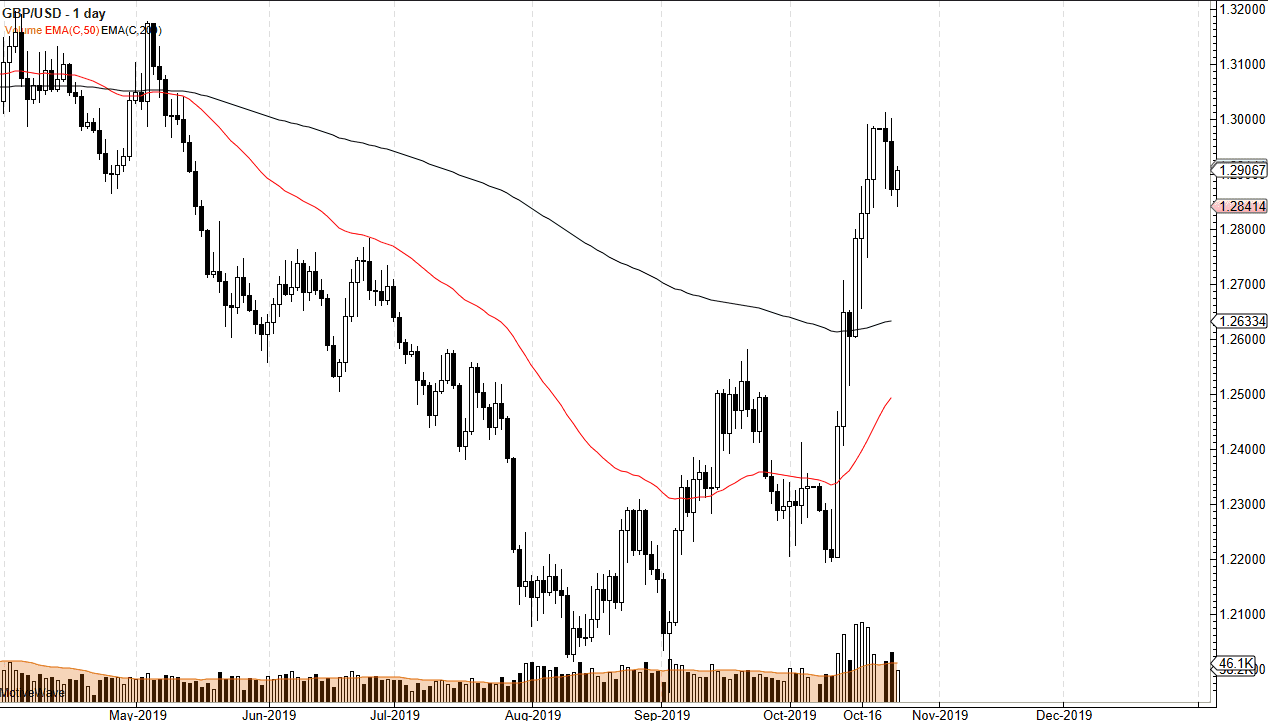

The British pound has initially fallen during the trading session on Wednesday but turned around to reach towards the 1.29 level. At this point, it’s likely that the market could continue to go back and forth but overall this is a market that’s being held hostage by the Brexit nonsense and headlines coming out. One thing that can be said though is that the idea of a “no deal Brexit” is very unlikely in the short term, so therefore people are starting to cover their shorts when it comes to this pair. Whether or not the British pound shoots straight up in the air is still debatable, but at this point it certainly looks as if it isn’t ready to break down.

That being said, it’s difficult to jump in and start buying at this level, as we had rallied so much. After this significant rally, at the very least the British pound needs to grind away to absorb and digest quite a bit of the gains. I also recognize that the 1.30 level above is resistance, but if it does give way to the buyers, then it’s likely that the market will try to go towards the 1.33 handle after that. Longer term, I do believe that the British pound has bottomed, but I would prefer to see some type of value enter this market that could be bought. A short-term pullback would help that, and I would be very interested in buying this pair closer to the 200-day EMA, which is down at the 1.26329 level. Unfortunately, I don’t know if I’ll get that opportunity but if I do, I won’t hesitate to pick up the British pound “on the cheap.”

On the other hand, if we get a daily close above the 1.30 level, then it’s very likely that we are going to see a new leg higher based upon money flowing into the marketplace. As far as shorting the British pound is concerned, I would be a bit hesitant to do unless of course we get some type of very negative headline involving Brexit. At this point, it looks as if a delay is probably in the process, so that helps, because not only will its slow things down, but it also gives the possibility of a finalized agreement more traction. It looks as if the market has simply priced in the idea of a “no deal Brexit” on October 31 out of the market.