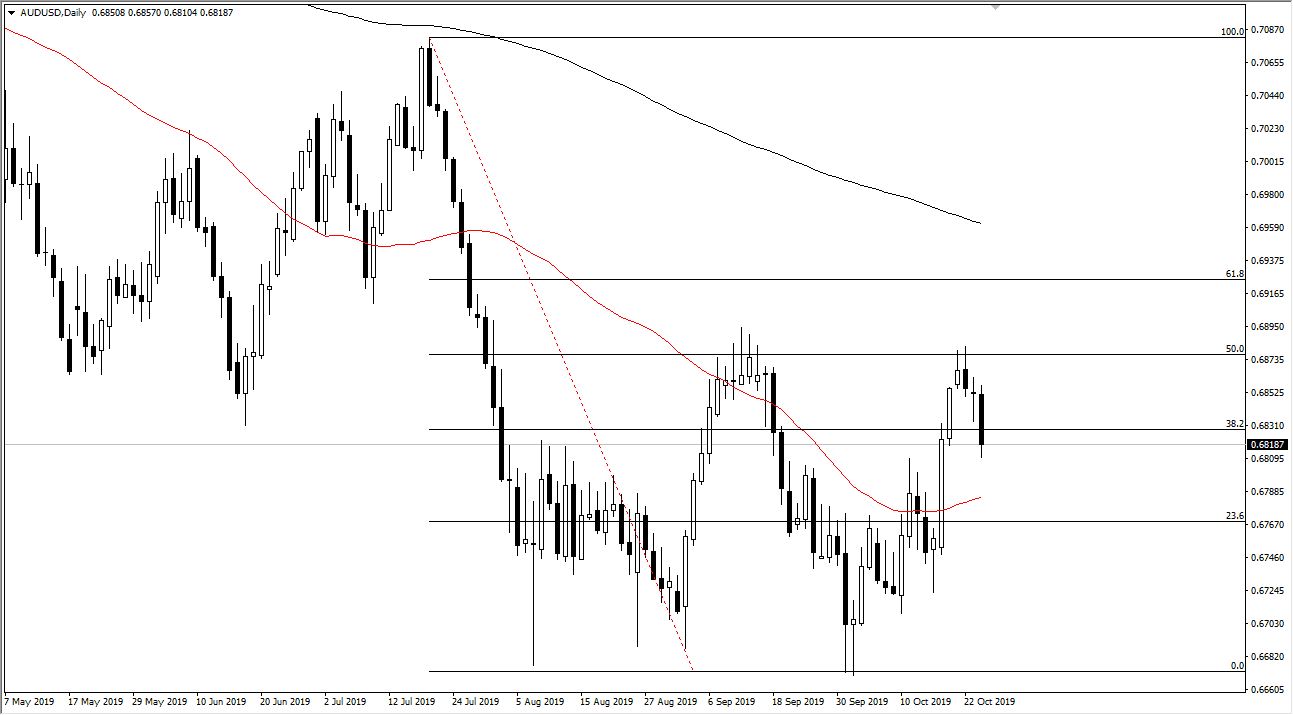

The Australian dollar has broken down during the trading session on Thursday, breaking the bottom of the hammer from the Wednesday session, showing support giving way. The market has been resistive to buying pressure over some time, so at this point it’s likely that we will not only rollover from here but perhaps continue to roll over. Looking at the longer-term chart, the Australian dollar certainly has been selling off quite drastically over the last couple of years, and the US/China trade situation continues to be a major problem.

The candlestick for the Thursday session is very bearish, as we are closing towards the bottom of it. This of course is a market that will unfortunately be held hostage to not only the negativity around the world as part of global trade is concerned but whether or not there’s going to be a headline coming out involving the US/China trade situation. It has rallied a bit as of late, but that probably has more to do with the idea that there haven’t been any headlines. It’s a simple relief rally that now is starting to struggle.

Central banks around the world continue to cut interest rates, and although the Federal Reserve is likely to do the same next week, the reality is that the bond market will probably continue to be elevated and given enough time the US dollar benefits as a result. After all, you have to buy those bonds in greenbacks.

The 50-day EMA underneath could be the initial target, but if we were to break down below there is very likely that we could go down to the bottom of the range that we have been in for several months, meaning reaching towards the 0.67 handle. If we were to break down below there then it could open up the move to 0.65, which would be a huge round figure that attracts a lot of attention. Obviously, the alternate scenario would be for the market to break above the 0.69 level, which would be the scene of the 50% Fibonacci retracement level. If that happens, then the 200-day EMA could be targeted next, as it is a longer-term resistance barrier and trend defining instrument. All things being equal though I think that what we are looking at here is more consolidation than anything else. I’m not expecting fireworks, but it does look like a gentle grind to the downside is likely.