The Australian dollar has initially fallen during the trading session on Wednesday, finding buyers at the lows again to turn around of form a bit of a hammer for the trading session. This makes sense, because we are at extended lows, and the pair does tend to look very much like a market that wants to consolidate in general. Beyond that, we also have the jobs figure coming out on Friday that will have a massive influence on what happens with the US dollar.

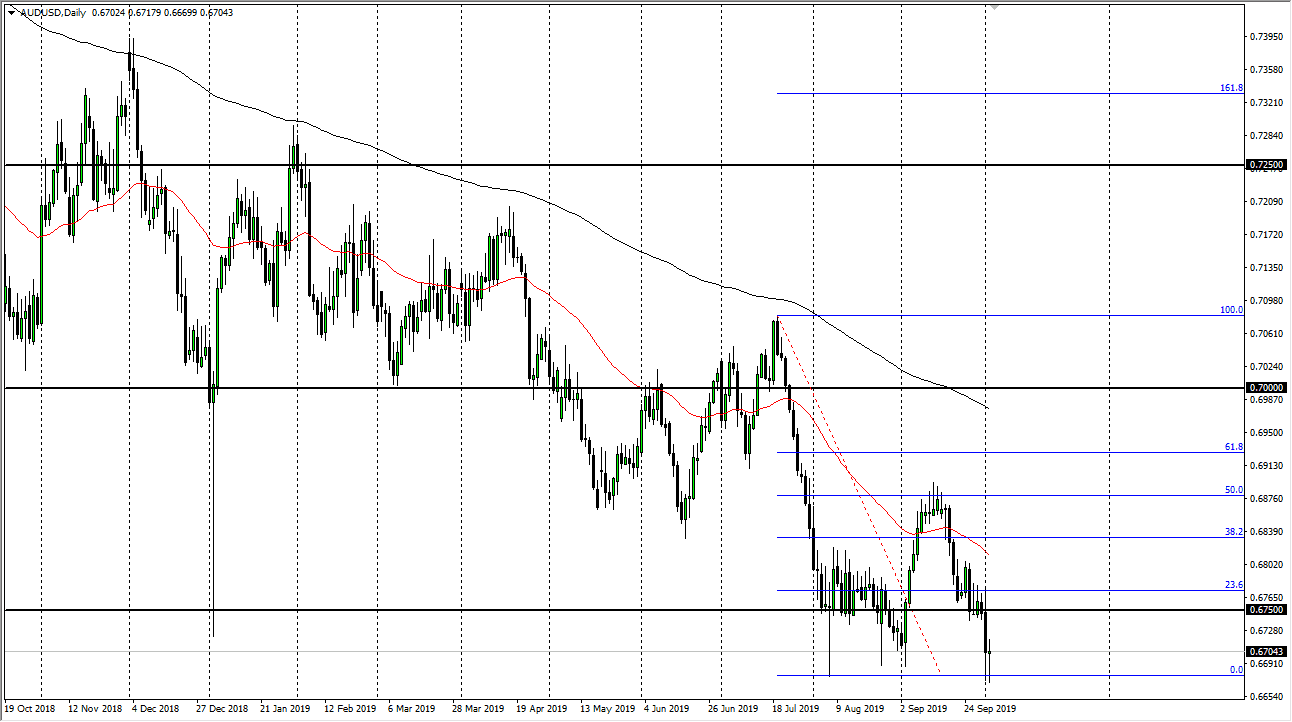

Looking at the chart, it’s obvious that the recent lows have been very “sticky” when it comes to buying pressure, and that should be something that’s paid attention to as we have tested the 0.67 level several times, and each time the buyers have come back into play. That being said, the Australian dollar is on its back foot, and I think that there is probably more downward pressure than up, so the fact that we may bounce during the Thursday session isn’t necessarily something that I’m overly concerned about, because the jobs number will throw this market around and probably into resistance.

I see a lot of resistance at the 0.6750 level, but more importantly the 0.68 handle where the 50 day EMA is shown. At this point, I think that we will continue to see a lot of volatility, especially as we get closer to the US/China trade talks on October 10 and 11. Once we are passed that event, then the Australian dollar will react to what the possibility is for renewed talks, positive momentum, or anything along those lines when it comes to a US/China trade deal. The Australian dollar is highly sensitive that as the Aussie is highly levered to the Chinese economy in general.

As China goes, so goes the Aussie dollar. At this point I think that the market is ready to continue the overall consolidation but it’s obvious that there has been more selling pressure over the last several months than buying, so while we get this pop in the next couple of days, I’m probably going to sit on the sidelines and simply wait for exhaustion near the 50 day EMA or perhaps even the 50% Fibonacci retracement level closer to the 0.6875 level to start selling. However, if we close on a daily close below the most recent low, then I’m willing to surf shorting there.