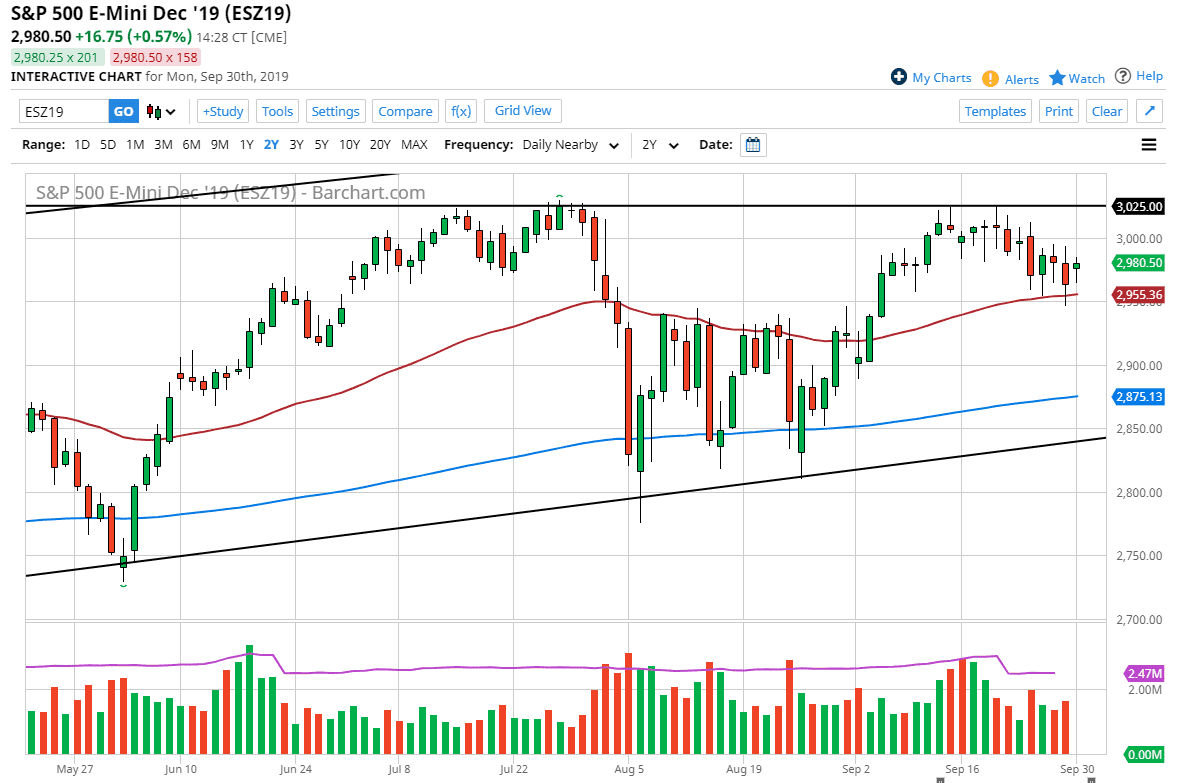

The S&P 500 gapped higher to kick off the week on Monday, but then pulled back a bit to try to fill that gap. It finally did, and then took off to the upside. The 50 day EMA is sitting just below and that of course will attract a certain amount of attention. I believe that this market will probably go looking towards the 3000 level again as it is a psychologically important figure, but I also believe that we go looking towards the highs after that. With that in mind, we continue to see people come into this market and “buy the dips”, and I don’t see how that changes anytime soon.

Looking at this chart, it’s obvious that the market has been in and uptrend for very long time but there’s also the possibility that we have formed a “double top” closer to the 3025 level. The biggest problem with that argument is that we have seen it happen before and get blown through. With that in mind I have to assume that the short-term action suggests that we are going to go higher for the short term move. Ultimately, I believe that the 50 day EMA is going to offer a certain amount of support and therefore it’s going to be difficult to imagine a scenario where we are sellers, but I do recognize that if we were to break down below the bottom of the candle stick for the session on Friday, essentially the 2950 level, we could drop down to the 2900 level and then possibly even the 200 day EMA level which is currently trading at the 2875 handle.

I like the idea of buying the dips in this market, as the stock markets have been so resilient. However, it’s been obviously a somewhat wild market and we have a whole plethora of headlines that can cross the wire is that any time to cause major problems. Because of this, keep your position size rather small, and make sure that you have your stop loss orders in place. This is a market that will continue to react to the US/China trade situation, impeachment, trade wars, Brexit, and just about anything else you can think of. At this point I would anticipate the more likely scenario is simply a drift higher though, as the resiliency must be paid attention to.