, the EU cannot force the UK out of the deal. However, Johnson threatened to impose early elections if there was such a delay and to withdraw the bill itself. Theoretically, the UK will be ready to leave in November, but the electoral maneuver will impose a longer period. Some Labor lawmakers who voted for Johnson's plan in principle (first vote) warned that their vote was so tactical that the Johnson plan could be amended and that their support could not be taken for granted.

According to the technical analysis of the pair: The fluctuation will continue to characterize the performance of the GBP/USD until the final approval of the latest Brexit deal, or the arrival of early elections. Currently the pair is in a strong bullish correction with the support of 1.3000 psychological resistance. However, the British government's failure and the EU's refusal to extend will cost the pound much of its gains.

As for the economic data today: From Britain, the Mortgage Approvals will be announced. From the US, durable goods orders, jobless claims and new home sales will be released.