US dollar likely to be choppy against the Japanese yen.

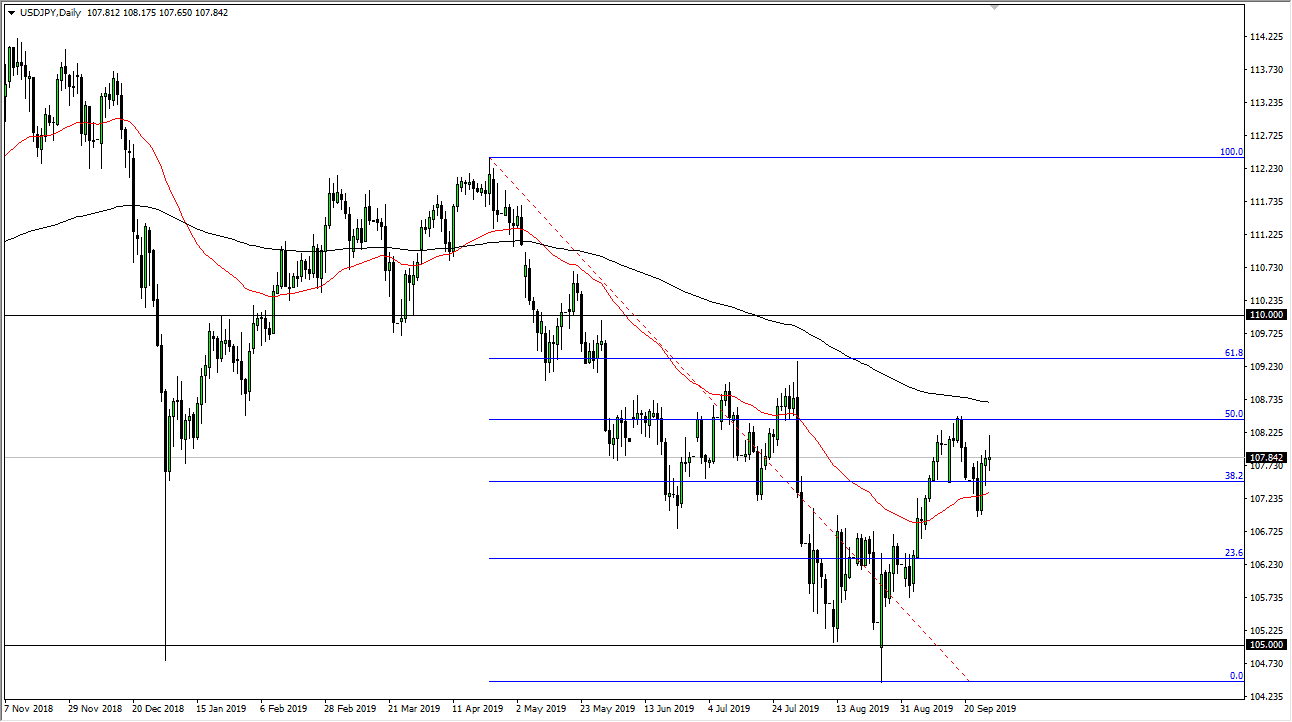

The US dollar has gone back and forth during the trading session on Friday, as markets continue to cause issues for this pair. That being said, the market is highly risk sensitive, and as risk appetite goes all over the place, it makes sense that this pair will do the same. The market continues to see a lot of pressure in both directions as we are currently trading between a couple of major moving averages. For example, the 50 day EMA is underneath and should continue to cause support while the 200 day EMA is above and should continue to offer resistance.

Beyond that, the most recent high has been found that the 50% Fibonacci retracement level which has that 200 day EMA just above it, so there are a couple of different reasons to think that this area will hold. Furthermore, the massive breakdown candle that sent the pair lower previously was formed in this general vicinity as well, so that Road higher is certainly fraught with all kinds of issues.

To the downside, the 50 day EMA should offer support, just as the low from Wednesday should be. If we break down below the low from the Wednesday session, we are more than likely going to go looking towards the ¥105 level eventually, but it will be erratic as per usual. Unfortunately, we have been trading in financial markets based upon the most recent headlines and Tweets, so having said that it’s likely that the market will continue to be very erratic, so therefore short-term trading is probably about as good as this pair gets.

I suspect that short-term back-and-forth scalping is basically where we are at between the 50 day EMA underneath and of course the 200 day EMA above. With that, the market continues to be difficult to navigate so therefore I would keep my position size small trading this market, because quite frankly it can get ripped in one direction or the other rather quickly. If we can break above the 200 day EMA, then it’s a very bullish sign and could send this market looking towards the ¥110 level, but right now and after the Friday session, it looks like that has become just a little less likely. To the downside, there will be a lot of noise but a return to the lows would make quite a bit of sense as well.