On the daily chart, USD/JPY still has a chance to for an upward correction, and a return back above 108.00 resistance. But at the same time, global trade and geopolitical tensions also support the Japanese yen as a safe haven for investors in times of uncertainty. The Japanese yen will react a lot with Japan's sales tax increase to 10% from 8% on October 1. It is not entirely clear why Prime Minister Abe insists on raising the tax when aggregate demand is not strong, trade tensions not only between the United States and China, but between Japan and South Korea, and the slowing global economic growth, pose a challenging international environment. Regardless of sovereign debt concerns (over 200% of GDP), the Japanese government relies on the Bank of Japan in that it will change the dynamics. The Tankan survey for the third quarter (September 30) is expected to show the modest momentum that the economy appeared to be enjoying earlier this year and is beginning to fade.

The course of trade talks between the United States and China, will strongly dictate the pair’s direction, as Japan will be firmly linked commercially and strongly with both sides of the world trade war, and resolving their dispute will revive the Japanese economy. Failure of the current round of talks between the world's two largest economies means further retaliation between them, hence increasing pressure on global economic growth, which faces strong recession expectations.

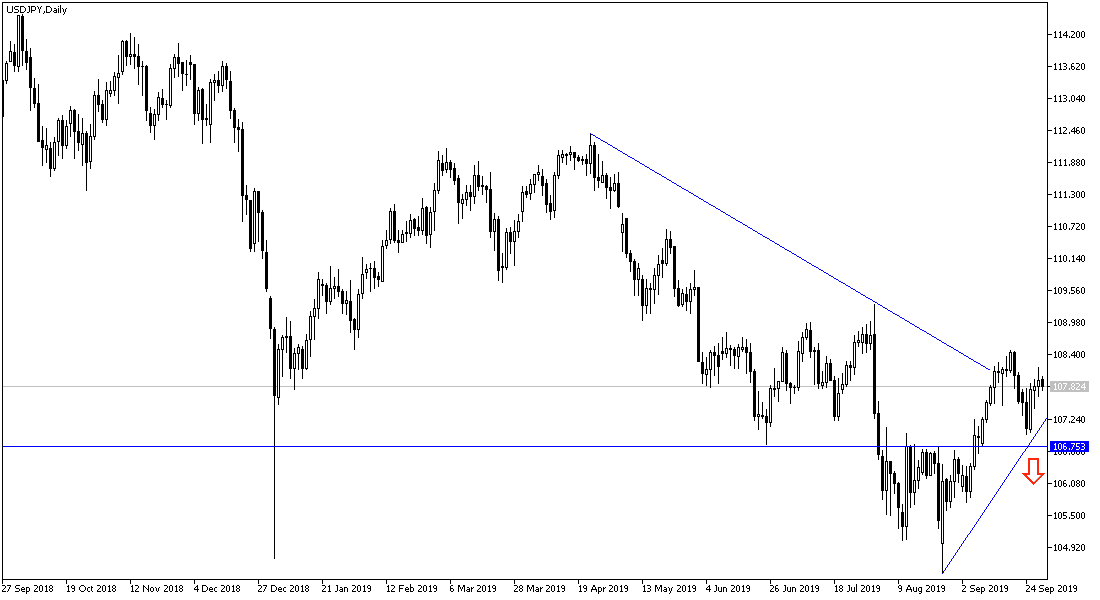

According to the technical analysis of the pair: USD/JPY is still the weakest performing for the USD against the other major currencies. A break back above 108.30 resistance might give the pair a strong momentum to move up to 109.00 and 109.75 levels, and then to break through psychological resistance 110.00 which confirms the strength of the uptrend. Conversely, if the pair moves below the 107.00 support level, the bearish trend will be confirmed, and hopes for a move higher will be shattered. Taking into account that concerns about the future of global economic growth and political disputes will be a fertile environment for the strength of the Japanese yen.

On the economic data front: The Japanese yen will be influenced by the release of Japanese industrial production data along with retail sales figures and the Chinese official manufacturing PMI data from Caixin. From the US, the Chicago PMI will be released.