The British pound has rallied a bit during the trading session on Monday as traders came back to work from the weekend. The market is reacting to the extension of Brexit offered by the European Union to the United Kingdom. With that being the case and another three months to debate the situation, it will relieve some of the overhang on the British pound. However, this is a market that continues to show signs of bullish pressure regardless, so I think at this point pullbacks will continue to be looked at as potential opportunity.

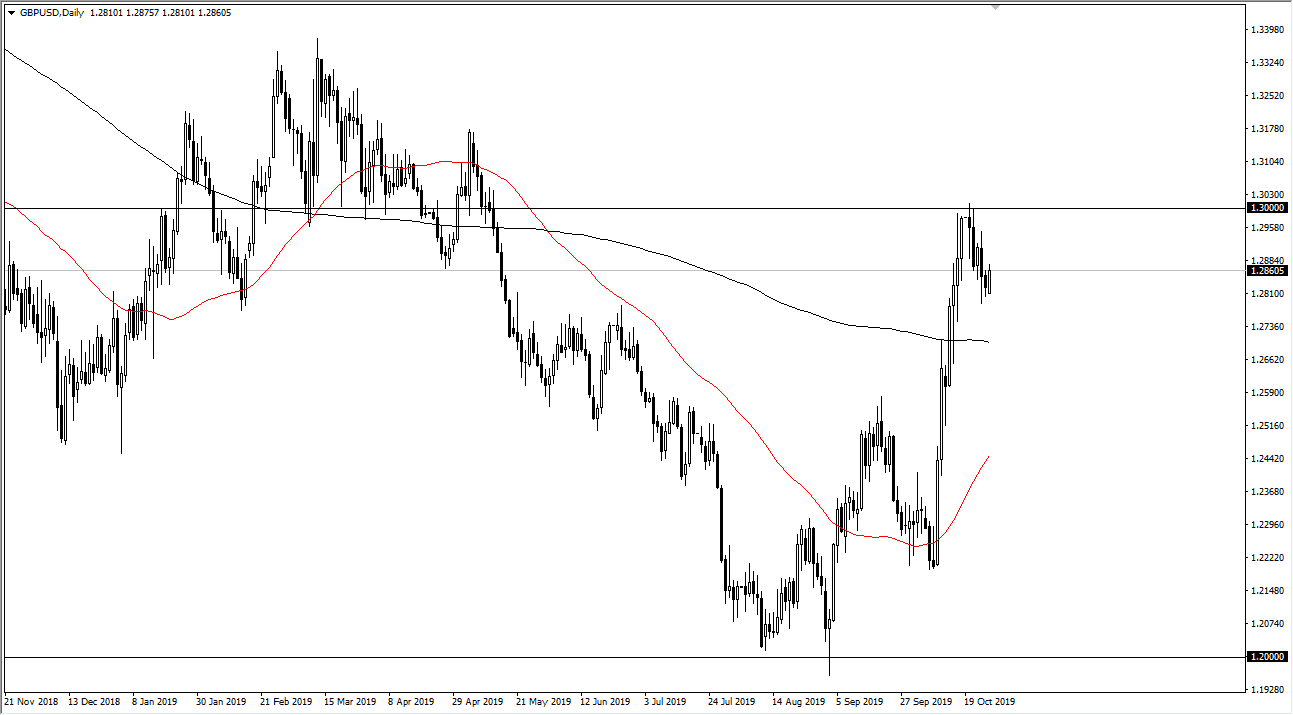

The 200 day EMA underneath at the 1.27 level underneath should continue to offer support based upon the 200 day EMA but the 1.27 level is also an area that has been crucial support and resistance in the past as well so don’t be surprised at all to see this offer a bit of amounts. At this point, the market also has a major resistance barrier above about the 1.30 level, as the large, round, psychologically significant figure will of course offer quite a bit of interest as well. One thing that is very likely to continue to be an issue is extraordinarily choppy conditions.

At this point, the market has been extraordinarily bullish and impulsive to the outside, but at this point I would assume that a lot of people will be looking to get involved in this market as they may have missed the move to the upside. We are still historically cheap, so if the United Kingdom doesn’t absolutely collapse, this is a currency that should continue to rise over the longer term.

All things being equal though, market participants are likely to be short covering going forward, especially if the 1.30 level gives sliced through as it should send this market towards the 1.33 level which has shown a lot of interest on longer-term charts. Obviously, the market participants continue to be driven by the occasional headline and Tweet, but the trend has certainly changed and looks very likely to continue to the upside over the longer time frames. The 1.25 level is crucial as well, as the 50 day EMA looks likely to go looking towards that level. At this point is not necessarily whether or not you should be a buyer of the British pound, but whether or not you will get value on a pullback or if the market will break out to the upside.