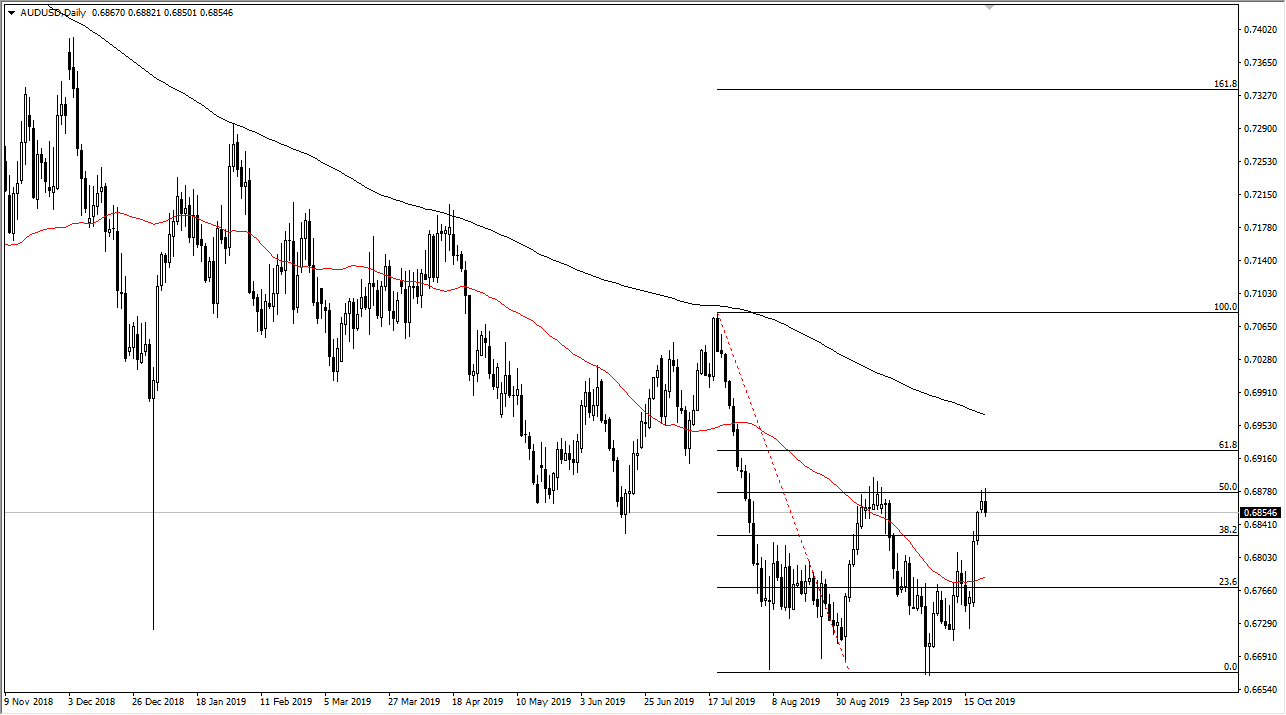

The Australian dollar initially tried to rally during the trading session on Tuesday but found resistance again at the 50% Fibonacci retracement level. By doing so it looks as if it is a mirror of the trading action from the previous session, and it shows that we are more than likely going to continue to see resistance in this general vicinity. If that’s going to be the case, then it’s very likely that we will see the Australian dollar continue the longer-term trend to the downside. It looks now as if we are at the top of what’s going to be a range.

The 0.69 level above is resistance from both a structural and psychologically standpoint. Beyond that, we also have the 50% Fibonacci retracement level, and several long wicks on short choppy candlesticks from the last visit to this area. Because of this, it’s very likely that we will see a bit of a reaction to this area as you would expect. With that in mind, I like the idea of feeding this market although I am the first to admit that it might be a long and slow grind lower. After all, keep in mind that the payer is highly influenced by the US/China trade talks and while they have gotten a bit more amicable as of late, we are miles away from any type of agreement.

Looking at the chart, we could go down to the 50-day EMA over the next several days, which is closer to the 0.6775 handle. Below there, the market could unwind down to the 0.67 had a which was the recent low. We have formed a bit of a “double bottom” at that area, so breaking through it is probably going to take some type of extraordinarily negative catalyst. On the other hand, though, breaking above the recent highs could in fact kick off a “W pattern” which is a bullish sign.

The “W pattern” would then attack the 61.8% Fibonacci retracement level which is closer to the 0.6925 handle, and then the 200-day EMA above which is painted in black. I don’t necessarily think this is going to happen, but it is certainly worth paying attention to as if it were to happen, it could be the beginning of a longer-term trend to the outside and perhaps a nice longer-term “buy-and-hold” type of scenario. Again, it’s not what I’m calling for, but we need to keep in mind that both sides of the equation should be paid attention to.