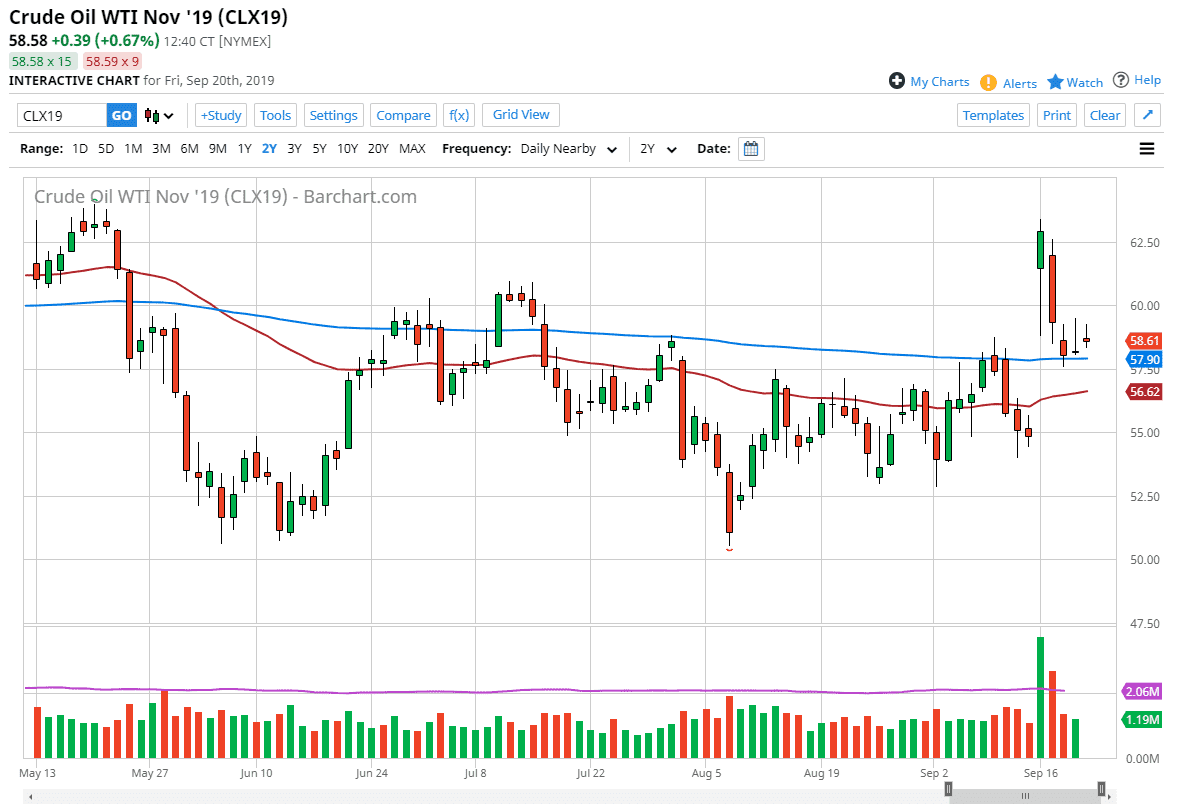

The West Texas Intermediate Crude Oil market has initially tried to rally during the trading session on Friday, but as we have seen more than once over the last couple of days, the sellers came back in and pushed lower. At this point, the market is currently sitting on top of the 200 day EMA which obviously is a technical signal. If we can break down below there, then it’s likely that the next move will be down to the 50 day EMA, then the bottom of the gap.

Speaking of the gap, remember that was because of the drone attacks in Saudi Arabia that knocked out a significant amount of refinery capacity. However, the kingdom has announced recently that by the end of the month things should be back to normal. That obviously works against the idea of a super spike in the oil market, so it makes sense that crude oil continues to drift lower to fill that gap, something that happens rather frequently in the markets, and in fact from a historical perspective, the crude oil markets have only left to gaps unfilled in the last 30 years. In other words, it is much more likely to happen than not to say the least.

I continue to look for short-term rallies to sell on signs of exhaustion, but I don’t necessarily think that we are going to see some type of huge flush lower. Ultimately, the market will break down below the $57.50 level, looking towards the $55 level overall. It won’t happen overnight, but clearly that gap still gives us plenty of area the cover and therefore an opportunity to make some money to the downside. After all, the fundamental reasons that cause the spike in the first place are gone now. Beyond that, we also have a serious concern when it comes to global growth, something that seems to be somewhat elusive. With that elusive growth, it makes sense that the crude oil markets and more importantly the demand will start to drop. With that in mind, I have no interest in buying this market and I do believe that the $60 level now is the short-term “ceiling” going forward. If we were to break above there, then it opens the door to the $62.50 level, but at this point I find that to be very unlikely, at least not until we fill that gap.