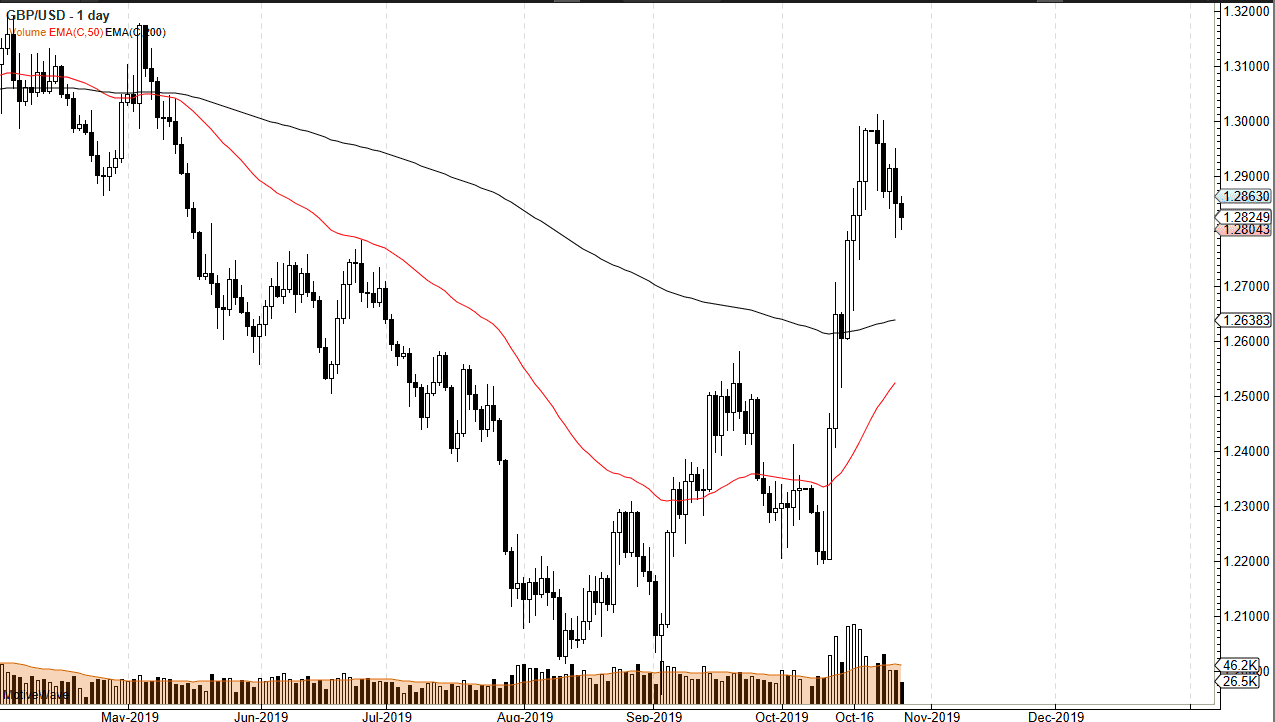

The British pound has pulled back a bit during the trading session on Friday, reaching down towards the 1.28 handle. That is an area that is a large, round, psychologically significant figure, and it’s likely that the market will continue to pay attention to this figure, but I think given enough time we probably drop even further due to the Brexit headlines it will continue to push this market back and forth. The 200-day EMA underneath is at the 1.26 level, and then eventually the 1.25 level after that.

The market has gotten far ahead of itself, so a pullback makes quite a bit of sense. To the upside, the 1.30 level above is significant resistance, and also psychological to say the least. If we can rally towards that level again, I suspect that the sellers will come back unless we can build up enough momentum underneath. Otherwise, if we can just simply go sideways for an extended amount of time, then the market can become comfortable with being at this high level.

Brexit continues to cause a lot of Twitter headlines that throw algorithms in the hyperdrive in this market, so it will be difficult to trade the British pound for anything other than a longer-term trade, because it can whip around in 100 PIP intervals rather quickly. At this point, the 200-day EMA is exactly where I would like to see this market pullback in order to find enough value to go along, so I will be definitely paying attention to any type of the support level in that area. The 50-day EMA is starting to curl higher and reach towards that level as well, so we may get the so-called “golden cross” very soon as well, bringing longer-term traders back into the marketplace.

The Brexit situation seems to be getting better, or at least steering away from a “no deal Brexit”, so that has at the very least got a bit of short covering into play. Looking at the longer-term charts, the 1.30 level was massive support in the past, so it makes sense that the market will struggle to get above their short term. At this point, the market looks likely to pullback in order to build up the necessary momentum to try to take that level out as it is historically cheap when looked at through the prism of the last several decades.