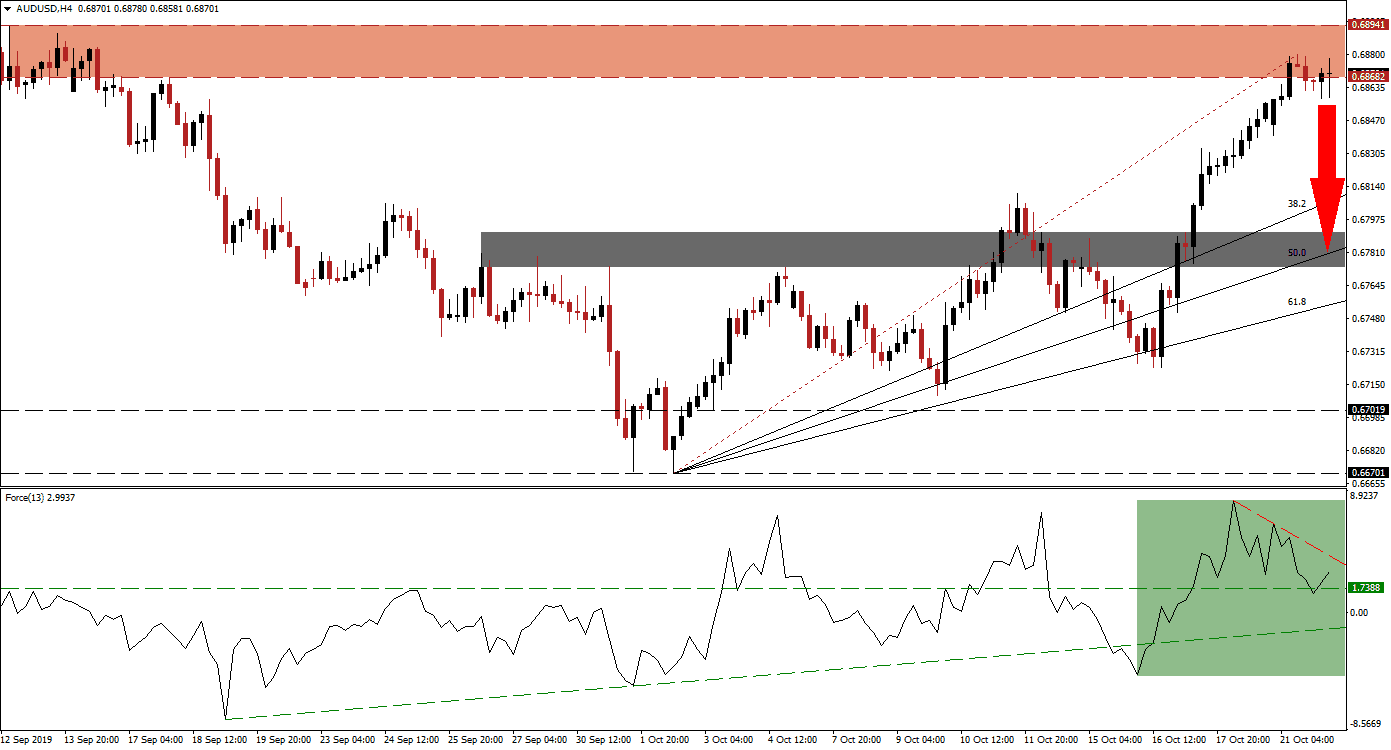

A series of higher highs and higher lows, which represents a bullish development, has propelled the AUD/USD to the upside. Fundamental factors, such as encouraging economic data out of China for the month of September, have assisted in the advance which took price action into its support zone. The strong advance resulted in a disconnect between this currency pair and its ascending Fibonacci Retracement Fan sequence and the loss in bullish momentum suggests a short-term reversal, partially fueled by profit taking, may be imminent.

The Force Index, a next generation technical indicator, is flashing a sell signal with the formation of a negative divergence; this occurs when price action extends its rally as its technical indicator moves in the opposite direction. The AUD/USD has exhausted its upside and the Force Index briefly dipped below its horizontal support level before reversing. It’s descending resistance level is approaching, as marked by the green rectangle, and should push this technical indicator below its horizontal support level which will turn it into resistance; more net sell orders are anticipated following a sustained breakdown. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

As the advance stalled, the AUD/USD recorded a lower high than its previous push into this resistance zone which is located between 0.68682 and 0.68941 as marked by the red rectangle. The current intra-day high was recorded at 0.68797 from where this currency pair moved below its resistance zone before reversing back into it; this pattern has repeated itself since the lower high was set. A sustained moved by the Force Index below its horizontal support zone is expected to provide the spark for a short-term profit taking sell-off which is expected to keep the long-term uptrend intact.

Forex traders should monitor the intra-day low of 0.68577 which represents the low of volatile price action pushing below its resistance zone. A move below this level is further expected to increase selling pressure in the AUD/USD from where a move back into its short-term support zone is expected; this zone is located between 0.67730 and 0.67906 as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is located inside this zone and given the current fundamental picture, a breakdown below is unlikely. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.68700

Take Profit @ 0.67800

Stop Loss @ 0.69000

Downside Potential: 90 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.00

Should the Force complete a breakout above its descending resistance level, the AUD/USD may follow through with a breakout above its resistance zone. A new fundamental catalyst would be required in order to sustain a breakout as the upside remains exhausted without a short-term corrective phase. The next resistance zone is located between 0.69546 and 0.69956.

AUD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.69150

Take Profit @ 0.69900

Stop Loss @ 0.68850

Upside Potential: 75 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.50