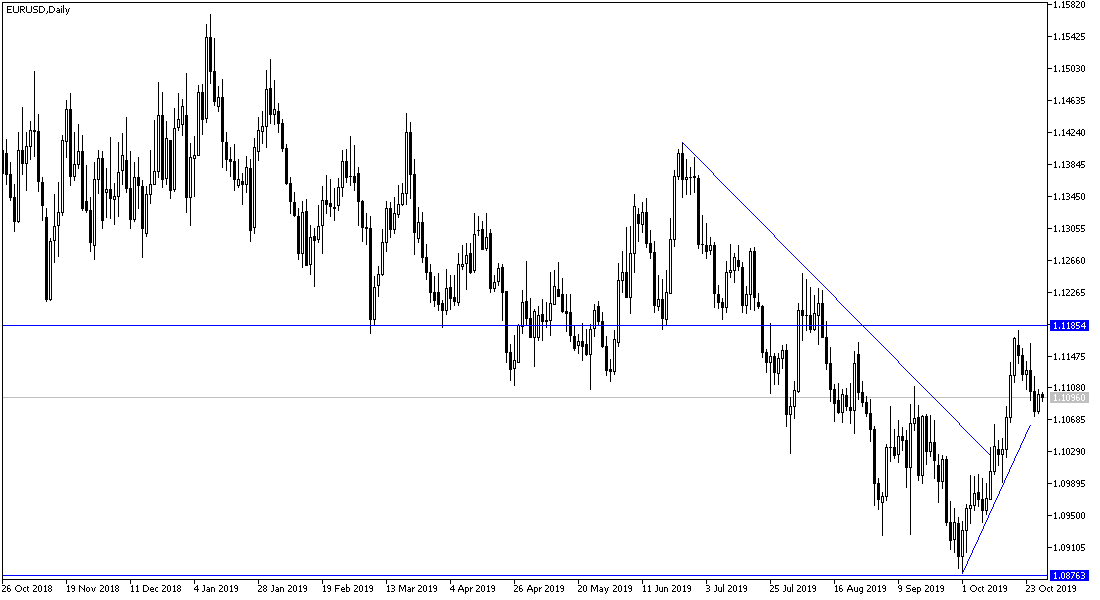

With the start of this week’s trading, and after a bearish correction in the last trading sessions of the EUR/USD, the pair tried to compensate for losses, which pushed it to the 1.1072 support, rebounding towards the 1.1106 resistance. The pair was in a limited range on Monday with the absence of any important and influential data, and investors focus on the Fed's monetary policy decisions to be announced on Wednesday, amid almost certain expectations that the bank will cut the US interest rate for the third time to face risks to the US economy due to the prolonged trade dispute between the United States and China. Overall, the charts continue to show a bullish short-term trend.

Mario Draghi will leave office as president of the European Central Bank, and is credited with saving the Eurozone from a disaster that could lead to its disintegration. The bank's arsenal of anti-crisis tools has been expanded through new and unconventional policies and measures he and others said have helped end a financial crisis in 2010-2012 and created millions of jobs in the 19-nation monetary union. His successor will be former IMF chief Christine Lagarde. French President Emmanuel Macron and German Chancellor Angela Merkel praised Draghi's role in stabilizing Europe during the crisis. Merkel said that investors bet on the collapse of the Euro, but "today, after eight years, we are far from it." Mr Macron said Draghi's behavior was "decisive in saving Europe from collapse".

Opposition to the ECB's Governing Council increased in September, after Draghi's penultimate meeting, when he approved a plan to repurchase bonds at a pace of 20 billion Euros a month due to uncertainty from the United States and China that threaten to derail Europe's hard-won economic growth. Several members had publicly questioned the move, and one of the stimulus opponents resigned, without giving a public reason.

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD price, and we reiterate that the breaking the 1.1120 resistance will stimulate the upward correction again and may support performance towards the resistance levels 1.1200 and 1.1285 respectively. In the short term, the pair is still in an upward correction. But in the long run it remains bearish. The pair's downward pressure may return if it falls below the 1.1000 psychological support.

As for the economic calendar data today: There are no significant economic data releases from the Eurozone today. Only focus will be on the announcement of US consumer confidence and pending US home sales.