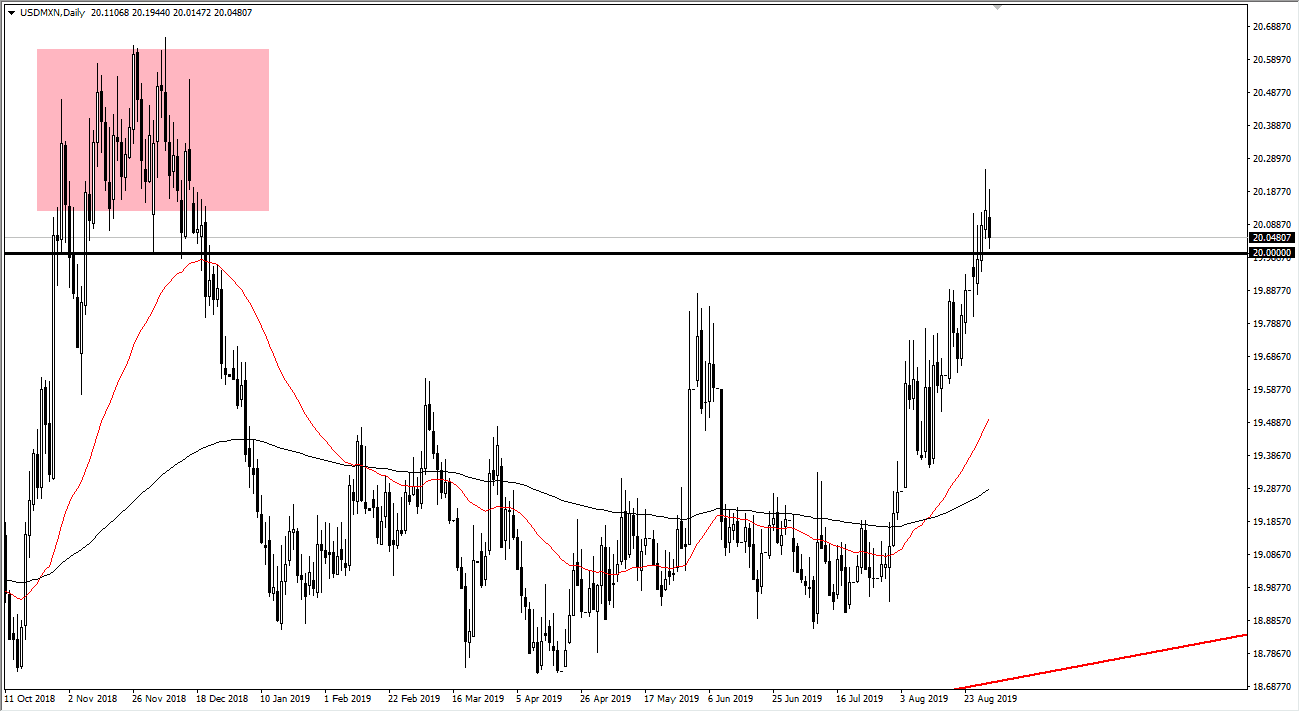

The US dollar has rallied again initially during the trading session on Friday but as you can see has rolled right back over as the markets are sitting just above the 20 MXN level, this is an area that of course causes a lot of interest. That being the case, it’s very likely that the market will continue to see this area as a bit too far, and it certainly has gotten a bit parabolic. At this point, the one thing that we would have to ask is whether or not we are parabolic? I suspect that we are, and it now looks as if we are about to form a bit of a three bar reversal.

Ultimately, I think that a break down below the 20 MXN level sends this market down to the 19.75 MXN level. I do recognize that we are in an uptrend and with good reason, especially considering that the risk appetite around the world is all over the place but certainly not good. At this point, I think that the market will continue to favor the US dollar, because the fear out there is palpable. The Mexican peso is of course and emerging markets currency, and that of course favors weakness as long as there are going to be concerns about global growth. Beyond that, we also have a lot of problems in Argentina and while Mexico is in Argentina, it is quite often used as a proxy for Latin America. With that, I think that the pullback probably offers a nice buying opportunity, especially if we get near the red 50 day EMA. With that, I’m a buyer at lower levels but in the short term it looks like we could get a pretty significant pullback.

The alternate scenario of course is that we break above the top of the shooting star from the Thursday session, which would be extraordinarily bullish. It would probably begin a bit of a “blow off top”, and therefore a very dangerous situation. This would probably coincide with some type of financial issue out there, and I think at this point it’s likely that we would find some type of financial meltdown in general. I’m certainly not saying that can happen, it’s a real possibility but based upon the technical analysis it’s a lot less likely at this point in time.