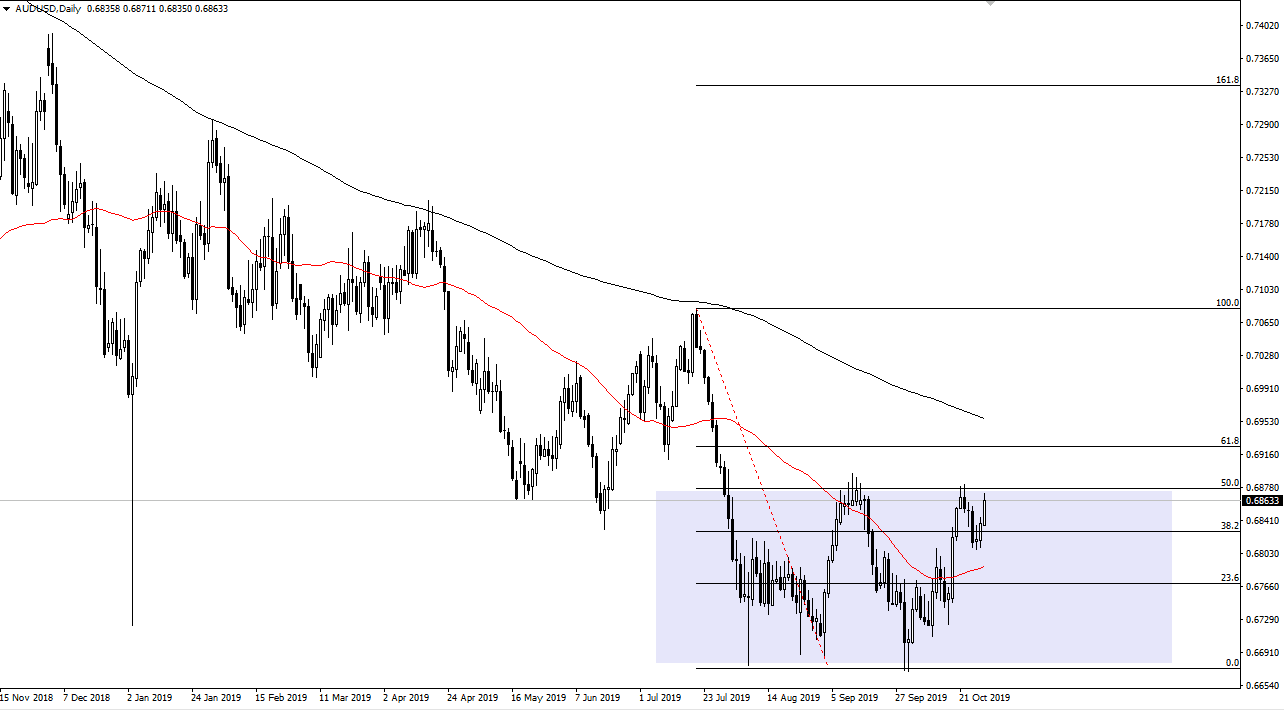

The Australian dollar has rallied a bit during the trading session on Tuesday, as we have reached towards the highs that have been tested several times. The Australian dollar continues to deal with the external forces of the US/China trade situation, and then of course also has to worry about Chinese economic figures. Adding even more chaos to the mix in the next 24 hours is the fact that the FOMC Interest rate decision and statement come out. That being said, the 25 basis point cut is already baked into the price of most things market related, and now people will be paying attention to the statement more than anything else. If the Federal Reserve looks extraordinarily dovish in its outlook of potential monetary policy, then it’s likely that the US dollar will get hammered. If that’s going to be the case, then the market should continue to rally to the upside and could make a run towards the 200 day EMA which is painted in black above.

Looking at the chart, you can also make an argument that the market has been consolidating and therefore should see a lot of resistance in the range of the 0.69 level, where the market has pulled back from previously. At this point, the market would more than likely see quite a bit of volatility, and perhaps exhaustion that you can take advantage of. Ultimately, if the market was to break down below the 0.68 handle, which has offered support over the last several days, could open up the door towards the bottom of the overall rectangle.

That being said, it’s almost impossible to value the Australian dollar in its own world, because it’s going to be noisy and chaotic to say the least. The markets will continue to bounce around in this area but given enough time it’s likely that we will see some type of impulsive candlestick that we can take advantage of. If we get the right statement out of the central bank, this could be the beginning of the end of the downtrend, especially if there is a continued conciliatory tone coming out of both the United States and the Chinese delegations. With that, is very likely to continue to be a very volatile and choppy market. With that, position sizing should be small simply because of the massive amount of negativity that could suddenly find itself jumping into this market.