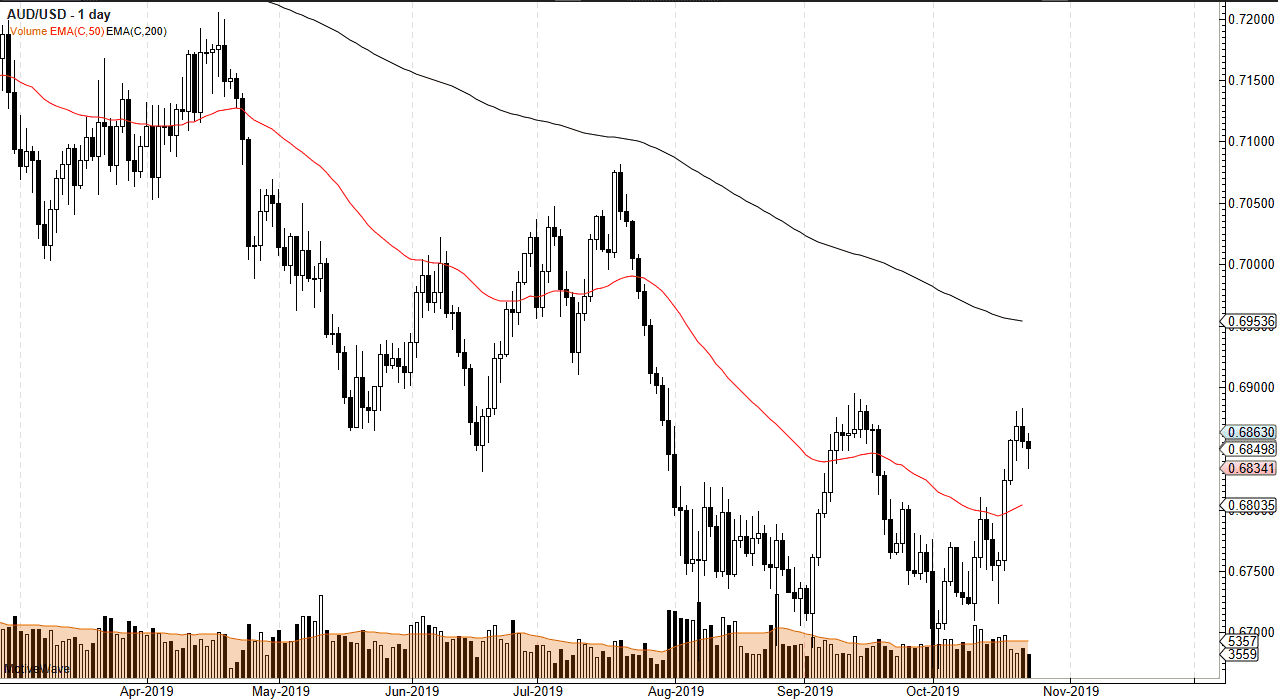

The Australian dollar has initially fallen during the trading session on Wednesday, reaching down towards the 0.68 level before turning around to show signs of life again. From the candlestick alone, it looks as if there is a bit of a pushback at this point to continue this market to the upside. However, when you look at the longer-term charts, and the last couple of days, you can see that the 50% Fibonacci retracement level or the 0.69 level has offered resistance. This is an area that looks to be rather resistive going forward, as it is not only the 50% Fibonacci retracement level but a large, round, psychologically significant figure.

A breakdown below the bottom of the session on Wednesday could open up the door to the 50-day EMA which is currently trading at the 0.68035 level but sloping a bit higher. It’s interesting to see whether or not we can break down below there because if we break down below that level it’s likely that the market will go down towards the bottom again at the 0.67 handle. At this point, the market is likely to see a lot of back and forth in this general vicinity, as the Australian dollar is held hostage by the US and Chinese delegations discussing trade policy.

If the market was to break out above the 0.69 level, then it’s likely that the 200-day EMA will be tested which is closer to the 61.8% Fibonacci retracement level which is closer to the 0.6950 level. The market is going to be driven on headlines and rumors more than anything else. Looking at this chart, I would anticipate a lot of short-term back and forth in this general vicinity as we await the next catalyst to move the markets in general. That is a bit of a proxy for markets overall, as there are plenty of noise that has made the market essentially sit still. The market is likely to be difficult to trade for a bigger move, at least until we get some type of impulsive candlestick that expands the range. Overall, this is a market that will continue to be one that you should watch, but unless you are scalping, the Australian dollars difficult to trade for any significant move.