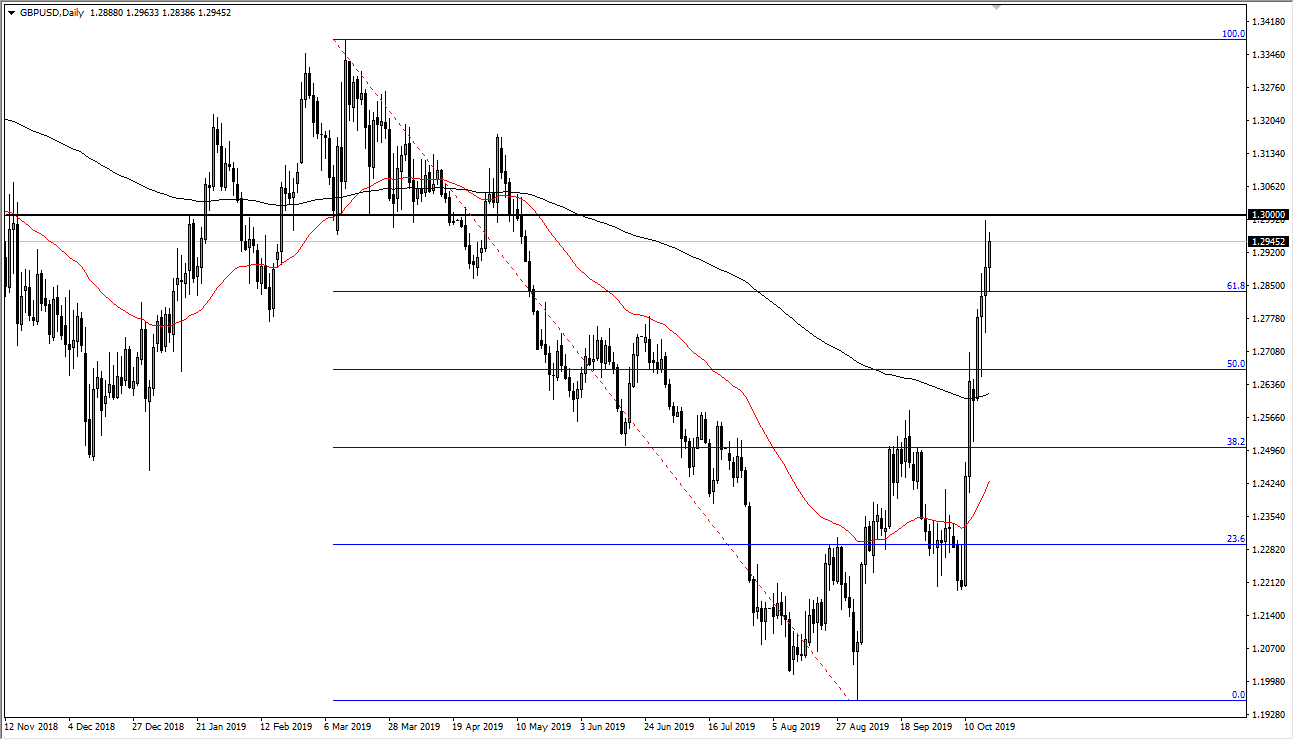

The British pound has a rough weekend ahead of it. Quite frankly, with the parliament in the United Kingdom voting on the Brexit deal that Boris Johnson has struck with the Europeans, it’s almost impossible to have a position on over the weekend. I anticipate that there will be a huge gap one way or the other at the open on Monday, and that of course is going to be difficult to trade. However, when I look at the charts it’s obvious to me that the 1.30 level will be crucial. It’s not only important on daily charts but it’s also important on weekly and monthly charts. Because of this it’s more than likely going to be a place where we make some type of major decision, which makes sense as the UK parliament will be doing the same.

If they vote this thing through, then Brexit finally settled. That probably since the pound higher longer term but don’t be surprised if there is a little bit of a “sell the news” situation. I would anticipate that there should be buyers done at the 200 day EMA. However, if they vote against it, and it’s very possible that they could, then we will probably see a extremely brutal gap lower on Monday.

The other potential scenario that I see is a massive gap higher, but I suspect that might be a bit difficult to achieve considering that we are about 700 pips higher than where we started. We might get a little bit of a gap, but I don’t think that we will explode to the upside because most of the people who wanted to be long of the British pound probably already are. If we do get that Though, I’m not going to be jumping at it until we break above the 1.32 level, as there is a lot of noise between here and there. In other words, I think that the easiest trade is to simply short the pound on signs of failure out of the UK parliament. If we do take off to the upside, being patient and waiting for that pullback that will certainly come is the best way to go. If this is truly a trend change, it will probably last for about three years as per usual, giving you plenty of time to enter the market and simply hang onto the British pound.