For three consecutive trading sessions, the EUR/USD has been subjected to a bearish correction that pushed it towards the 1.1106 support and failed to continue with its recent gains, which reached the 1.1179 resistance at the beginning of this week, its highest level in more than two months. The weak economic performance of the German-led Eurozone continues to prevent strong and sustained gains. Yesterday, Eurozone consumer confidence fell to a 10-month low of -8, with expectations for a steady reading of -7.

Today’s trading session is most important one for this pair, as we will first have the announcement of the purchasing managers' indexes for the manufacturing and services sectors, the most important sectors for the block, which were greatly affected by the global trade war and formed the recession in the Eurozone, and then the ECB, at the last meeting, cut interest rates to a negative range and activated Bond buying programs again to counter this recession. At the last meeting of the bank under the leadership of Mario Draghi, the bank is not expected to carry out any monetary policy update pending the bank's new official, Christine Laggard, who wants local governments to provide additional stimulus plans along with the bank's efforts to accelerate the revival of the block's economy, and avoid further pressures from the trade war led by the Trump administration, which didn’t spare the Eoruzone.

Some expectations are that the Euro is expected to outperform the US dollar as the situation in the Eurozone improves and a combination of several factors weakens the US dollar. The forecast is based on monetary easing to negative interest rates and bond buying plans. At the same time, the European Central Bank (ECB) is unlikely to cut interest rates further than the current level, as it could hurt the fragile banking system in the Eurozone. Extremely low interest rates are generally negative for the currency as they reduce foreign capital flows; stopping further cuts will be positive for the Euro.

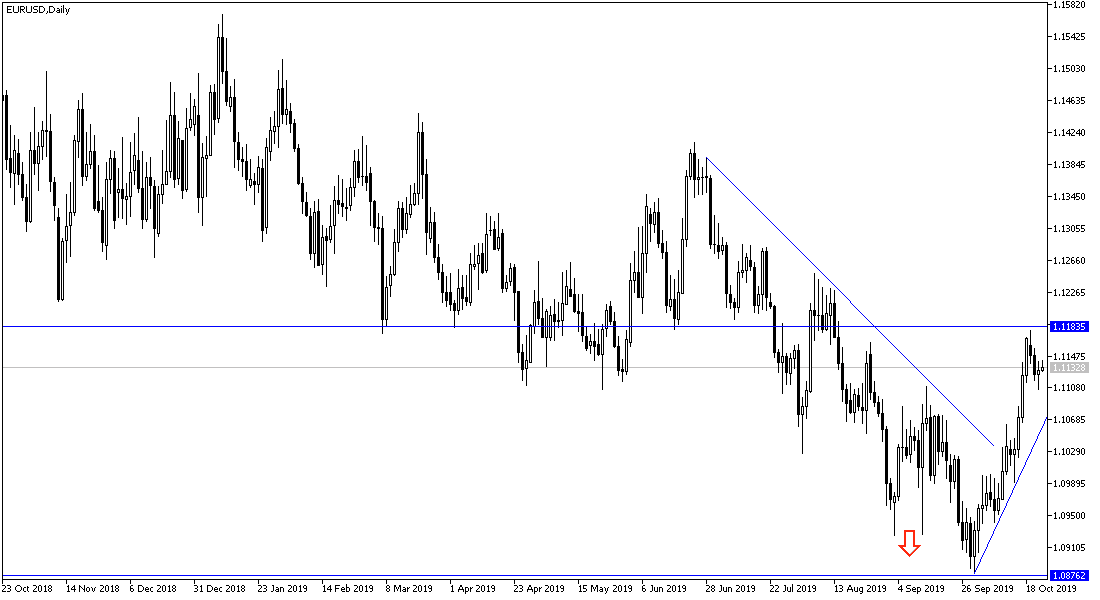

According to the technical analysis of the pair: The EUR/USD continues the bullish correction as long as it is stable above 1.1120 resistance, and will strengthen the look if the bulls pushed the pair to the resistance levels of 1.1200 and 1.1285 respectively. On the other hand, the bears' success in moving towards the support areas of 1.1045, 1.0980 and 1.0880 will restore the bearish strength of the pair, which remains its long-term trend even after its recent gains.

As for the economic calendar data: From the Eurozone, there will be announcement for PMI readings for the industry and services sectors, and then later the monetary policy decisions of the European Central Bank and statements by its Governor Mario Draghi. From the US, durable goods orders, jobless claims and new home sales data will be released.