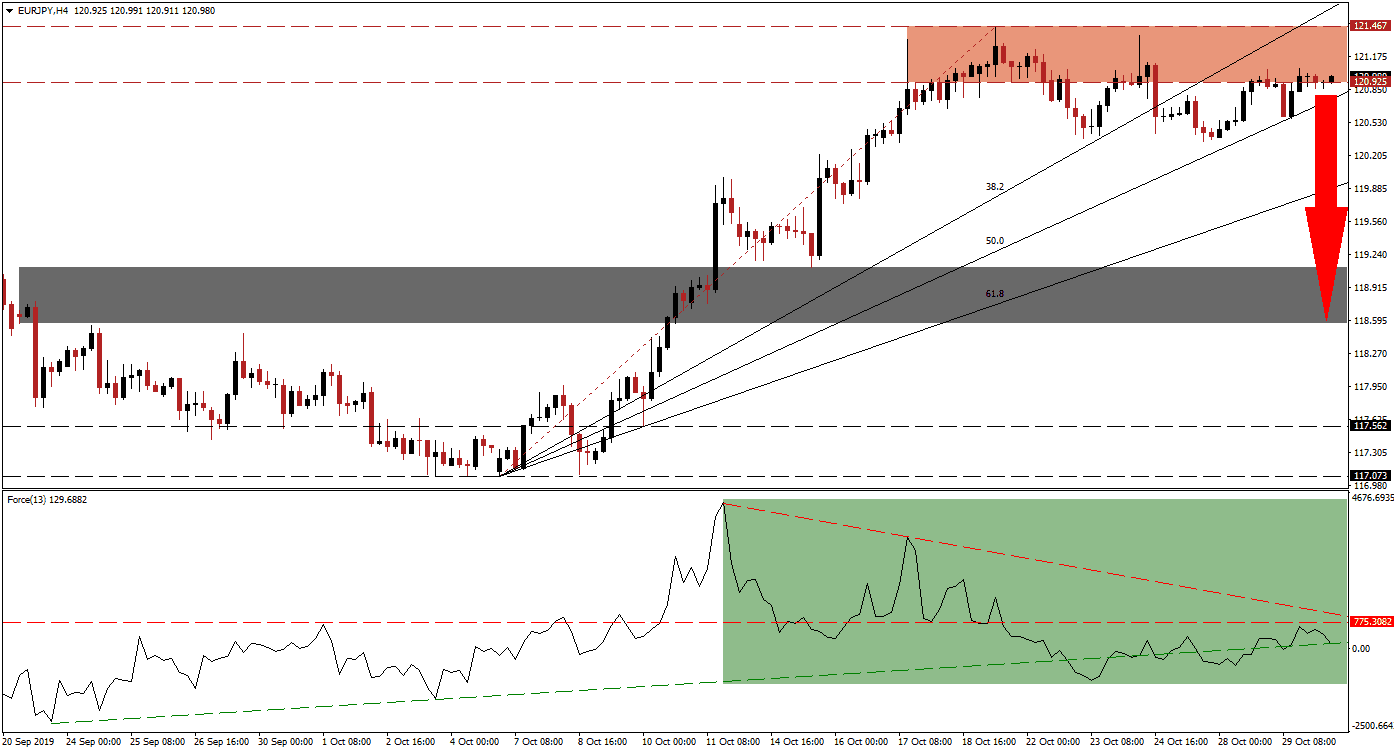

After the EUR/JPY reached its resistance zone, the upside momentum started to cripple and a sideways trend emerged which remained centered at the bottom range of this zone. This allowed the Fibonacci Retracement Fan sequence to catch up to price action and further increased pressures on this currency pair. Today will feature a heavy economic day for the Euro with inflation as well as confidence data which may provide the next fundamental catalyst; together with the pressure provided by the Fibonacci Retracement Fan sequence, the next move in price action is shaping up on the horizon. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next generation technical indicator, points towards a sharp loss in bullish momentum which suggests that a breakdown sequence in the EUR/JPY may follow. After price action initially reached its resistance zone, a negative divergence formed which essentially ended the advance. Price action completed its first breakdown, but was reversed by its 38.2 Fibonacci Retracement Fan Support Level. The Force Index followed through with a breakdown below its horizontal support level which turned it into resistance and is now pushing below its ascending support level as marked by the green rectangle. This is another bearish development which point towards a sell-off in this currency pair.

As bullish momentum is being replaced by bearish one inside the resistance zone, located between 120.925 and 121.467 as marked by the red rectangle, a series of lower highs formed which represents a major bearish trading signal. During the sideways trend with a bearish bias, the EUR/JPY moved below its 38.2 Fibonacci Retracement Fan Support Level and turned it into resistance; the 50.0 Fibonacci Retracement Fan Support Level is now closing in on the bottom range of its resistance zone from where a breakdown is expected to follow and initiate a bigger corrective phase. You can learn more about a breakdown here.

With the Fibonacci Retracement Fan sequence already crossing the resistance zone, forex traders should prepare for a breakdown sequence which can take price action down into its next short-term support zone. Japanese retail trade data surprised to the upside and provided a fundamental boost to the Japanese Yen which is not reflected in the price as of yet; together with the slow return of risk-off sentiment, this combination is expected to partially fuel a breakdown sequence in the EUR/JPY with the other part provided by a profit-taking sell-off. The next short-term support zone is located between 118.567 and 119.112 as marked by the grey rectangle.

EUR/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 120.950

Take Profit @ 118.600

Stop Loss @ 121.500

Downside Potential: 235 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 4.27

Should the Force Index surprise with a double breakout, first above its horizontal resistance level and more importantly above its descending resistance level, price action may attempt to follow through with a breakout of its own; this is expected to be a short-term event as the fundamental as well as technical scenario favor a corrective phase in the EUR/JPY. The next resistance zone is located between 122.312 and 122.620 which should be viewed as a great short selling opportunity.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 121.700

Take Profit @ 122.500

Stop Loss @ 121.400

Upside Potential: 80 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.67