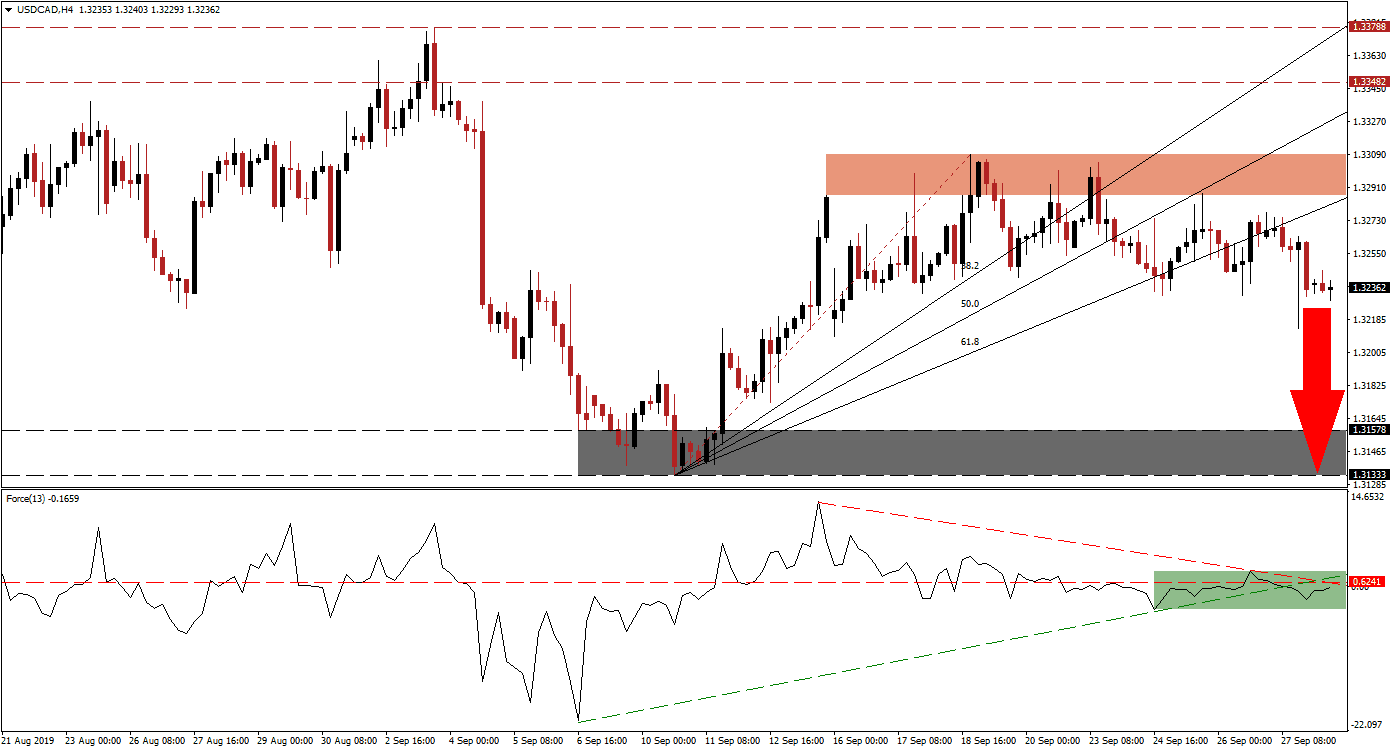

While the US Dollar has remained resilient in the wake of core fundamental economic problems which have now been joined by political issues, the USD/CAD is leading the erosion of this resilience. After the short-term resistance zone rejected an advance, price action quickly accelerated to the downside which resulted in a breakdown through the entire Fibonacci Retracement Fan sequence, turning it from support into resistance. After the 61.8 Fibonacci Retracement Fan Resistance Level held, this currency pair started its next move to the downside.

The Force Index, a next generation technical indicator, has been caught in a crosswind of bullish and bearish pressures. The ascending support level has crossed its horizontal resistance level as well as its descending resistance level while the descending resistance level has done the same with the Force Index trading in negative territory below all three. This is marked by the green rectangle in the chart. Bears have won this battle and are in control of price action which is driving the USD/CAD to the downside. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Bearish momentum has increased after the short-term resistance zone which is located between 1.32865 and 1.33089 as marked by the red rectangle. The top range of this resistance zone also represents the top of the current Fibonacci Retracement Fan sequence. The rise in oil prices have contributed to the strength in the Canadian Dollar, a commodity currency, and further added to the breakdown in the USD/CAD. Forex traders should now pay close attention to the intra-day low of 1.32138 which marks the low of its most recent rejection by its 61.8 Fibonacci Retracement Fan Resistance Level; a move lower is expected to result in more net sell-orders in this currency pair.

Following the price action reversal from its 61.8 Fibonacci Retracement Fan Resistance Level, there is no support for the USD/CAD until it will reach its next support zone which is located between 1.31333 and 1.31578; this is marked by the grey rectangle. Today’s economic data out of the US may provide a fundamental catalysts to the downside, if the Chicago PMI will print a number below 50.0; economists anticipate a reading of 50.0. A number below it indicates contraction in the sector and given regional reports across the US a downside surprise cannot be ruled out which would further enhance the breakdown. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.32350

- Take Profit @ 1.31350

- Stop Loss @ 1.32650

- Downside Potential: 100 pips

- Upside Risk: 30 pips

- Risk/Reward Ratio: 3.33

A push in the Force Index above triple resistance could result in the USD/CAD to reverse to the upside and through its 61.8 Fibonacci Retracement Fan Resistance Level back into the short-term resistance zone. This should be considered a good short-entry opportunity as fundamental factors favor more downside in price action. A move above the intra-day high of 1.32642 may result in an extension into its resistance zone from where a breakout is unlikely to materialize.

USD/CAD Technical Trading Set-Up - Limited Reversal Scenario

- Long Entry @ 1.32700

- Take Profit @ 1.33050

- Stop Loss @ 1.32550

- Upside Potential: 35 pips

- Downside Risk: 15 pips

- Risk/Reward Ratio: 2.33