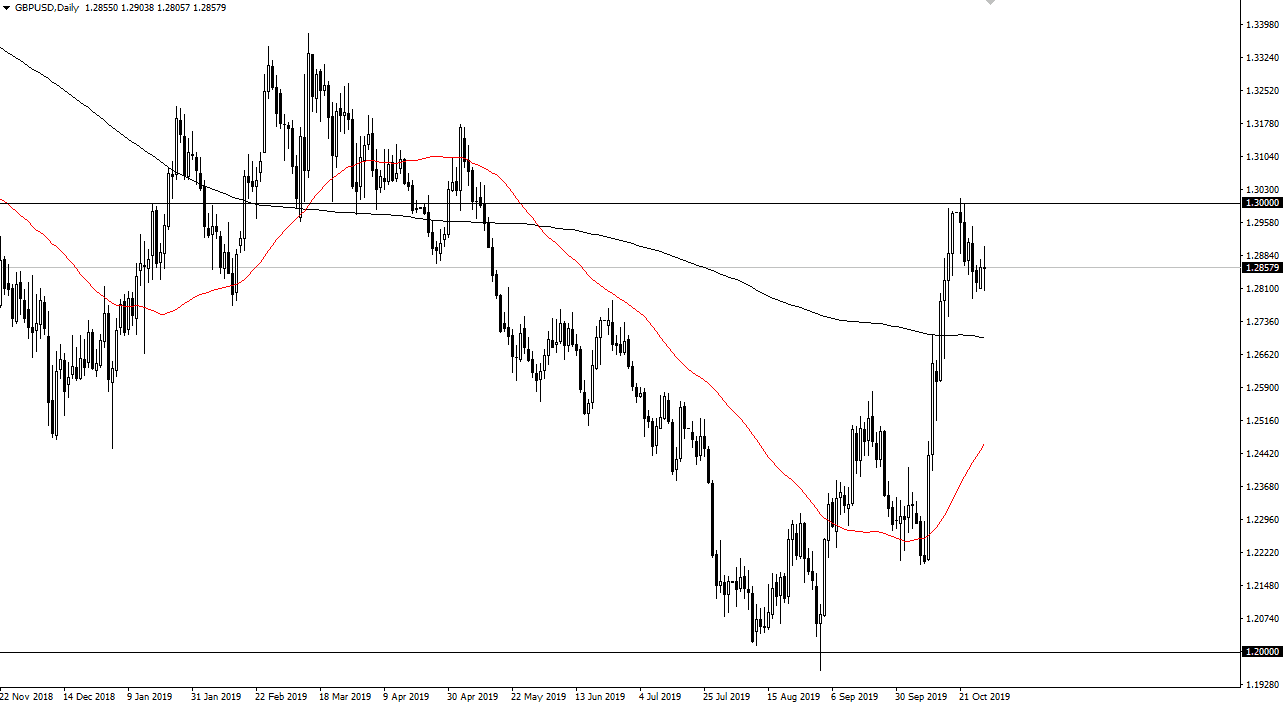

As the Brexit situation continues to be as clear as mud, the British pound doesn’t really know what to do. Currently we are watching the UK Parliament debate the possibility of an election, it has a lot of trader sitting on the sidelines trying to figure out what to do. At this point, the market is very likely to continue to bounce back and forth, as the market looks likely to form a bit of a flag in this area. The 200 day EMA underneath should be support, as it typically offers a lot of support and resistance for longer-term traders.

Looking at the chart, the 1.30 level obviously has offered a lot of resistance, as it is a large, round, psychologically significant figure. At this point, the market was to break above there, the market is likely to continue to go to the upside as it would break through what has sent the market lower. However, the alternate scenario is that we break down below the 200 day EMA and go looking towards the 1.25 low underneath. The noise in this area will continue to offer a lot of back-and-forth trading opportunities, but a longer-term trade will need some type of clarity when it comes to Brexit, the UK Parliament, and perhaps even the global situation in general.

Looking at this chart, another thing that should come into play is the FOMC statement during the trading session on Wednesday, and of course the interest rate decision. If the central bank in the United States sounds overly dovish, that could send the market higher as the US dollar sells off. Beyond that, the market looks very likely to continue the uptrend based upon not only US dollar weakness but the fact that we have been forming a bit of a bullish flag that measures four remove all the way to the 1.38 handle above, with the 1.33 level offering a certain amount of resistance as well. Ultimately, it does look like a situation where you should be looking to buy pullbacks as they occur, as it offers value in a currency that looks ready to take off. As far as selling is concerned, I don’t have any interest in doing so right now, because the British pound has exploded to the upside so vehemently over the last several weeks. At this point, the only thing you can do is buy this market.