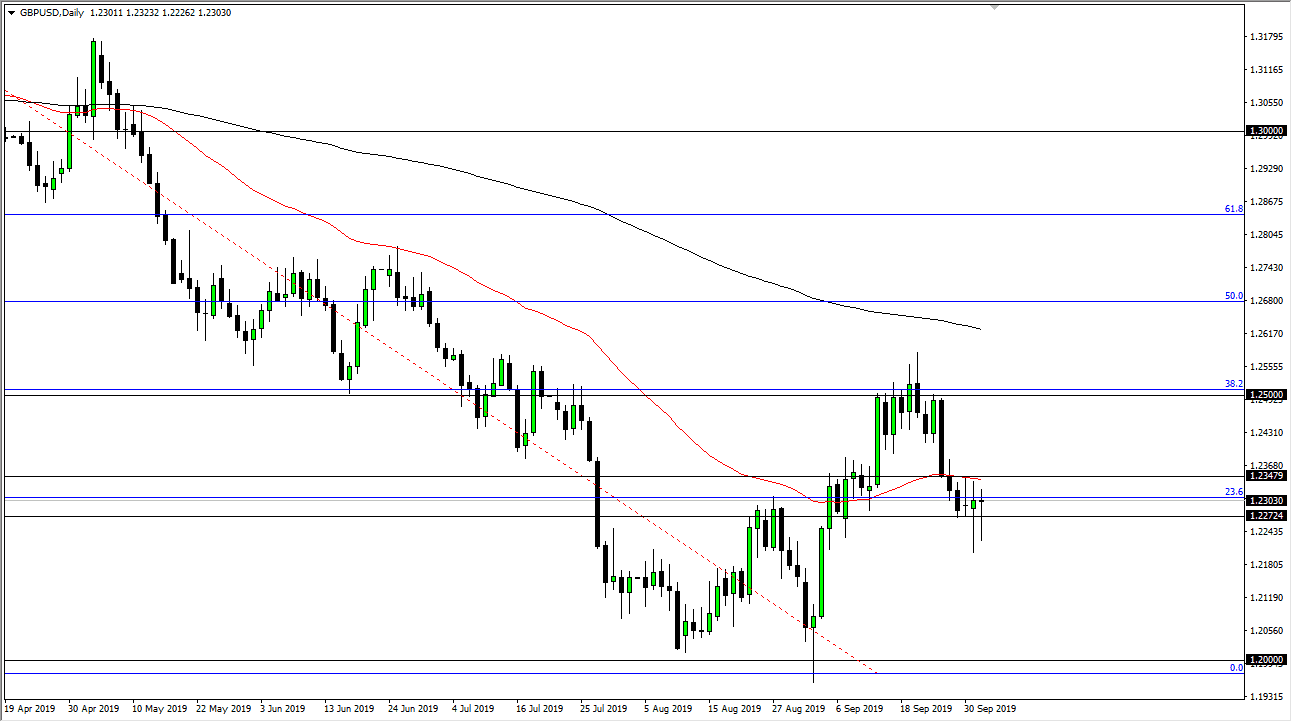

The British pound looks likely to bounce after initially falling during the trading session again on Wednesday, before turning around to form a hammer. The hammer that was formed during the previous session also look supportive, so I think it’s likely that we may see a bit of a fight. A break above the 50 day EMA which is painted in red on the chart just above could send buyers into this market and looking towards the 1.25 level above. That is obviously a large, round, psychologically significant figure that you should be paying attention to, so having said that it’s likely that the sellers would jump in right around that area as they had previously. Beyond that, the 200 day EMA is starting to reach lower, as it is currently near the 1.26 level and aiming to reach the 1.25 level.

The alternate scenario of course is that we break down and that would be a very strong sign as it would break the back of a couple of hammers in a row. That doesn’t happen very often, and it would be a big capitulation of the British pound strength. Also, it probably would figure out to be a negative sign for risk appetite in general as it would show money flowing toward the US dollar which is considered to be the “safest currency”, with perhaps the exception of the Japanese yen.

Brexit headlines continue to be a major problem for the British pound, so even if we do rally I’m still looking at this as a market that could break down. Ultimately, the market looks likely to be very volatile over the next couple of weeks as we approached the crucial October 31 deadline for the United Kingdom to leave the European Union. Ultimately, this is a market that will be highly influenced by the occasional headline or Tweet, so keep that in mind. There has been a lot of noise around this marketplace and it’s only going to get worse for the next couple of weeks. That being said, on a break down below the support I think that the market then goes looking towards the 1.20 level again. All things being equal, I believe we are a lot closer to the bottom of the British pound than the top, but we may have one more major flush lower ahead of us in the relatively short term future.