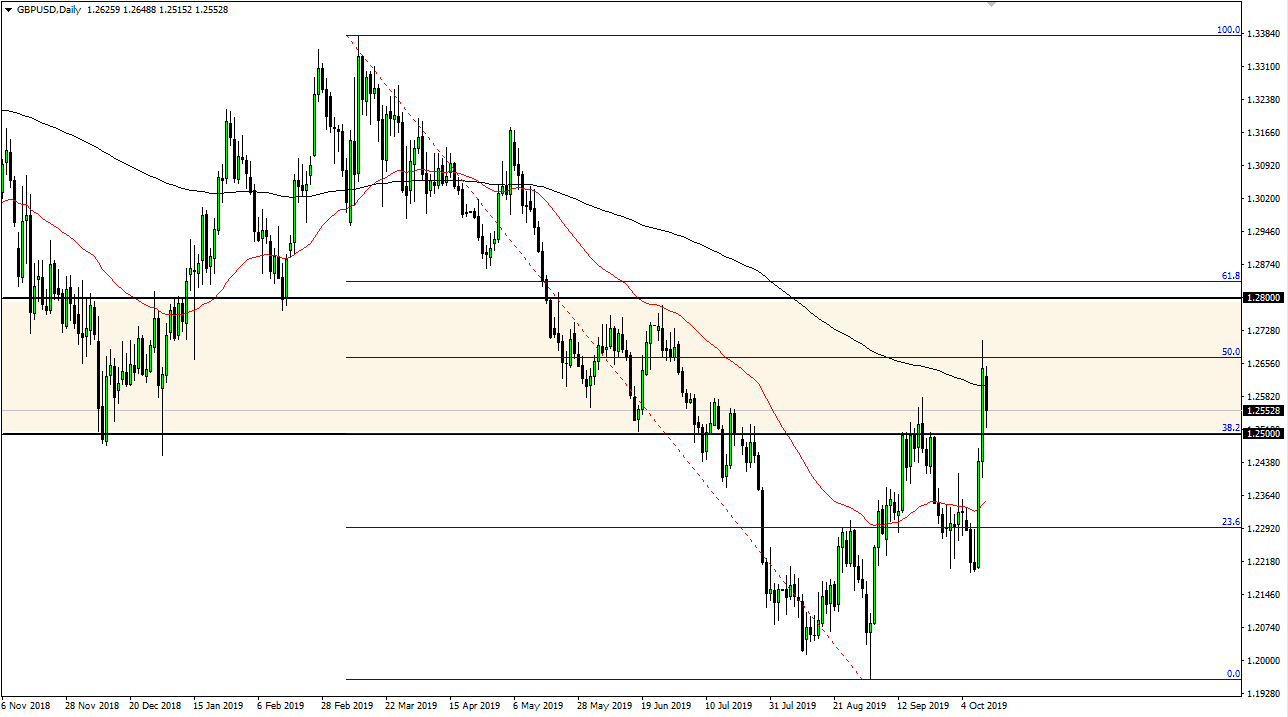

The British pound has pulled back a bit from the 200 day EMA on Monday, as we continue to see a lot of noise. The 50% Fibonacci retracement level is right there as well, so having said that it makes quite a bit of sense that there was some selling pressure. After all, the Brexit situation continues to be muddy at best, as although there has been a bit more positive tone coming out of certain people’s mouths, the reality is that we still don’t know how it’s going to play out. If that’s going to continue to be the case then obviously Brexit is going to weigh upon the British pound.

The 1.25 level underneath should offer support as it did during the day on Monday, but if we were to break down below that level then it could be a bit more believable as far as the selloff is concerned. The same thing can be said about the 1.28 level above, because I think it’s broken it would basically break above the 61.8% Fibonacci retracement as well, which of course is a very bullish sign. My personal experience is that typically when you break the 61.8% Fibonacci level, you go looking towards the 100% Fibonacci retracement level. That currently is at the 1.34 area.

The Brexit will continue to be a major issue, and we are already starting to see a bit of a walk back by some of the commenters, so I think we should continue to see this market go back and forth and perhaps show signs of indecision. That of course is going to continue to be a major problem, just like it has been for three years. The bounce has been rather interesting and strong but is based upon people reading too much into the statements of the Irish and the UK Prime Minister’s. With that, it’s likely that the market will continue to move based upon noise. If we get a strong negative headline, this think will come crashing down like a house of cards. Ultimately, the market would continue to be noisy and difficult, so it’s not hard to imagine a scenario where you should simply stay away from it. Eventually will get some type of certainty, but I am the first person to admit that I have been saying that for three years now.