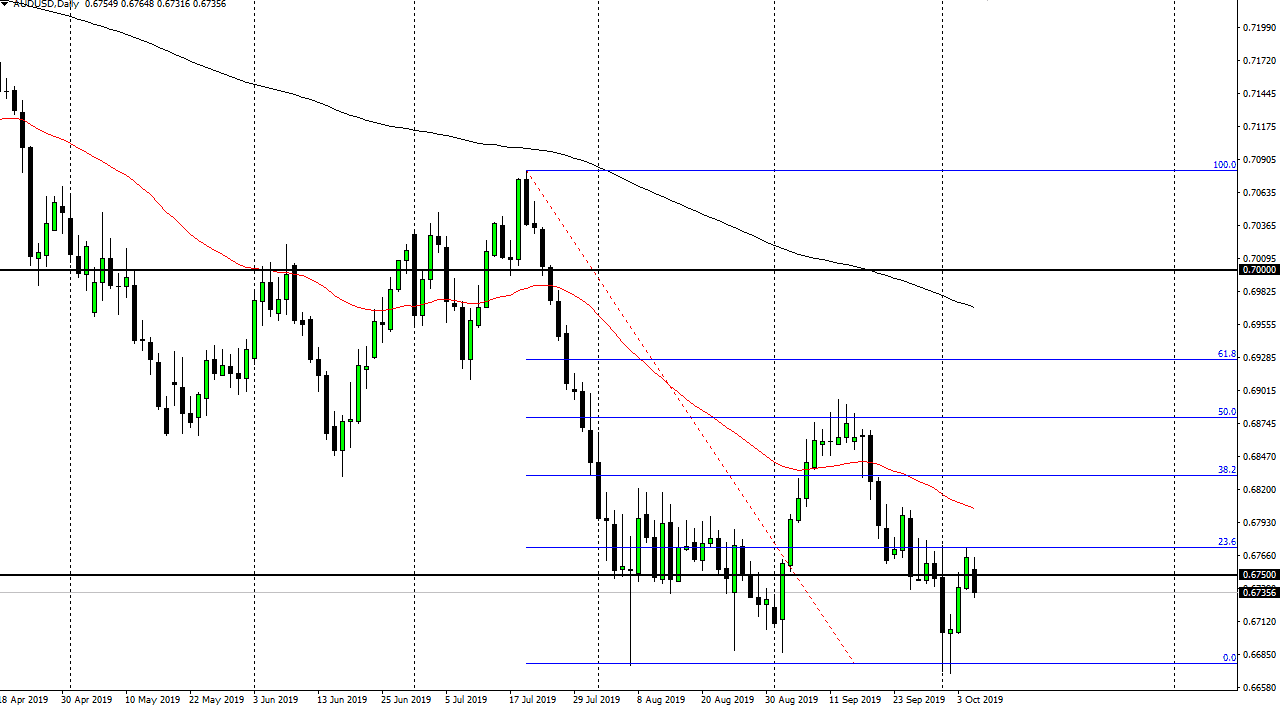

The Australian dollar initially gapped lower to kick off the trading week, as we continue to dance around the 0.6750 level. We broke down below there though, showing signs of exhaustion. Ultimately, this is a market that should continue to see a lot of attraction in this area, as it has essentially been “fair value” lately. This is an area that markets have been attracted to, and until we get some type of conclusion to the trade situation between the Americans and the Chinese, I suspect that we will probably get choppy trading and essentially “dead money” in the market.

To the downside, the market has reached as low as the 0.67 handle area recently, an area where buyers continue to come back in and push to the upside. Ultimately, this is an area that should continue to be difficult to break down through, and if we were to do so, this is a market that would probably go looking towards the 0.65 level after that. That of course is a large, round, psychologically significant figure, and would attract a lot of attention. Having said that, to the upside the market probably will see quite a bit of resistance at the 50 day EMA which is currently trading near the 0.68 handle, and then of course the 0.69 level which is the 50% Fibonacci retracement level. All things being equal, I think this is a market that continues to see a lot of back-and-forth short-term choppy trading, meaning that it’s probably going to be basically a waste of time to trade for anything more than a quick scalp.

However, if we can get some type of headline out of that meeting, it’s likely that the Australian dollar will be the first place traders look to. If the meeting ends up relatively positive, then we could be looking at a potential move to the upside. On the other hand, the meeting being negative will send the Australian dollar lower. Between now and the end of the week, this is a market that’s going to be very quiet, and perhaps try to base the move on what those negotiations produce. My money is on the downside, as the United States and China are miles apart on what they want, and this is one of those few areas where Donald Trump and the Democrats agree, China needs to be dealt with.