The British pound fell rather hard during the trading session on Tuesday, but turned around as reports were leaked that perhaps the EU was opened to the idea of extending the timeline involving the so-called “Irish backstop.” The EU has since denied this, so therefore it looks as if it was more headline gaming and algorithm trading as we have seen for three years in this pair.

Every time the British pound move suddenly like this, you can pretty much bank on the idea of a Twitter headline causing it. At the end of the day, the British pound is still something that is very unstable so it’s difficult to hold onto in this environment. That being said, a lot of people are starting to bank on the fact that perhaps the worst case scenario has already been priced in, and if that’s the case we have nowhere to go but up. Clearly that was not the case earlier in the day on Tuesday, as there was no specific news that sent the pair down, it was a simple continuation of the overall trend.

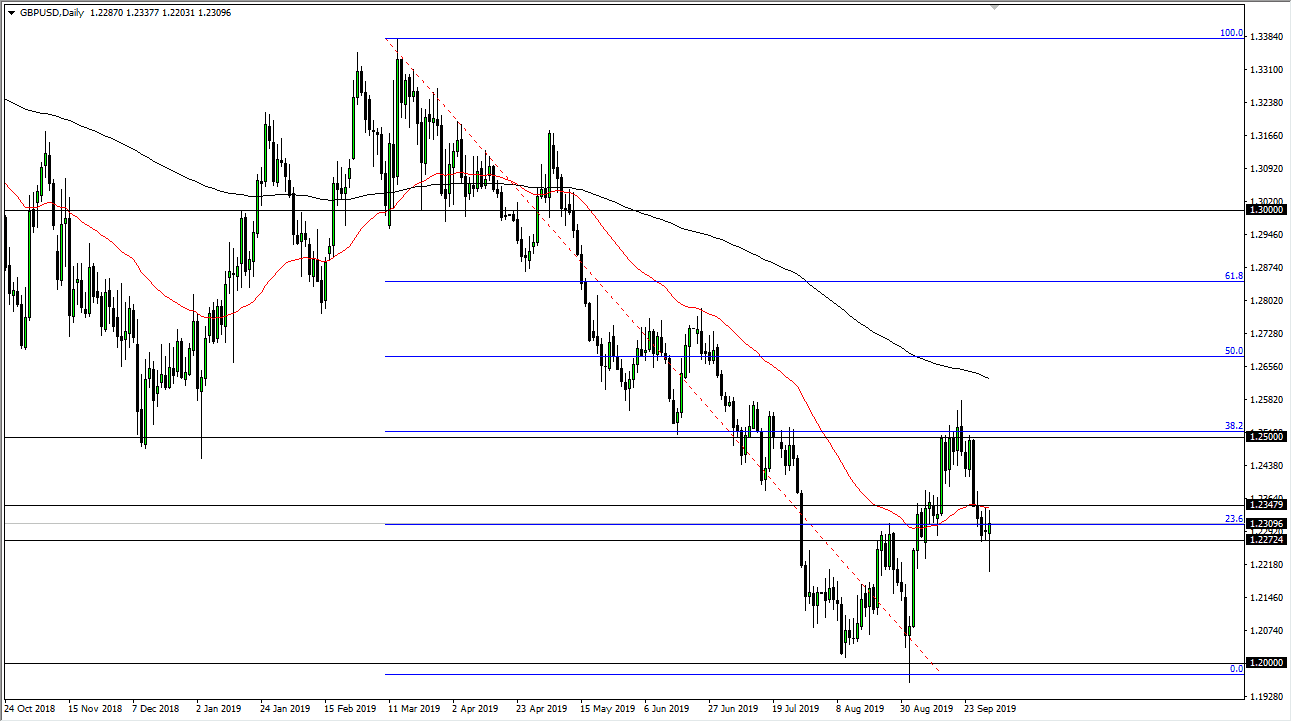

A break down below the bottom of the candle stick for the trading session I suspect that this market goes looking towards the 1.20 level again. Alternately, if we break above the top of the candle stick for the trading session on Tuesday, then we could go looking towards the 1.25 level above which of course was significant resistance previously based upon the large, round, psychologically significant figure and of course the 38.2% Fibonacci retracement level. In the meantime, we have the 50 day EMA just above the candle stick for the trading session on Tuesday, so course that will come into play as well. You should also note that the 200 day EMA is just above the 1.25 level as well, so rallies at this point are probably somewhat limited. That doesn’t necessarily mean I’m a seller, just that I would be more apt to sell this market after and exhaustion candle forms on a short-term rally. Beyond that, the US dollar continues to attract a lot of attention as people jump into bonds in the world that is less than certain. We are a long way from confirmation of anything Brexit related, so that will continue to make this a very volatile situation. Algorithmic traders of course are making things worse as per usual.