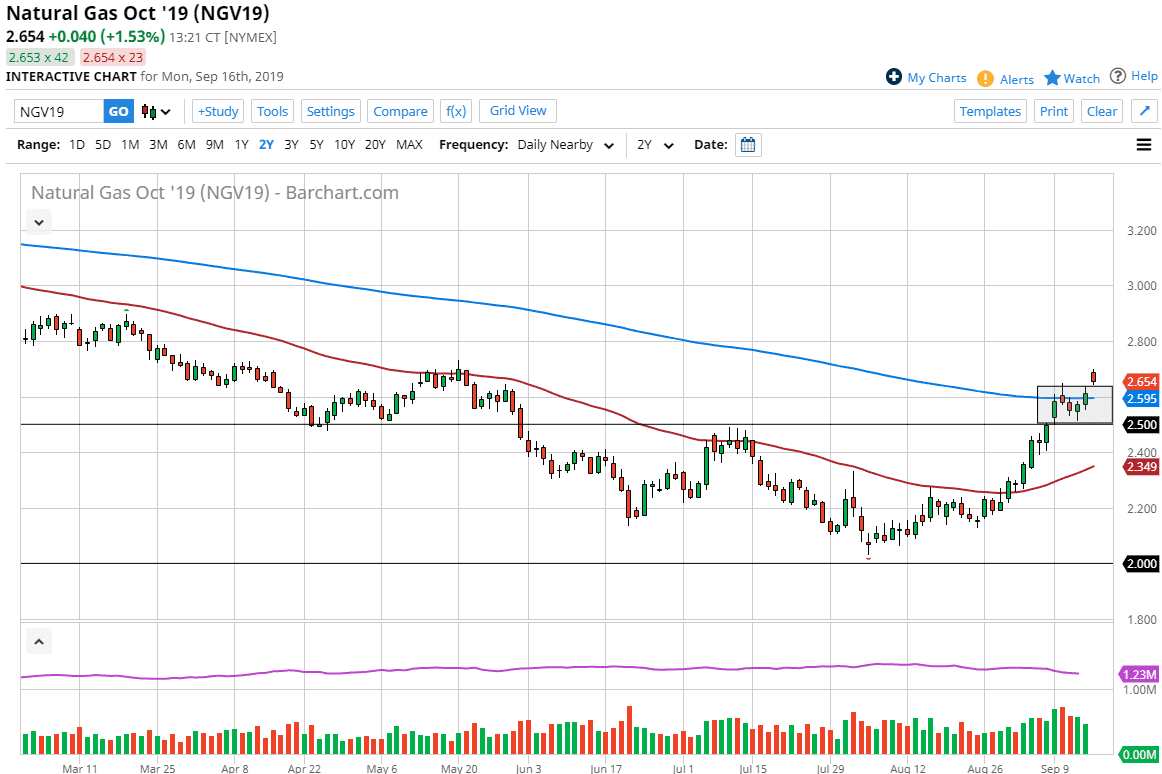

Natural gas markets gapped higher to kick off the week after the drone strike in Saudi Arabia, and that is perhaps in sympathy to the idea of the energy complex having less supplied in general. Tthis is a market that is starting its Winter pop that we get every year, and the fact that we have cleared the 200 day EMA suggests that longer-term traders are starting to come back into this market. We did try to fill a bit of the gap from previous and therefore it’s likely that we are going to go much higher.

Underneath the $2.50 level should offer support, just as the $3.00 level should offer massive resistance. In fact though, that is my target now because obviously we are not going to get the pullback that we need in order to find value, and it now looks as if we are going to go into a bit of a parabolic move. Typically, this is a market that rallies later in the year, as both Europe and North America enter colder temperatures. However, it is a bit earlier this time, so that is part of what made me so skeptical.

Looking at the chart, it’s likely that you can draw a few lines now and print a slightly bullish flag, and we just broke above the top of it. Ultimately, the market looks as if it wants to go higher, so therefore using the measured move one would anticipate a move to at least $3.00 above. That doesn’t mean that it’s going to happen overnight, but clearly we are starting to enter a bullish phase as demand for natural gas will probably spike as crude oil is going to struggle to fill demand at times. As the Saudi output has been cut in half and could be so for weeks, if not months and therefore it’s likely that natural gas will continue to be bullish, at least until the end of the year. While I have not been one to buy natural gas all year, my bias has completely changed over the last couple of days, and therefore I’m looking for buying opportunities on short-term dips and will continue to look at these pullbacks as potential value opportunities. The $3.00 level of course will be significant psychological resistance, but I think we go beyond that sometime this winter.