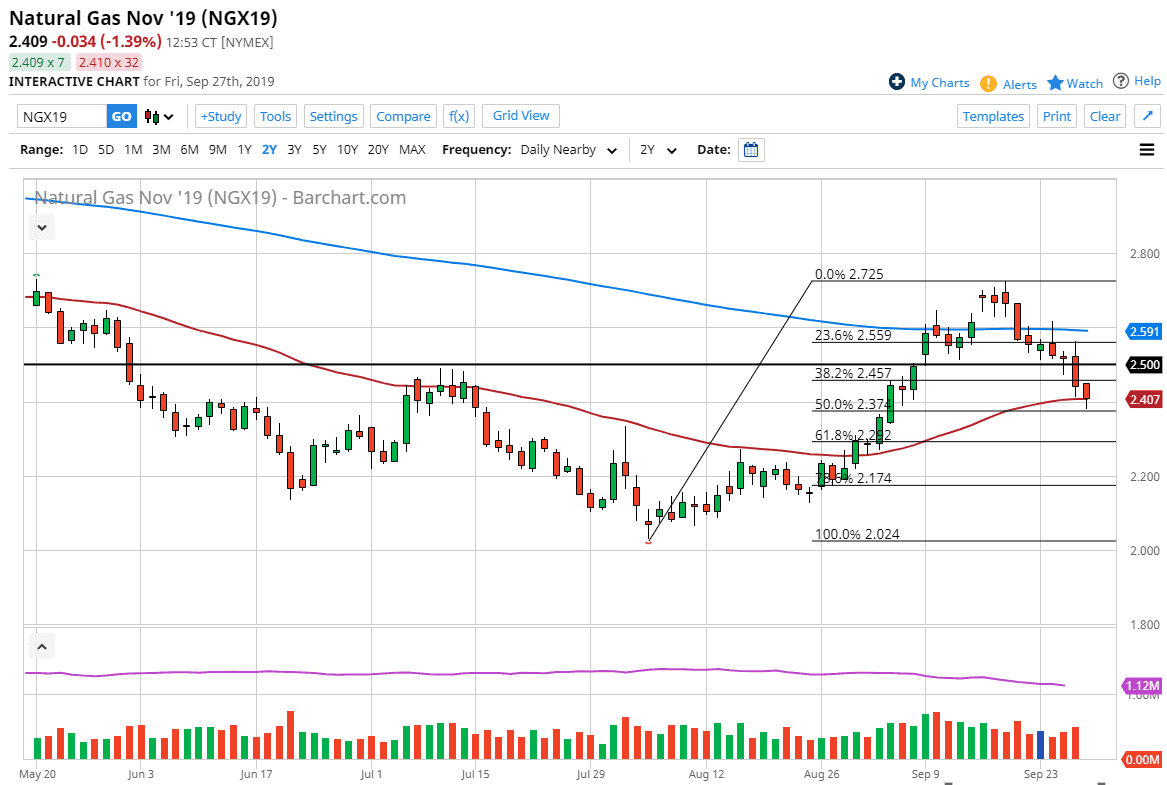

Natural gas markets fell during the trading session on Friday to break down below the $2.40 level. This is an area that has been important, as we have the 50 day EMA right there, and then of course the 50% Fibonacci retracement level is at the bottom of the range during the day as well. At this point, the natural gas markets look as if they are a bit of a pullback, and at this point it’s likely that the value hunters will come back in as we are starting to approach the cold months. We are trading the November contract currently, and therefore it makes sense that the market participants should jump in and rally as the market is looking to the winter months for demand.

The bottom of the candle stick for the trading session on Friday is the 50% Fibonacci retracement level, and if we break down below there it’s likely that the market goes looking towards the 61.8% Fibonacci retracement level after that. Either way, it’s only a matter of time before the buyers come back in and pick up the natural gas contract because it’s getting cheap. All things been equal though, it does look like we are trying to rally.

The market breaking back above the highs from the Friday session would be reason enough for me to start buying natural gas because I recognize just how explosive this move will be eventually. As soon as we start to get the cold weather forecasts coming in, natural gas markets tend to take off. This is a cyclical trade that I pay attention to every year, and it is probably only a matter of time before the market finds itself reaching above the $2.50 level. Market participants shorting this market will find themselves ran over given enough time. At this point, the 61.8% Fibonacci retracement level also coincides nicely with previous resistance which market memory dictates it should now be supported. To the upside, it’s very likely that the market could go looking towards the $3.00 level, and beyond. The $3.50 level would be the next big figure target, but that probably won’t be realized until the month of January and the height of the cold season. At that point, the market typically will break down rather significantly as well. Being patient and waiting for the right set up is going to be paramount for longer-term traders that can get a huge profit going forward.