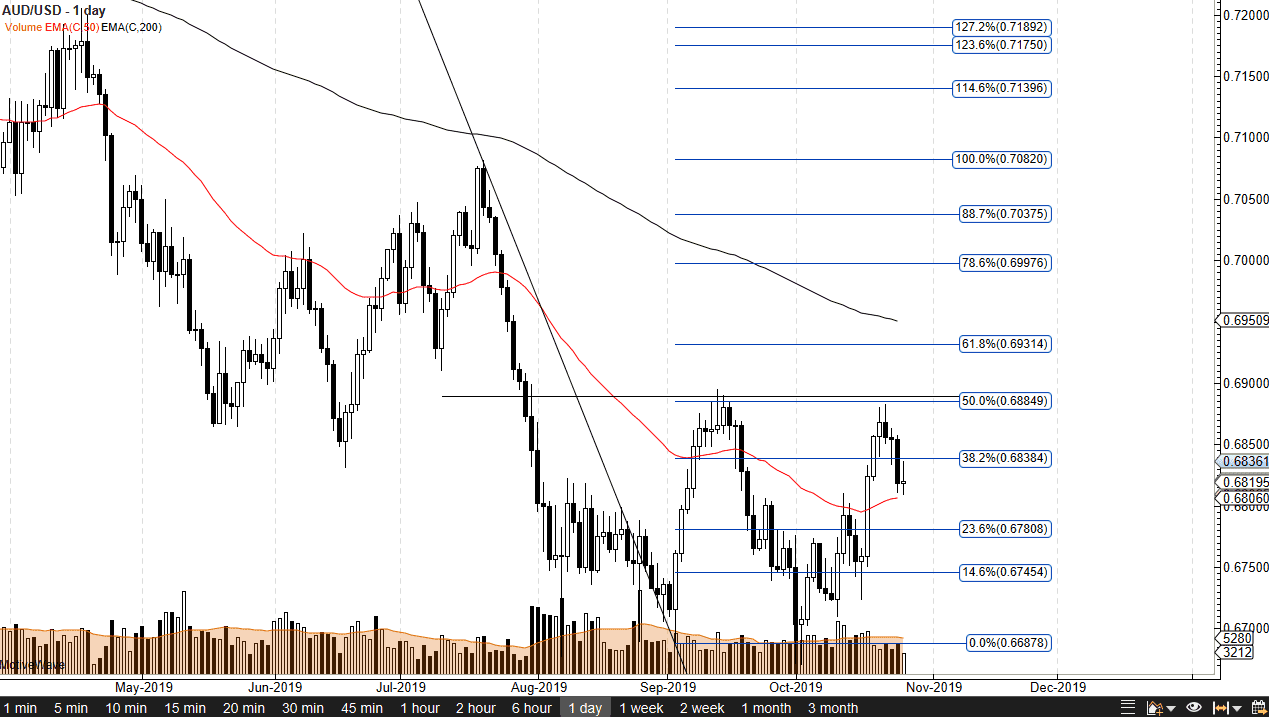

The Australian dollar has gone back and forth during the trading session on Friday, sitting on top of the 50-day EMA as traders close out their positions for the week. The market will continue to struggle with the idea of the US/China trade relations going one way or the other. Remember that the Australian dollar is highly sensitive to Chinese growth, which has been suffering at the hands of the trade war. When looking at the chart, you can make a significant argument for the idea of a 200-point range between the 0.69 level on the upper part and the 0.67 level on the lower part.

Looking at this chart, we have been in the longer-term downtrend so the question now is whether or not this is an accumulation phase or some type of simple consolidation that should lead to continuation. At this point it’s a little early to tell but I would be especially interested in selling this market if we could break down below the 0.67 level on a daily close. In the short term, I think that we probably go down towards that area as we try to figure out what to do next.

Weekend headlines could come out to send this market in one direction or the other, and they will be China related. Alternately, if we could break above the 0.69 level based upon good news, then that could be the beginning of the end of the downtrend. It doesn’t mean that it’s going to be easy to go much higher, but clearly, we would probably test the 200-day EMA currently trading at the 0.69509 level, and then perhaps even higher than that. All things being equal I like the idea of trading small inside the 200-point range but then start adding bigger positions outside of this box. Technical analysis suggests that this box of 200 points should be matched on any break higher or lower, so keep that in mind going forward. Because of this, a little bit of patience may be needed for a larger position but in the meantime, it looks very likely that we are going to have to play “small ball” with this pair, as we have had to do over the last couple of months. This is a market that will continue to be very news driven more than anything else.